So, here's the scoop on trading financial options, right? When I stick with a binary option until it expires, there are only two results: I either score a set amount or I get nothing. That's why we call them binary options – it's that simple. It’s a straight-up yes or no game, and we traders are making choices based on whether we think it’ll pay off or not. That’s why it’s one of the easiest ways to get into Pocket Option trading experiences for beginners and experts.

And you know what? Since it sounds so straightforward, a lot of people think they can make money without any training. Well, I guess they’re kinda right, at least to a point.

Some thrill-seekers dive in, treating their trades like high-stakes opportunities, hoping to strike gold by pure chance. But even these risk-takers should play it smart, using basic strategies like the Martingale method, probability theory, and grasping mathematical expectations. These high-risk players love to make lots of smaller trades in quick succession.

On the flip side, we’ve got the pros – the ones who make informed calls. They approach binary options like they would with stocks or commodities. The big question, though, is whether I can roll with a solid trading strategy without relying on the Martingale method.

Absolutely, if I know my tools for technical analysis! The binary options market is no different from other markets. It’s all about reading the charts and making educated guesses. If you’re curious, check out the Triple Power Strategy for some great insights into technical analysis in trading binary options.

Intro to the Triple Power Strategy

This strategy's got a legit name since it uses three RSIs (Relative Strength Indices). And let’s be real: three is always better than one. Newbies might wonder, “What’s the point of using three RSIs when they give the same signals?”

Well, each of those RSIs runs on different timeframes. The Triple Power Strategy uses three RSIs to filter the noise and avoid false signals. Another cool feature? I can use this strategy on any timeframe while keeping the default settings the same.

For the three RSIs, I set them to periods of 5, 14, and 21. Once I’m ready to roll, I’ll be looking at three nearly identical oscillator windows showing different signals.

How I Trade with the “Triple Power” Strategy

Alright, let’s get to it! I’m all set to trade with the Triple Power Strategy. But before jumping in, I gotta pick up a few tips.

First off, don’t expect signals to pop up everywhere. I need to understand that trades won’t come around that often. Sometimes, I might go an entire day without a single signal, especially if I’m focused on one asset. That means I should avoid high and medium timeframes – M15 is the sweet spot for this system.

Second, I can trade any asset. This strategy is low-key and doesn’t rely on volatility or the time of day. Since signals don’t come in often, I can keep an eye on 3-4 assets at once.

No need to worry about the rare signals because they come with high accuracy. Almost every trade I make will be profitable, except for those wild spur-of-the-moment moves. So, I need to be smart and avoid using this strategy during major news events.

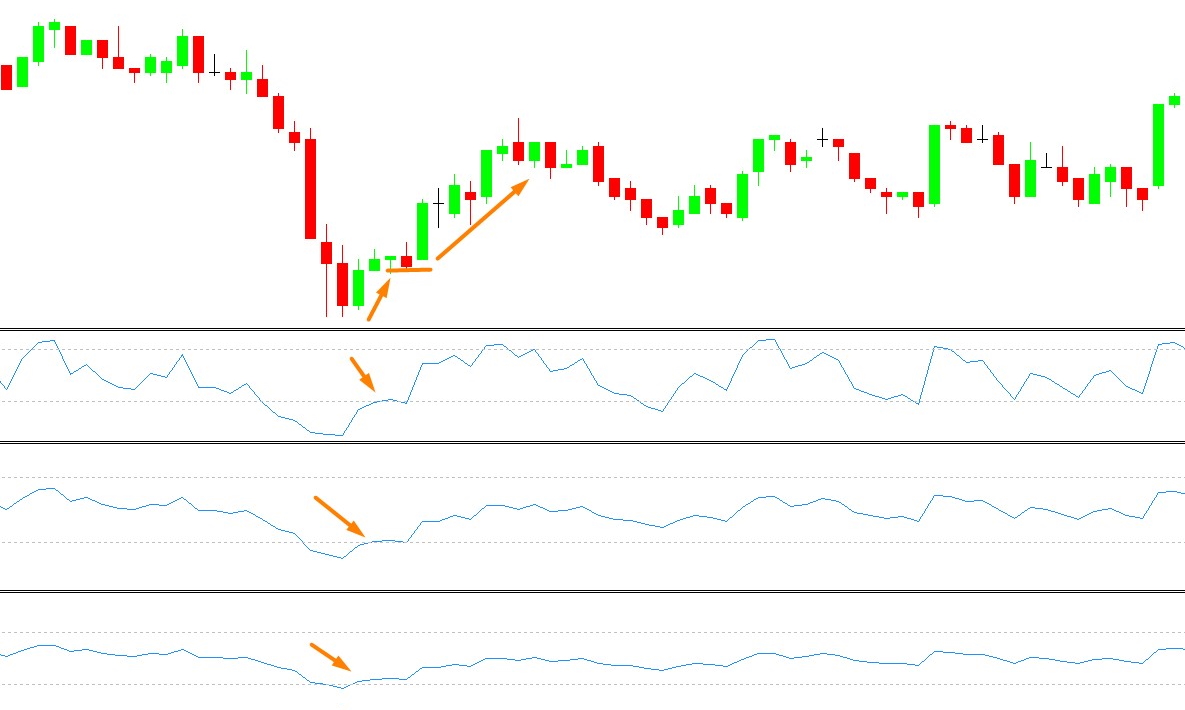

The CALL option? I know it’s the time to act when all three signal lines come out of the oversold zone.

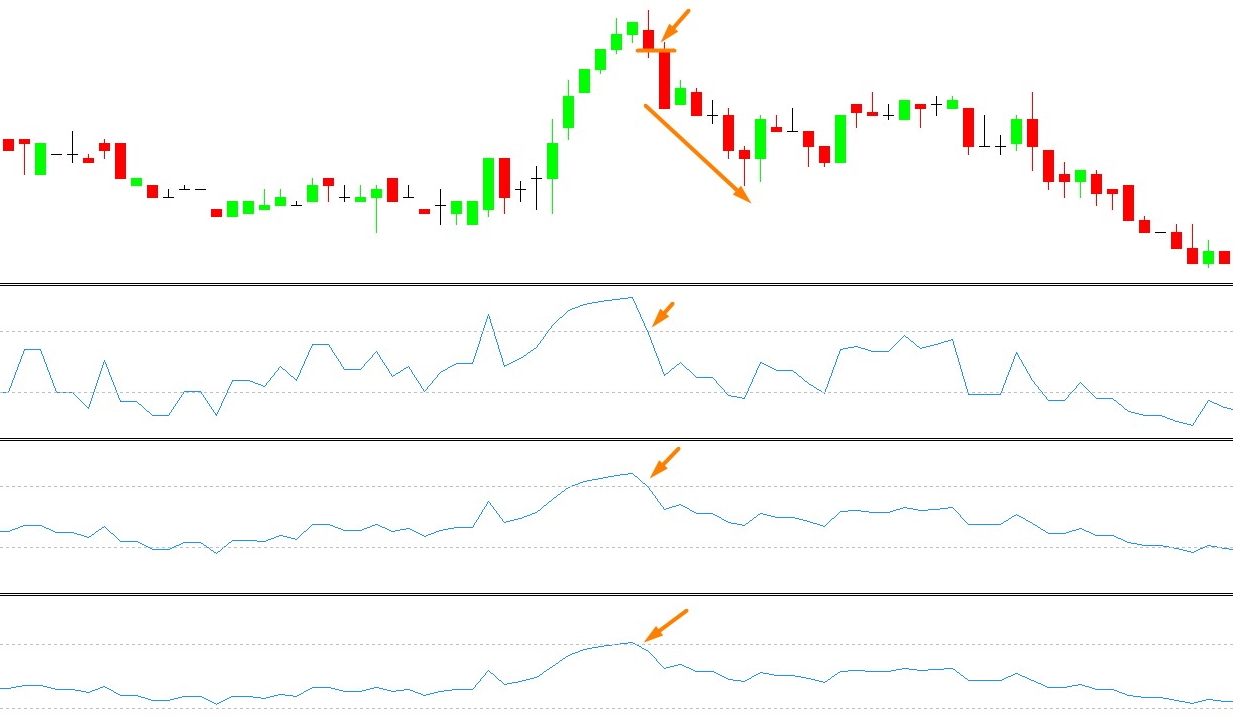

The PUT option? I take action when the signal lines on all three RSIs drop out of that overbought zone.

Pro tip: Aim for an expiration that aligns with a formation of 3-5 candles.

So yeah, I’m making my trades based on whether I think the answer is a yes or no. That’s what makes these options some of the easiest financial assets to work with. Despite all its simplicity, I need to ensure I fully understand how binary options work, the markets and timeframes I can trade in, and what the pros and cons are before diving deep into these instruments and figuring out which brokers are trustworthy.