Want to elevate your trading game? I've got my sights on those effective technical indicators. My strategy really depends on how I analyze the trends, patterns, averages, and great opportunities. Choose the right tools, and boom—you build a strong foundation for success in trading. Get it wrong, and it could really sting.

So, how does a beginner like me choose a successful strategy? Honestly, I think it’s best to start with the big names and adjust one, two, or maybe three indicators at a time, paying attention to whether they boost or tank my performance. This way, I can quickly figure out what fits my style. Many experienced traders prefer either medium or long-term strategies in this field.

Today, I’m exploring a straightforward and solid medium-term strategy using signals from three powerful indicators. While some traders throw everything at you, I recommend concentrating on just three key tools. While trading, you can learn about various strategies with a broker like PocketOption that provides all the tools and indicators you need to trade confidently.

Indicators for Medium-Term Strategy

When I'm using my medium-term trading strategy, I rely on three main indicators: Bollinger Bands, Stochastic, and SMA. Each one is crucial in this field. Let’s break it down:

- The Stochastic Oscillator is my preferred momentum indicator, comparing a specific closing price against a range of values over a set timeframe. I can adjust its sensitivity by changing that time period or using a moving average for smoothing.

- Bollinger Bands include a centerline with two price channels (the high and low) on either side. The centerline acts like my reliable exponential moving average, while the channels reflect the asset's standard deviations. They either spread out when price movements are volatile or narrow when things calm down.

- SMA is a classic—helping me decide whether to be bullish or bearish. It calculates the average price of an asset over a specified period, indicating the current trend direction. If the price stays above the moving average, I'm in a good spot. If it's below, it’s time to reassess my strategy.

When I set this up, I always use “Japanese Candles” on an hourly timeframe for better clarity.

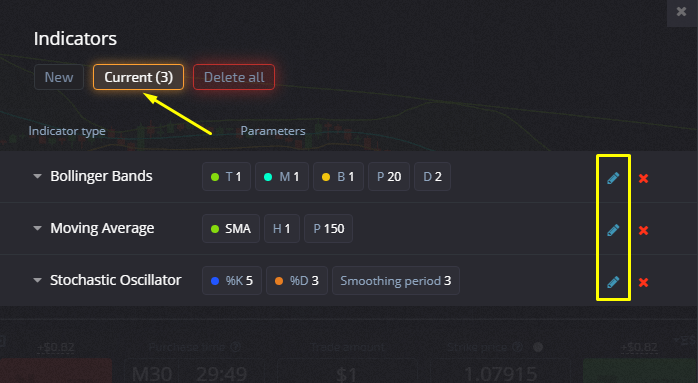

Now, to get those indicators right, I customize the defaults to my liking:

- SMA – period 150;

- Bollinger Bands – period 20, deviation 2;

- Stochastic – period (k) 5, period (d) 3, deviation 3.

To adjust the selected indicators, I click on the “Active” tab and give that “Pencil” icon a little tap.

How to Trade on a Medium-Term Strategy?

Once I have my indicators set up, I focus on these signals:

- Put option:

SMA should indicate a downtrend. This is when I buy after the price rebounds from the upper Bollinger line, and I see the Stochastic moving out of the 80-100 zone heading down.

- Call option:

SMA should show an uptrend. I'm ready to act when the price bounces off the lower Bollinger line, and I see Stochastic moving out of the 0-20 zone heading up.

Remember, the expiration period? At least 2 hours, folks!

Basic Tips for Medium-Term Strategy

I make sure to follow these key rules to keep my medium-term strategy on track:

- I'm all about picking highly volatile assets with active trading.

- No way am I trading in a stagnant market—I'm only in when the trend’s going either up or down.

- Stochastic needs to ditch the “pre-” zone first. If it's stuck, I'm out.

In summary, the word on the street is that a medium-term strategy using three indicators doesn’t have to be complicated. But, keep this in mind: the Stochastic Oscillator can occasionally throw some surprises, giving off false signals now and then. That's when it suggests trading while the price moves in the opposite direction, which can be a disaster. During those unpredictable, wild market conditions, I use Stochastic as a filter—only taking signals that align with the trend.