Let me tell you about my favorite tool: the Ichimoku Kinko Hyo. This indicator can be a bit tricky at first, but it’s super helpful for tracking market momentum and identifying future support and resistance levels. It’s made up of five lines: the tenkan-sen, kijun-sen, senkou span A, senkou span B, and chikou span. Seriously, there are tons of resources and guides about this indicator. The best part is that it provides reliable signals to help you succeed in your trading. It averages multiple data points, plots them out, and then uses those to generate a “cloud” that hints at where prices might meet support or resistance down the line.

Now, I’m not saying you can master Ichimoku in a week. It’s like earning a master’s degree—it takes time to really understand it. But for traders using the Pocket Option Broker Terminal, you’ve got the Ichimoku advisor right there in your toolkit. Add it to your chart and start using those signals to boost your trading.

How does the indicator work?

Designed by Goichi Hosoda back in the late 1960s (what a visionary!), the Ichimoku cloud offers a wealth of data points compared to standard candlestick charts. Sure, it might look confusing at first, but once you get the hang of it, the signals become pretty clear.

The Cloud is your best friend. If the price is below the cloud? That’s a downtrend. If it’s above? Then we’re looking at an uptrend.

This indicator made its debut in the securities market before spreading to other financial areas, but the settings have remained the same.

So, what’s included in this indicator? It comfortably sits on the price chart, consisting of five lines and a shaded area known as the cloud.

Here are my recommended settings:

- The Cloud is formed by the levels of Senkou Span A (green) and Senkou Span B (orange), creating an average price range.

- The Tenkan Sen line (yellow) indicates the current trend direction.

- Chikou Span (blue) acts as your closing price estimator.

- Kijun Sen (red) serves as the main trade signal line.

I suggest using Ichimoku for long-term trading. Go all out and try different parameters across various time frames—from hourly up to monthly.

In the broker PocketOption platform, you can easily adjust the periods for Tenkan Sen, Kijun Sen, and Senkou Span B like an expert.

Here’s the recommended setup for TS, KS, and SS B:

- 1 hour to 4 hours: 9; 26; 52.

- 1 day to 1 week: 12; 24; 120.

- 1 week to 1 month: 120; 240; 480.

Once you’ve set up the indicator, it’s go time!

How to trade with Ichimoku Kinko Hyo?

Let’s dive into a few simple signals for a successful trading strategy:

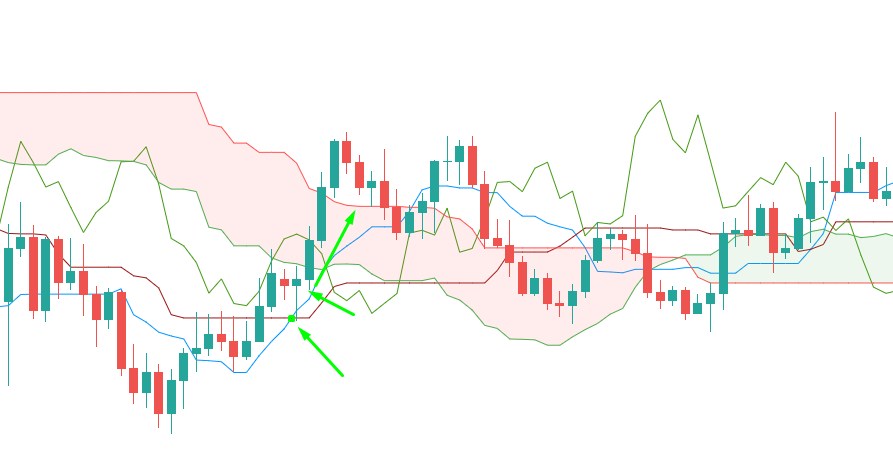

Smart traders like us know to watch the Ichimoku Cloud when the Tenkan Sen and Kijun Sen lines cross.

Here’s the play: when that blue line crosses above the red line, it’s time to CALL!

Now, flip it: make a PUT option when the Tenkan Sen crosses the Kijun Sen from top to bottom.

Keep this in mind: when the price is above the cloud, we’re seeing an uptrend; below it? That’s a downtrend. If the price enters the cloud, we’re either trendless or making a transition.

When Leading Span A is rising and above Leading Span B, we feel the uptrend vibes—this area should usually appear green. If Leading Span A drops below Leading Span B, we’re heading into a downtrend with a red backdrop.

Using the Cloud as your support and resistance area? Smart move. It provides future support/resistance levels, making it unique compared to other indicators that only focus on current levels.

Another promising signal occurs when the Ichimoku Cloud breaks out from its edges. Here’s the play:

- Get a CALL when it bounces off the upper boundary;

- And grab a PUT option when it bounces off the lower boundary.

Since we’re in it for the long haul, the timing for trades often lines up with the formation of one or two candles.

I know it looks like a jumble of lines on the chart. No worries, most software lets you hide some of the lines. For instance, you can hide everything except for Leading Span A and B, the ones that form the cloud. You’ll want to identify the features that simplify things for you, so focus on the lines that resonate and drop the ones that are distracting.

Sometimes, the cloud may seem less effective if prices stay above or below it for an extended period. During those times, keep an eye on the conversion line, base line, and their crossovers, as they usually follow the price more closely.

Hello,

I'm having difficulty understanding this post …

Please take a look at this …

For buying a CALL contract, you should wait for the blue line to cross above the red line.

The Chikou Span (blue) needs to move upward and cross the Kijun Sen (red).

To initiate a PUT contract, the Tenkan Sen must drop below the Kijun Sen.

This means the Tenkan Sen line (yellow) has to go down from above and intersect with the Kijun Sen (red).

Could you please advise …