You know what they say – diving into digital contracts is like finding a shortcut to some sweet trading profits. And guess what? There’s some truth to that claim.

Binary options are the real deal for folks who like to trade often. I mean, the opportunity for big bucks is just waiting for you, and get this – it’s not about how many pips you’ve navigated to make the cash.

But let’s be honest here. Saying that trading digital contracts is a walk in the park compared to Forex or other markets would be an exaggeration. Success in this game relies on having a solid strategy to back you up.

So, what’s the scoop for newbies trying to get their feet wet? Where do I grab a system to kick off the digital options hustle? Don’t worry; there are methods out there, and we’re about to break one down right here.

Our focus today is the “Intersection Point” strategy, and it’s equipped with a solid lineup of benefits. First off, it combines two indicators to boost the odds on those sweet contract signals. Secondly, it’s as simple as pie to implement, and you won’t even break a sweat figuring out all the settings. Plus, this IP strategy shines on shorter timeframes, making it perfect for the binary options scene.

How do I set up my trading space?

To kick off the “Intersection Point” system, I’m focusing on a lively asset like the EUR/USD or GBP/USD pair. Gotta keep it volatile, right?

I’m setting the timeframe to M5. Most traders prefer this timeframe for binary options since it offers trading opportunities often, and it comes with less risk than those speedy turbo options that only last 60 seconds.

For the chart, I’m going with either a bar chart or those slick Japanese candlesticks.

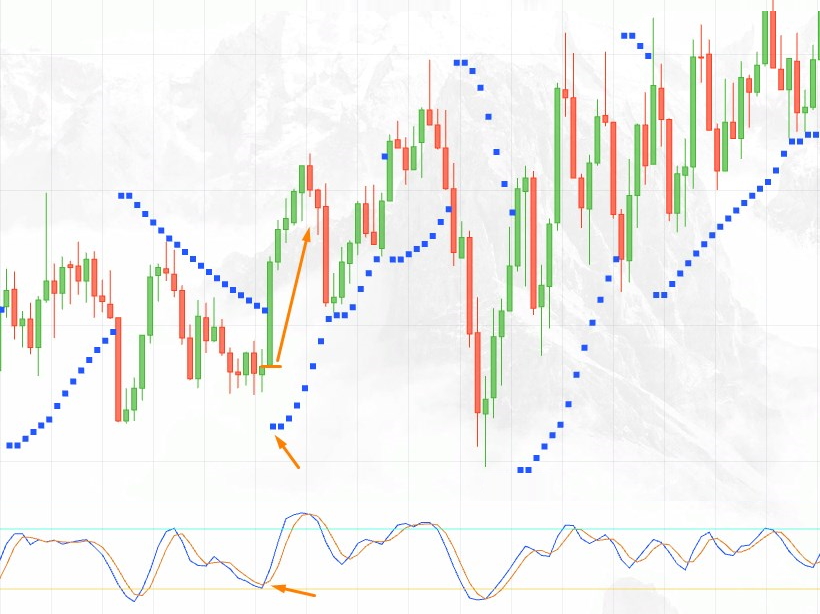

In this setup, I’m relying on two key indicators: the trend Parabolic SAR and the Stochastic oscillator. They’re all set and ready to go in the Pocket Option terminal, and I can use them straight out of the box – no adjustments required.

How do I trade with the “Intersection Point” Strategy?

This system is all about its name. My mission? Keep an eye on the Parabolic points and the beautiful crosses of the Stochastic lines.

Now, here’s the game plan for when I want to take a CALL option: wait for that fast Stochastic line to break above the slower one from below, and right when a Parabolic point appears below the candle or bar.

On the flip side, if I’m looking at a PUT option, I need to jump in when that blue Stochastic line dives below the orange line, while a Parabolic SAR point is forming above the bar.

I’m setting the expiration period equal to the length of two bars or about 10 minutes.

This shows that I can use certain strategies without diving deep into complex trading theories. The “Intersection Point” approach is simple and beginner-friendly, making it a great fit for rookies.

But don’t forget, no trading setup guarantees a foolproof 100% success rate. So, keeping it smart with my cash management is key – I’ll never risk more than 3% of my bankroll on a single trade.

To wrap it all up, the “Intersection Point” strategy serves as a handy tool for trading binary options, especially for those just stepping into the trading world. Sure, it won’t guarantee solid results, but with disciplined risk management on my side, it can be a real gem in my trading toolkit. For those interested in exploring comprehensive trading strategies and insights, the pocket option broker platform offers a comprehensive range of opportunities that can enhance your approach.