I gotta say, Bollinger Bands are like the veterans of the trading world. This classic tool was created back in '87 by John Bollinger. He took the straightforward idea of standard deviation and transformed it into something that even beginners can understand. They say the band phenomenon started way back in the '60s, and since then, we've been hit with all sorts of tools and indicators that can honestly seem overwhelming. Over the years, a bunch of variations have popped up, but the ones still making waves today include Donchian, Keltner, Percentage, and of course, the iconic Bollinger Bands.

So, what are these Bollinger Bands I'm always talking about? Imagine them as those stylish curves that surround the price charts, usually consisting of a moving average (that's your middle band), an upper band, and a lower band. They help us figure out whether prices are climbing or dropping in relation to one another. The key is picking a middle band that truly represents the intermediate-term trend, combining that trend information with price levels.

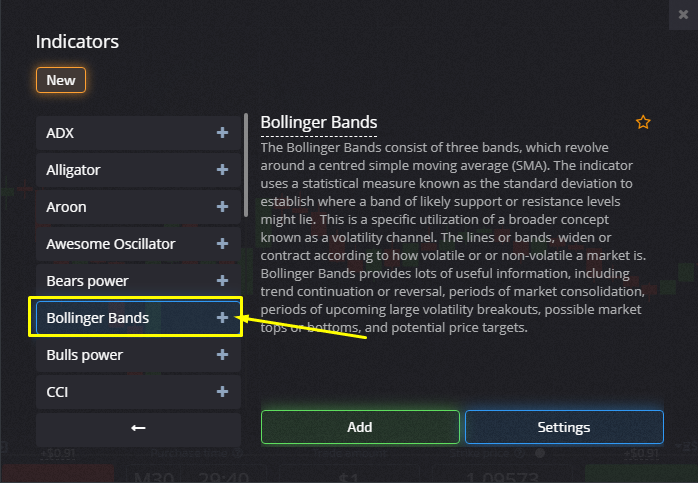

These days, I've seen most traders leaning toward Bollinger Bands like they're the hottest thing around. They’re even part of the essential toolkit on pocket option platform offering diverse trading insights. Talk about a must-have!

More About Bollinger Bands

First off, I draw those upper resistance and lower support lines, extending them to form channels. This is where I expect prices to settle down. Some traders get creative, sketching straight lines that link the peaks or troughs to identify the upper and lower price extremes, then they add parallel lines to outline a channel. As long as prices are moving within this channel, I can feel confident that things are going as planned.

Bollinger Bands, like many trend indicators, sit right on the price charts. You’ll spot those three lines working together.

Price action usually stays within the bands. On the Pocket Option platform, the middle line is your blue line, dividing the action.

Recommended Parameters for Bollinger Bands

So, let’s simplify: Bollinger Bands consist of three lines showing moving averages that stick to the same period.

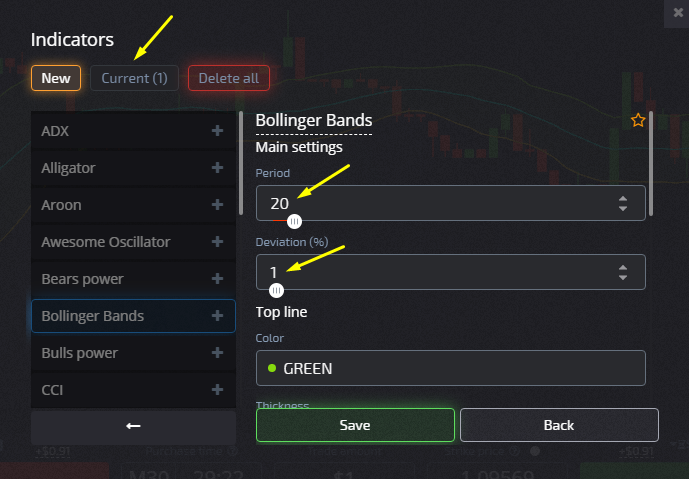

John Bollinger himself suggests using a 20-period parameter, no matter what timeframe you’re working with. The standard deviation index, which keeps those lines evenly spaced, should be set at 1.

On the Pocket Option platform, the lines’ colors and thickness, along with the background, are totally customizable. Set it up how you like!

Trading Options with Bollinger Bands

So, how do I go about securing contracts using Bollinger Bands? First, I focus on buying options that follow the trend. Bollinger Bands point the way:

- Long position when a price bar closes above the Upper Band;

- Short position when a price bar closes below the Lower Band;

- If the price bar sits in the middle, we’ve got a flat market;

- If the price is rising, we’re in a “bullish” zone;

- If the price is dropping at the bottom of the channel, it’s a “bearish” signal.

Sure, every strategy has its downsides, but let me tell you, Bollinger Bands are like a reliable guide pointing out those extreme short-term prices. When prices dip below the lower Bollinger Band, it’s a great opportunity to take advantage of those oversold situations before the price rebounds toward that center moving average line.

When's the right time to grab a contract? Surprisingly, with Bollinger Bands, I don't even need to worry about pinpointing the trend! If the stock price keeps touching the upper band, they’re typically considered overbought; conversely, consistent hits to the lower band signal oversold territory—a solid signal to buy.

When using Bollinger Bands, I mark the upper and lower bands as target prices. If the price bounces off the lower band and crosses over the 20-day average (the middle line), that upper band becomes the target price. In a strong uptrend, prices love to fluctuate between the upper band and the 20-day moving average. When that trend shifts and the price falls below that 20-day average, I need to keep an eye out for a potential reversal.

I keep my expiration terms aligned with the timeframe of two candles.

Timeframes can vary from 5 minutes to an hour.

While it’s true that every strategy has its downsides, Bollinger Bands continue to be one of my go-to tools for spotting those extreme short-term price movements. Snatching up stocks when they dip below the lower Bollinger Band often allows me to capitalize on those oversold conditions and profit when the stocks rebound toward that mid-moving average line.