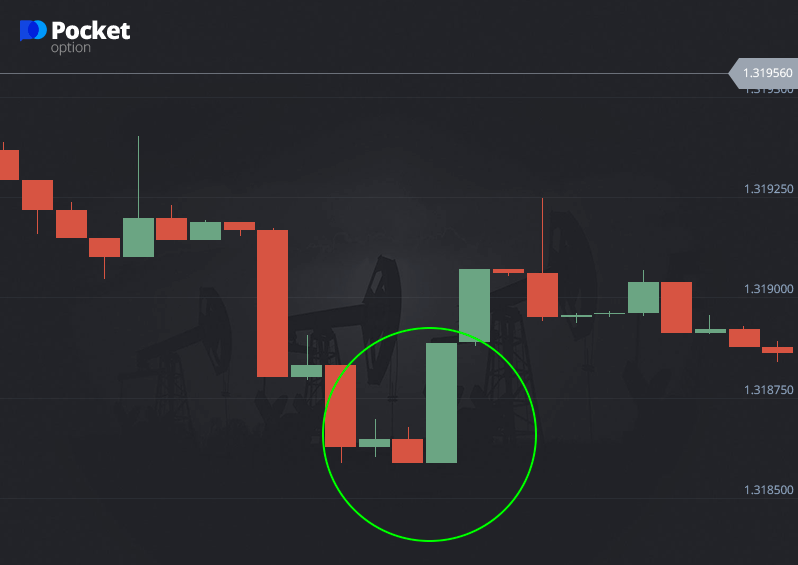

So, have I ever keyed into tweezers in trading? Absolutely! When I spot tweezers lighting up on my screen, it's game on. These signals indicate a trend change. It takes a pair of distinct candles, the same size, to trigger the Tweezers—during a downtrend, I see them at the bottom, and in an uptrend, they're found at the top. The min and max points in those tweezers? Super simple: they're usually set by the closing candles and their shadows. Plus, the candles can be stacked one after the other or come from a few different ones.

The charm of the “tweezers”? They provide a clear, strong signal. Spot those tweezers, and I'm ready to roll with innovative trading insights available on the PocketOption trading platform offering comprehensive tools and strategies.

Steve Nison shared some insights on Tweezers in his awesome book “Japanese Candlestick Charting Techniques.”

These candlestick patterns might look a little different sometimes, but they all share some key features: they often appear at crucial market-turning points, making them prime for analysis – a heads up to potential reversals.

My Game Plan When Signals Show Up:

- Watch out for candles that share the same extremes on the chart; be ready for a trend switch;

- Once I see the “tweezers,” I'm jumping into the new price direction.

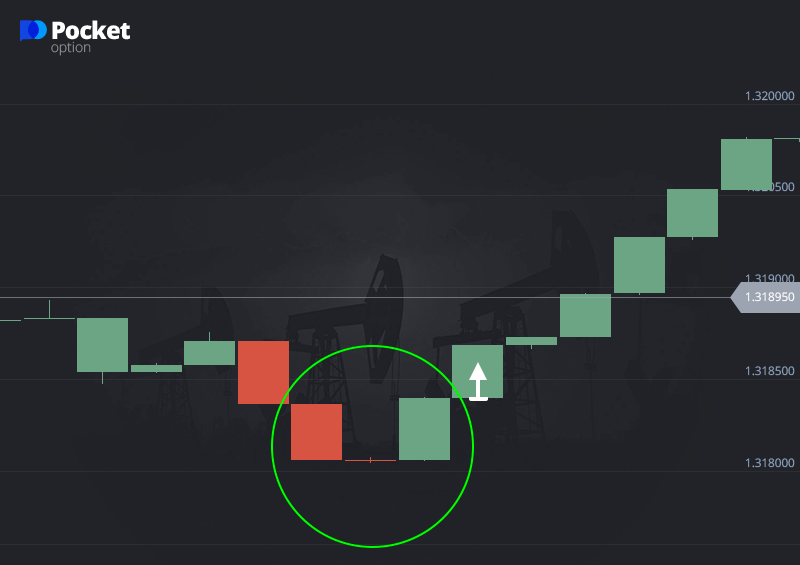

GO LONG after the Tweezers show up

Tweezers with a sneaky absorption pattern

Those tweezers pack a punch, so I'm inclined to hit that buy button without waiting for the next candle, especially when they pull their move near the edges.

But if I'm not sure, I'll chill for that next candle and double-check my trend. Better to confirm before jumping in, right?