I have to say, the stochastic indicator is like my secret tool in the trading world. This feature is a must-have for all us technical analysts out here. You can count on most trading platforms having the stochastic, and it's definitely included in trader courses.

So here's the breakdown: the Stochastic consists of two lines, the %K line and the %D line. They fluctuate between 0% and 100%. You’ll find this indicator positioned below the price chart, showcasing a scale divided by levels along with two moving averages: a fast %K (that's the blue one) and a slower %D (the orange one). The Stochastic provides insight into how the closing price compares to the past trading range over a specific time period. We traders? We depend on this for trading stocks, FOREX, and even those broker options.

More About the Stochastic

This Stochastic gem is a momentum indicator created by the brilliant George C. Lane (1921 – 2004). This guy was a securities trader, educator, speaker, and a true technical analysis expert. He worked with a group of futures traders in Chicago who developed this oscillator. The Stochastic tells us where the latest closing price stands in relation to the previous high-low range. It shows us exactly where the price is sitting amidst the changing margins.

You gotta know the dynamic duo of lines: the %K line is speedier than the %D line. So, as a trader, I need to keep an eye on how the D line and the price interact with either the overbought (that’s over the 80 line) or the oversold (under the 20 line) zones. Here’s the game plan: selling becomes an obvious choice when the indicator rises above 80, while I should consider buying when the indicator falls below 20 and starts to tick upwards with solid volume.

The %K line? It’s calculated based on the difference between today’s closing price and the period low, which gets divided by the difference between the period high (Highest High) and the period low (Lowest Low). In the meantime, the %D line is a Simple Moving Average of the %K line—so it’s a bit more relaxed than the %K.

About Generated Signals and Settings

The indicator usually sits below the price chart, with its scale divided by levels and those two moving averages: fast %K (blue) and slow %D (orange).

K refers to the number of periods shown on the chart. If I’m looking at daily data, the %K period represents days; if we're dealing with weekly charts, then it’s weeks, and so on.

D indicates the number of periods used in the Moving Average calculation.

These levels create three main zones:

- Oversold market: From 0 to 20;

- Flat market: From 20 to 80;

- Overbought market: From 80 to 100.

Here’s how I roll with the conclusions based on the lines:

- If both lines are in the oversold zone, there's a good chance there’s been a quick price drop—time for a trend reversal.

- If the lines are up in the upper zone, brace yourself—after a price surge, we might see a drop.

- The neutral zone? That’s where the market is flat, usually reflecting the direction of the lines.

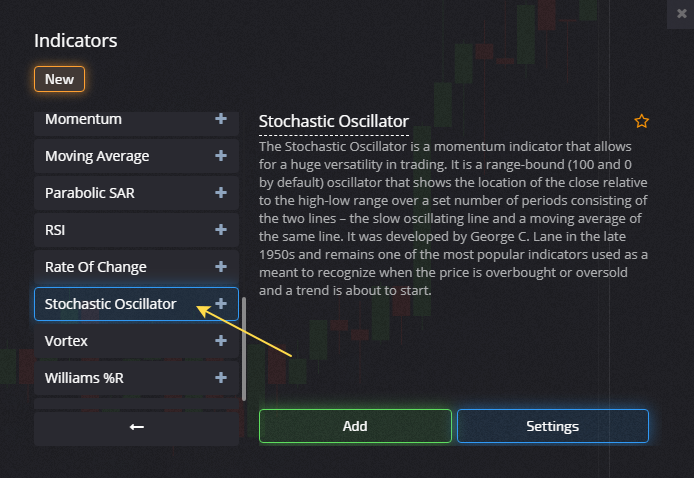

Stochastic in the Pocket Option Terminal

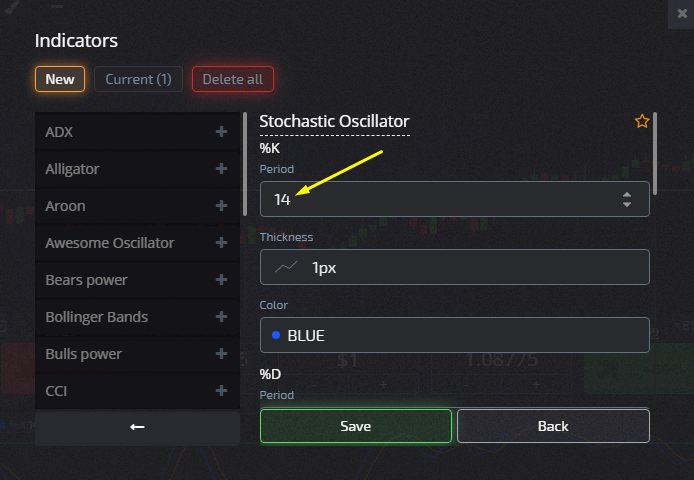

In the Pocket Option, the Stochastic has three neat parameters:

Period %K, period %D, and deceleration. I can also customize it by changing the color of the signal lines, which is a nice feature.

Now, here’s the lowdown based on my strategies:

- Short-term strategies go with: 5; 3; 3;

- Medium and long-term strategies recommend: 14; 5; 3.

How to Trade Options with Stochastic?

Dr. Lane always mentioned that great trades often come up when there’s divergence, especially when the %D fluctuates between 10 and 15 for a buy signal and 85 and 90 for a sell signal. He emphasized that the most significant signal is that divergence between %D and the asset. During divergence, the Stochastic %D line makes a series of lower highs while the asset continues making higher highs—it indicates we’re overbought. An oversold situation will display lower lows, while the %D marks higher lows.

When those patterns appear, I'm ready for a market signal. Time to grab that market position as the %K crosses the %D from the right side. A right-side crossover occurs when the %D touches its high or low before moving up or down, and the %K intersects it.

To simplify:

- Call when %K is rising and breaks out of the oversold zone, crossing 20.

- Put when %K drops down, exiting the overbought zone, crossing 80.

Make sure to set the expiration period to match those 2-3 candle formations.

To sum it all up, the Stochastic is a popular indicator for a reason—its accuracy is impressive. Whether you’re a seasoned expert or just starting, we all use it to nail those entry and exit points.

With Pocket Option, I can test my strategies on a demo account. Plus, the platform lets me trade anytime, six days a week—yep, even during lunch or overnight! Transparency and trust come standard here, and I never risk losing more than my initial investment. Interested in all my favorite markets? You can find them all in one place at OptionPocket for comprehensive trading insights.