Hey there! If you want to trade like a pro, you need to figure out the best hours. I’m talking about focusing on day or night sessions to really up your game. Seriously, finding my optimal time has made a huge difference. Even the top day traders can struggle outside those prime hours.

Let’s break it down and compare the charts for day and night trading.

Here’s the thing: daytime prices can be really variable, while nighttime tends to be more stable.

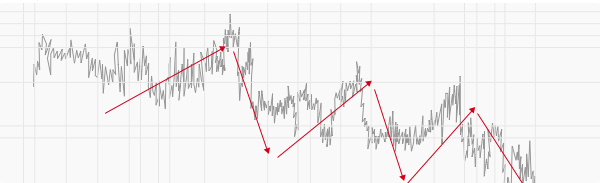

Check out how the daytime chart looks:

Honestly, jumping in during the first hour or two when the market opens can be a goldmine for traders. That first hour? Total volatility, full of chances. It might be a bit rough, but that’s when all the “newbies” are active.

And don’t forget about the last hour of trading from 3 to 4 p.m. ET—it’s also a great time. By then, we’ve taken a break since the morning, which helps us refocus and plan our next moves.

The last few minutes can get intense, with a lot of activity and big moves.

Now, let’s check out the night chart:

Choose your trading hours wisely and apply the right strategies, and you’ll be making profits whether it’s day or night! For those seeking to enhance their trading skills, the PocketOption platform offers comprehensive insights and strategies tailored for both beginners and seasoned traders.

Let me share some info about stock market hours – they can vary a lot, my friend. The major exchanges like the Shanghai Stock Exchange, Swiss Exchange, London Stock Exchange, New York Stock Exchange, and Nasdaq all have their own schedules.

Depending on where you’re located, you’ll need to adjust for local time because each exchange has its own rules and hours.

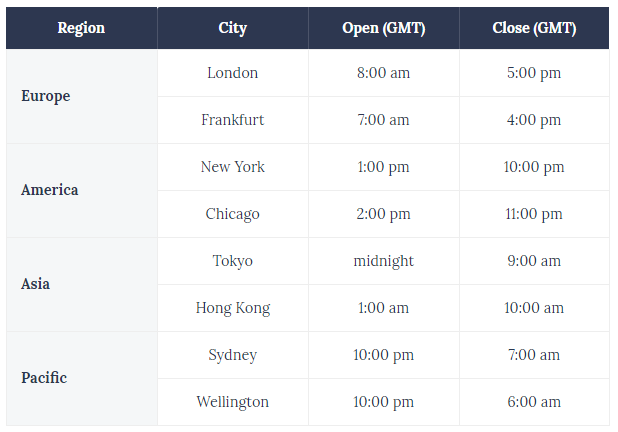

Here’s the scoop on market times (in GMT) from major cities around the globe:

We’re in a global economy, folks! Many big players are based in China, Russia, and Mexico, but there’s a ton of trading happening all over.

Make sure you keep an eye on the overall market trends too. Monday afternoons usually provide a great opportunity for buying because the market historically dips at the beginning of the week, especially around mid-month. Pro tip: many experts suggest selling on Fridays before that expected drop, especially if that Friday kicks off a new month or comes with a long weekend.