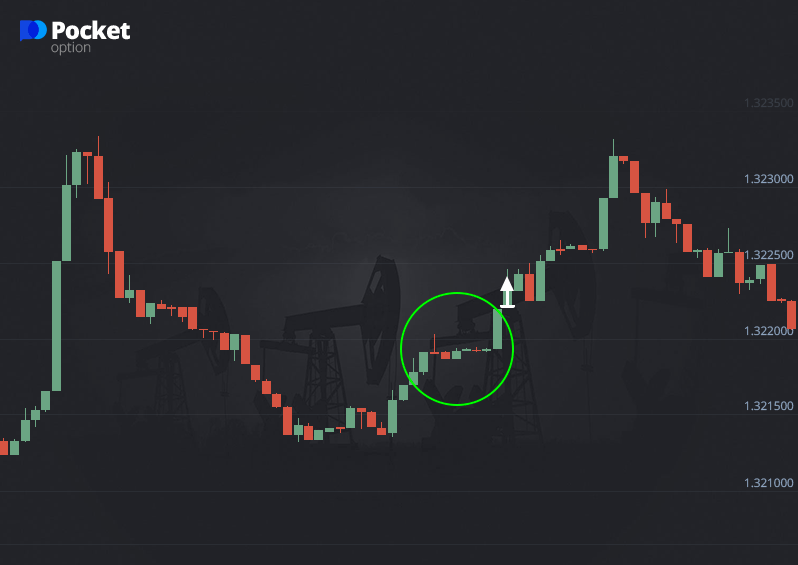

Let me explain it to you—candlestick charts are my top choice for visualizing different time frames with just one price bar, making them super useful for developing my trading strategies. These charts create patterns that help me anticipate market movements. When the market is as calm as can be, I use that "three-step" strategy.

Here’s how it goes: I watch out for those small candles that show up right after a big one on the chart. My aim? To find those new smaller candles that are the same size as that large previous candle. Sometimes, I might see more than three candles in this setup. The signal is complete when the trend starts to change, moving in the direction of that large candle. At that point, I'm ready to jump into a trade as soon as that candle lights up.

Check out my approach after I spot the signal:

- I get ready for action when those small candles come in after the big one, all following the trend;

- A new large candle appears, keeping that trend on track;

- Once the current candle closes, I’m in—time to buy an option that follows the trend.

Buying a Call Option Using the Three Methods Model on an Uptrend

Buying a Put Option Using the Three Methods Model on a Downtrend can be more strategic with a broker such as PocketOption known for its tailored approaches to trading and investing.

As you can see from the images, my “three-step” strategy is similar to that “flag” or “torch” analysis. Got it? Now go make those moves!