So, here’s the scoop from me. I’ve been digging into the smart strategies of trader Larry Williams, who’s packed the trading world with effective indicators and techniques. His Williams %R indicator is pretty neat, showing where the current price stands compared to the highest high over the past 14 periods—it’s similar to how the Alligator indicator works, along with a bunch of other tools. Larry’s been doing great in the financial markets, gaining a lot of loyal followers along the way. The strategies he offers? They focus on simple candlestick patterns without getting into any complicated tool stuff.

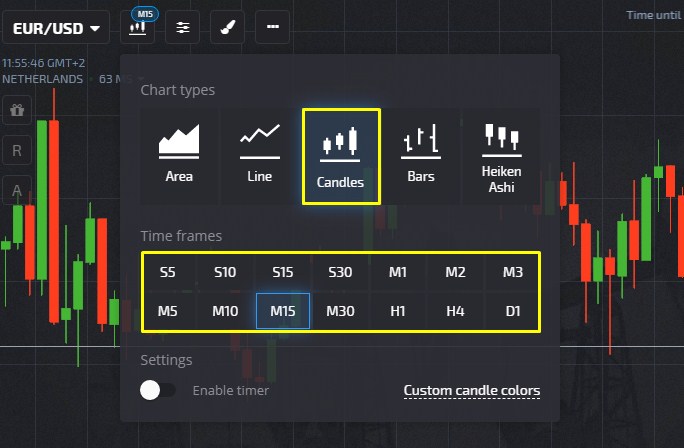

Now, let’s break down how I can nail those classic Williams “short-term” and “long-term” strategies. When I’m using Williams’ strategy at the broker platform of Pocket Option for strategic trading enhancements, the first thing I do is grab the candlestick chart and set the right timeframe in the settings.

Peak Point Strategy

When I’m using Williams’ indicators to check the trend and its strength, I’m all about finding those sweet entry points. Most traders wait for the zero line to crossover before jumping in, but that's just a bit too late for my liking. By sticking to this strategy consistently, I can cash in on those counter-trend moves and possibly double my profits, which is a sweet deal while trading.

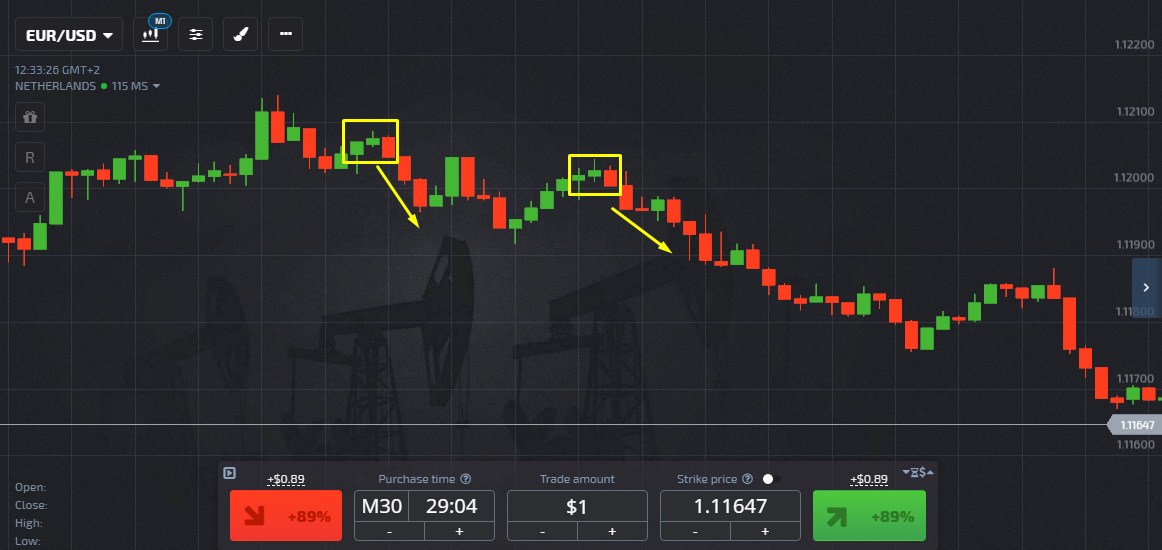

This strategy is perfect for turbo options. Given how fast-paced this trading is, I set my timeframe to one minute (M1) and focus on highly volatile assets like EUR/USD or cryptos.

Williams’ short-term strategy revolves around spotting local peak oscillations within 3 bars. His golden rule? Trade in the direction of the main trend.

During an uptrend, I keep my eyes peeled for the Williams %R indicator to dip below -80. When I see the price climbing again and the indicator crosses back above -80, that's my signal that the price is getting ready to trend up once more.

When that’s happening, I’m ready to grab the CALL contract on the uptrend if I notice a lower correction peak (the lowest price) has formed and the next candle wraps up above the last one.

On a downtrend, when the indicator hangs above -20, I’m looking for the price to drop while the Williams %R moves back below -20, signaling that a continued downtrend might be coming.

That’s when I’m going for the PUT contract in a downtrend, but only after I see the upper correction peak (the highest price) has been established, and the next candlestick closes lower than the last.

Pro tip: Stick to highly volatile assets, and set your expiration period to over 3 minutes. That should give enough time for three candles to form on the chart.

Gap Strategy for Long Term Trading

This Gap strategy? Pretty interesting—it’s more about the trader's psychology than just the indicators.

According to Larry, new traders often get a bit too fired up over breaking news, especially since those headlines often hint at the trend's direction. When the action starts, a lot of traders panic and create a chaotic market, leading to a small gap on the chart.

All that guessing and worry causes wild swings with the market shifting in different directions at the slightest hint of a counter-move.

When I’m sticking to Williams’ long-term strategy, I prepare by keeping these steps in mind:

- Jump on the CALL option if that downtrend candle is lower than the one before it and the market has moved upwards.

- If the market moves down during an uptrend, and a new candle is higher than the last one, I’ll be thinking about that PUT contract.

Set the expiration period from 12 to 24 hours.

Most signals I've encountered need that asset price to swing back into bullish or bearish territory before I get an entry signal. So, if the trend is strong, I can usually count on it continuing at least to another peak, which tells me the next dip into bearish territory is prime time to jump in.