Turbo options contracts? They're like the thrill of trading! Seriously, it's a super fast way to boost my trading capital. But here’s the thing: to handle this wild ride, I need a high-precision trading system that can catch those quick price changes. It’s all about those short moves, my friend!

Now, what's the scoop on binary options? They've got speed, they're quick—super exciting! I’m diving into this article to discuss the pros, the cons, and some of my top trading tips.

Advantages of Turbo Options

- Quick cash flow

- Simple technical analysis

- No need to follow the news

- Ideal for short timeframes

Disadvantages of Turbo Options

- Works best with volatile assets

- Chance plays a big role, feels like a gamble

- Can be pretty stressful and risky

So, a lot of traders are diving into turbo options, but hey, staying cautious is essential. Turbo options are those contracts that deliver action in just a few seconds up to 5 minutes. With the right strategy, I can make profits in no time.

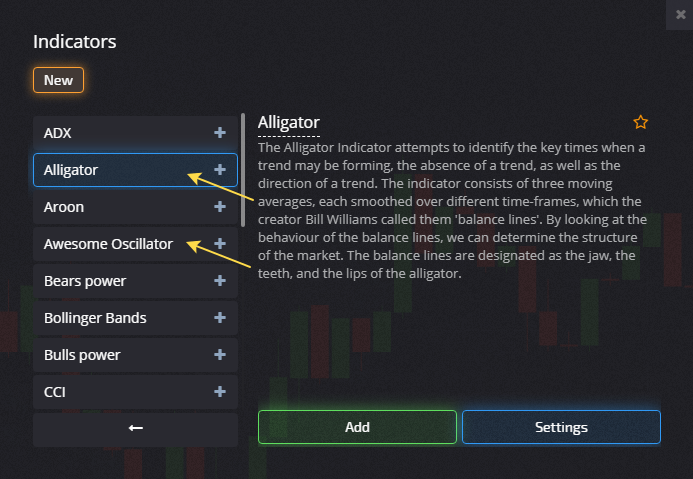

Let’s break down a turbo options trading strategy using three popular indicators:

- Alligator;

- Awesome Oscillator;

- RSI (Relative Strength Index)

All these indicators? Totally available in the standard menu of Pocket Option.

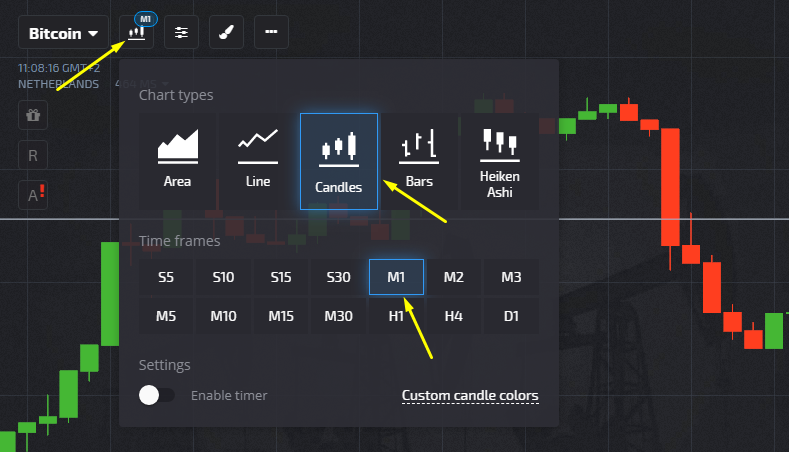

Setting Up Indicators and Chart

Like I said, this strategy is for those "fast" contracts. So, I'm gonna set my chart to shorter timeframes, aiming for a minute! I’m also choosing the “Japanese Candlesticks” chart type. To adjust the settings, just hit that chart icon in the terminal and change it up.

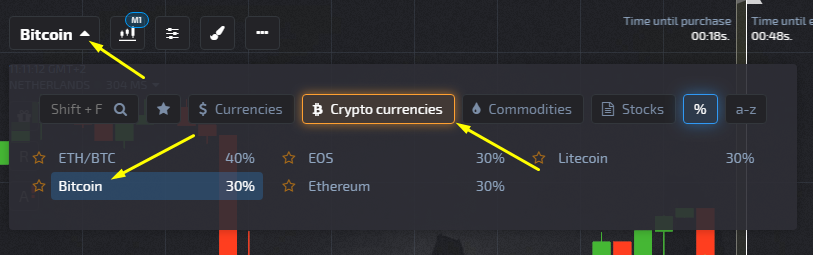

Let’s talk about asset selection. Choosing the right assets is key. Signals for my turbo options strategy come in fast—10-15 an hour—so I gotta filter out the noise. Targeting volatile assets helps since I'll notice those price moves across a few candles. For example, I might stick with cryptocurrency or currency pairs like EUR/USD or GBP.

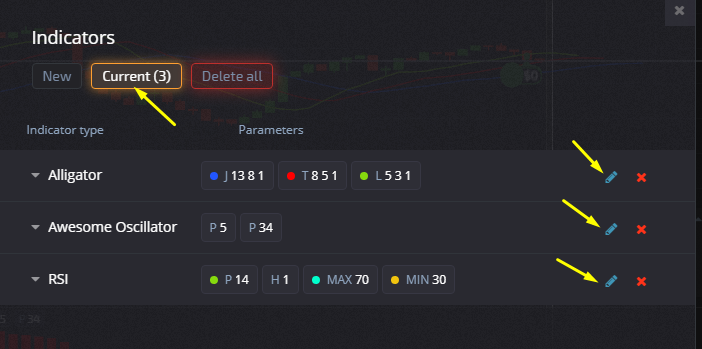

I like to play around with indicator parameters to find my sweet spot. If I ever want to return to the defaults, I just hit that pencil icon in front of the selected indicator.

Here’s the scoop on the settings I recommend:

- Alligator Jaw Period 13, Teeth 5, Lips 3, default shift;

- RSI Period 14, level 50 for both zones;

- Awesome Oscillator: Period 5 and 34.

Applying the Turbo Options Trading Strategy

Now that my settings are sorted, it’s time to wait for signals to start trades. The turbo options timeframe is super short, inviting all sorts of calls. The more I trade, the easier it’ll be to spot those sweet setups. Keep an eye on RSI crossings; when the signal line crosses 50 levels upward—boom, time to go for that CALL option! Another solid signal? When the Alligator’s green line crosses above red, plus the Awesome Oscillator’s right at zero.

When it’s time to switch to a PUT, I’m on the lookout for reverse signals. Close it up when the RSI drops, the Alligator’s moving in that same direction, and the Awesome Oscillator shows a bottom candle.

Expiration period? Set it between 1 and 2 minutes.

Money management is crucial. If I'm trading shorter timeframes and going for a CALL, that contract shouldn’t exceed 2% of my total funds. Overall, trading with Pocket Option for optimal strategies and success has everything I need to succeed in turbo options trading. I recommend using all three indicators and carving out your path in this trading landscape. Just remember, if you don’t grasp the trading fundamentals, stay away from turbo options or it might end up feeling like a gamble.