I gotta share the U-turn strategy with you—it's all about that quick turnaround! First off, you need a market that’s trending like mad for this setup to really pop. I’m talking about trend lines moving at least 20 percent either up or down. Always roll with the trend, especially when you're trying to catch those momentum setups. So, imagine this: the stock seems to be sinking for a bit, looking like it's about to drop. But then, bam! It shoots back up as buyers jump in, closing near the upper trading range of the day.

This is the kinda action I’m looking for on my daily charts every night after the market closes. The U-turn strategy is a top choice for grabbing quick gains and managing trades like a champ. It’s a fast-moving trade, taking advantage of stocks or markets that are briefly out of sync. For those looking into advanced trading perspectives, consider exploring the comprehensive features offered by Pocket Option platform for strategic trading enhancements.

At first glance? It might seem like the market’s breaking out. But wait! As the day goes on, it quickly turns around and aligns back with the overall trend.

You can spot a trade signal when a candle can’t close below a certain level. That candle might touch it with its shadow or body. If it bounces off support or resistance and returns to that level, that’s your hint that the price just can’t break through. Wait for the next candle to confirm—it's gotta be moving in the opposite direction.

Here’s the game plan for the U-turn strategy:

- The candle can't close past the level—just a touch with its shadow or body is enough;

- Hang tight for that second candle to confirm the rebound;

- Go ahead and grab an option in the direction of the rebound.

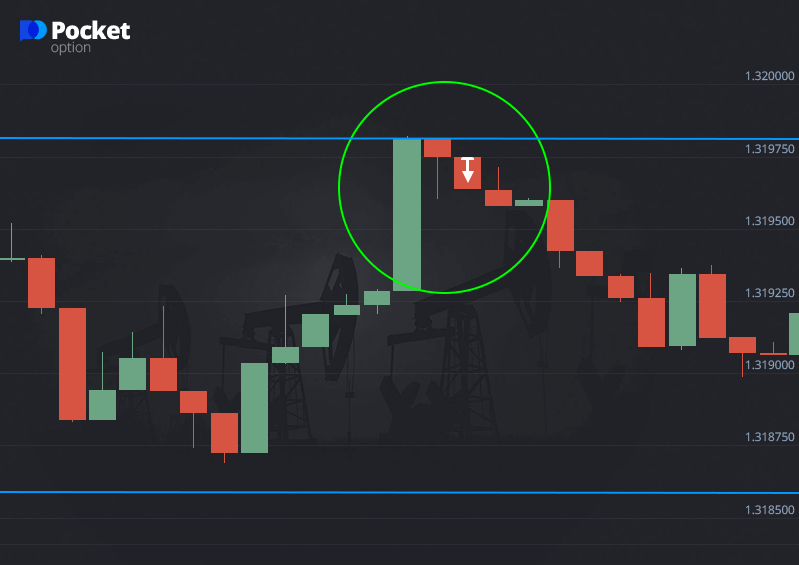

Put option after a rebound from a resistance level

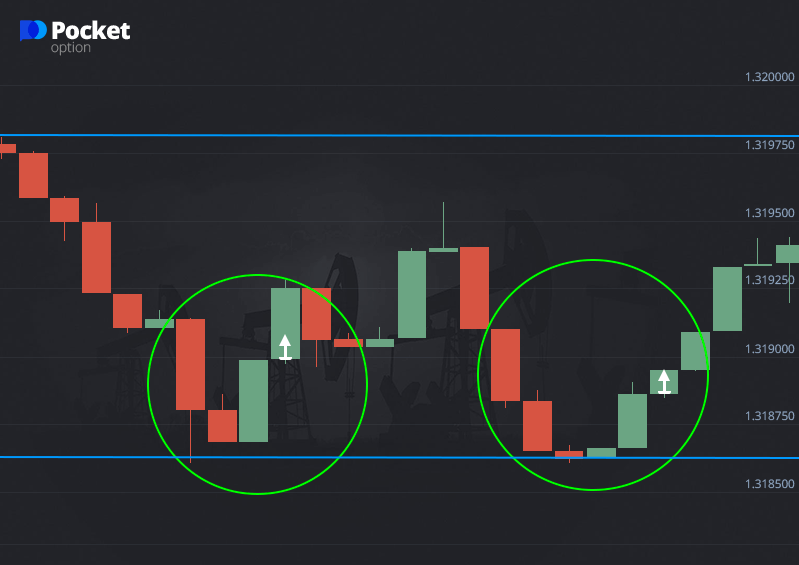

Call option after price rebounds from a support level

Call option after price rebounds from a support level

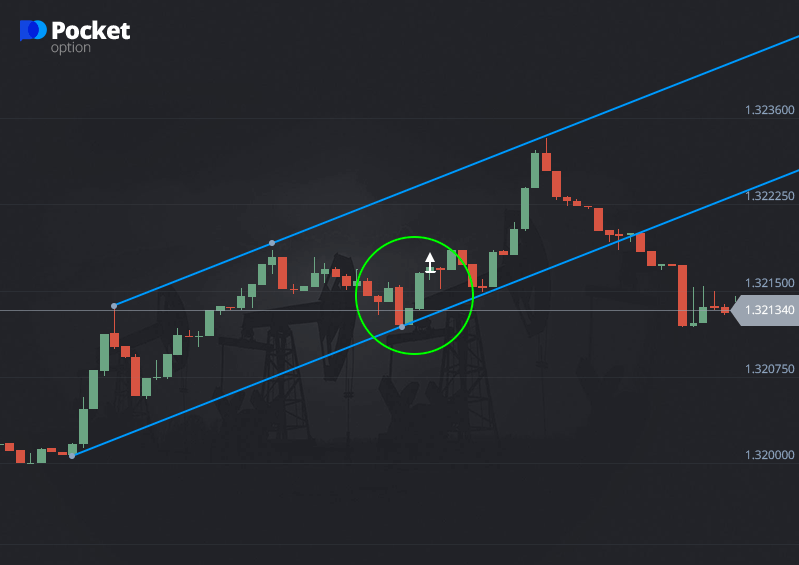

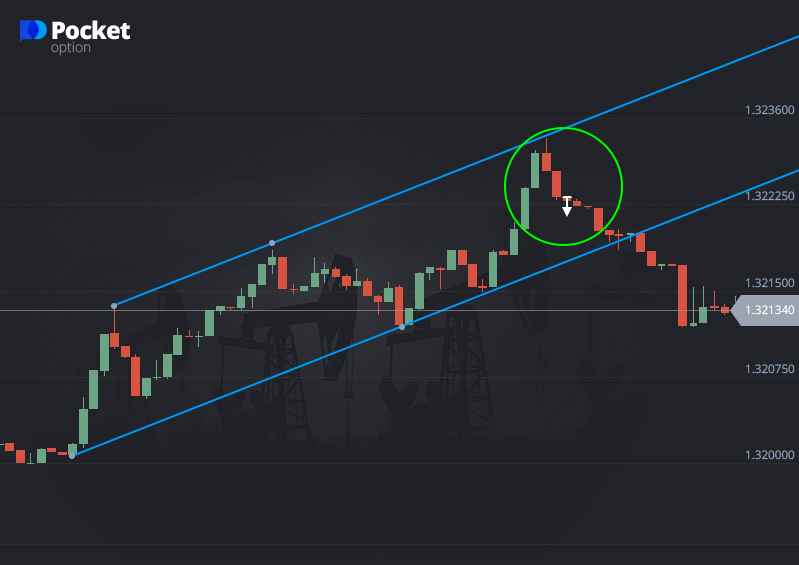

Call option after a rebound from the bullish trend

Just a reminder, trader friends, that among all those support and resistance levels on the chart, only the ones confirmed by price really matter. Check the strength of those levels: you wanna look at the history of quotes and see how often the price hung around or bounced from these points. If the historical data shows no action at that level, it's probably just a false signal.

One big tip—never trust signals that appear after the first two hours of trading. It’s a day trade, so give those moves enough time to unfold and make some gains.

It’s easy to forget to close open orders and end up filled by accident. Keep your eyes peeled to avoid those pricey mistakes.

The U-turn strategy is all about taking advantage of the main trend. The setup happens quickly and disappears just as fast, so you gotta be alert to grab those opportunities as they come.

Use your stop orders or market orders to jump into the trade, and seriously, don’t dive into this trade if the entry hasn’t been triggered in the first two hours of the trading day.

Keep that position open until the day’s end, and keep an eye on it using 15-minute charts if you’re in the stocks game.

For futures or currencies, stick with 5-minute charts instead.