If you were to ask me about the key indicators for market analysis, I’d definitely mention the Stochastic oscillator right away. This tool has been around for a while and is still a favorite among many traders today.

And check this out: the Stochastic isn't just sticking around; it's been adopted in some modern trading options, including binary trading. Most brokers, like Pocket Option comprehensive trading platform for diverse strategies, offer this oscillator on their trading platforms, which are loaded with features.

Stochastic Overview

I really think this oscillator deserves all the attention it gets. It was developed back in the mid-20th century when traders didn't have many choices, securing its place in the spotlight.

Even today, the Stochastic oscillator is a key player in identifying overbought and oversold conditions—those moments when it's kind of too late to jump in and buy or sell.

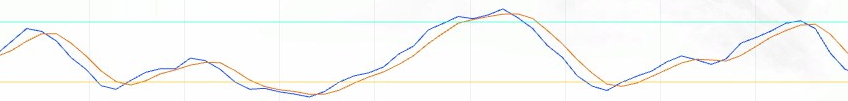

You’ll usually find the Stochastic displayed in a separate window below the price chart, showing a scale with levels and two signal lines.

Now, those signal lines represent moving averages that react to price changes over specific timeframes. We have the quicker %K line, which is depicted in blue, and the slower %D line, which is shown in red.

The predefined levels in the indicator? They’re crucial for trading. Lines hanging out between 0 and 20 indicate we have an oversupply, while the 80 to 100 range signals excess demand. Crossing into these areas usually suggests that a trend change is just around the corner.

Trading with Stochastic

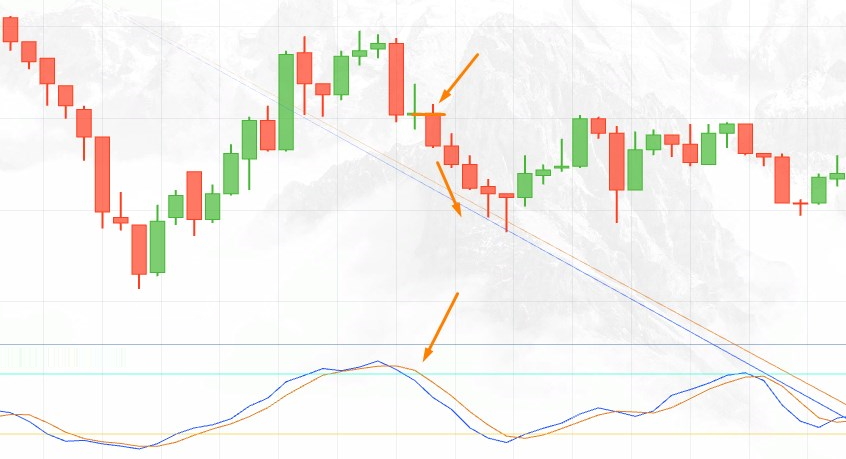

When I look at the data, it’s clear that I want to enter trades when those signal lines bounce out of overbought or oversold zones. Basically, that’s when a new trend is starting to form.

To get into the details, I’m taking a CALL position when those lines cross above level 20 from below. That’s my signal, folks.

On the other hand, I’m going for a PUT position when those moving averages cross and start heading down from above level 80.

Sometimes, I use a clever strategy. I jump into a trade when the fast and slow Stochastic lines intersect and I buy in the direction where the blue line crosses above the red line.

Trading Tips with Stochastic

So, I need to keep a few important points in mind to use the Stochastic effectively, which can really boost my profits while minimizing risks.

First off, the Stochastic doesn’t perform well in choppy markets. So, I focus on it when there’s a clear trend forming.

Second, it’s important to adjust the settings based on different timeframes. For timeframes under H4, I use fast, slow, and signal line values of 5, 3, and 3. If I'm on timeframes longer than H4, I increase those numbers to 14, 5, and 3.

Lastly, I want to avoid using the Stochastic in volatile markets, like cryptocurrencies. This indicator reacts very quickly to price changes, which can lead to a lot of false signals.

In the end, when I use the Stochastic under the right conditions, it’s a fantastic tool for finding entry and exit points in trending markets. But I need to be aware of its limitations—like its poor performance in sideways markets and the potential for false signals in highly volatile situations like crypto. By following these strategies and adjusting my settings based on the timeframe, I can tap into what the Stochastic has to offer while keeping risks down and profits up.