Hey there, fellow traders! Let me tell you, I’m living the dream as a modern internet trader. Unlike those "old school" folks who had to make phone calls and crunch numbers with their complicated formulas, I’ve got an awesome set of tools right at my fingertips today.

I’m talking about indicators that I can pull up on my screen with just one click, and they can accurately predict the future direction of asset prices. It's a total game changer when using a platform like Option Pocket.

But listen up – not everything’s perfect. With all these available tools, I’ve seen plenty of traders go overboard, cramming 5 or more indicators onto their charts. Talk about confusing signals! That usually leads to one thing: poor decisions.

In this guide, I’m gonna explain the Rainbow system for you. It’s all about one reliable indicator – the Moving Average (MA). Trust me, this tool sends clear buy signals for digital options and works like a charm across any timeframe. And in this market, that's essential.

Setting Up My Trading Workspace with the Rainbow Strategy

First things first, let’s discuss the MA. This trusty tool is one of the originals in the finance world, used across stock exchanges, commodities, and even crypto.

Setting it up is super easy. I’m going for a simple moving average here, which means the new point on the line is the average of the closing prices over a set period.

So, from that, it’s clear that the MA curve on my chart reacts quickly to price changes, keeping up with the main trend. No wonder lots of traders prefer it over flashy trend lines.

Now, here’s the interesting part: the MA's reaction speed depends on its period. Shorter periods? Faster reactions!

And there you have it, that’s the magic behind the Rainbow strategy.

To get started, I’ll add three MAs onto my chart: one with a period of 5 (lilac), another with 10 (blue), and a third with 15 (yellow).

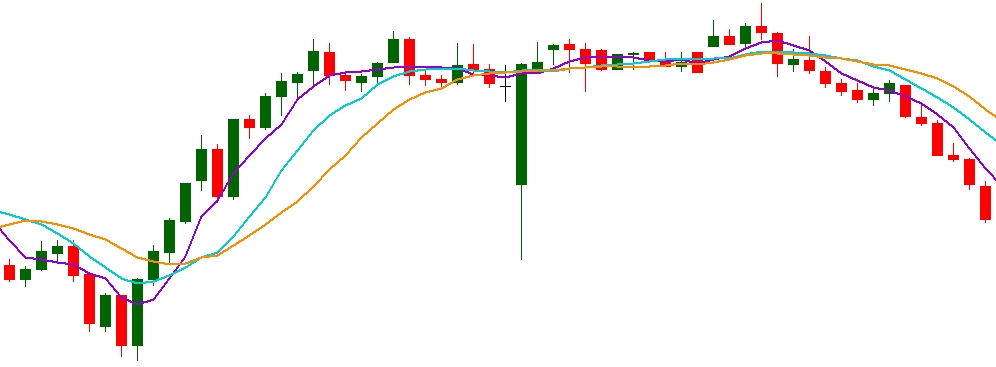

Given how this tool works, when the market trends smoothly, all three MA lines are moving in the same direction, nice and parallel.

However, when the market's about to change, the MA with the shortest period – the one with a 5 – will be the first to catch the shift. That’s the crux of the strategy.

Trading Like a Pro with the Rainbow System

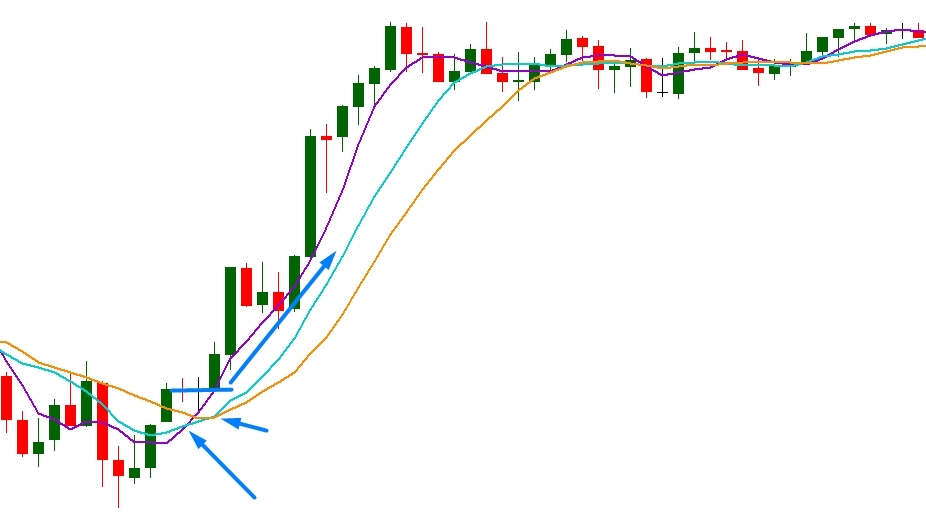

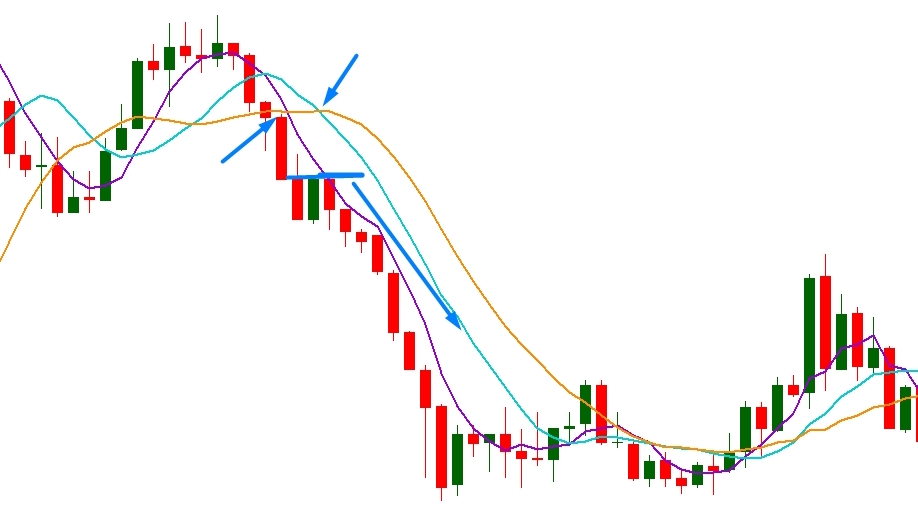

So, based on what I’ve just explained, if the junior line (the one with a period of 5) crosses the MA with a period of 15, that’s my signal that the main trend might be about to change. When the 10 MA crosses the 15, that's my golden buy signal!

CALL contract? I’m buying when both lines cross the MA 15 from below.

PUT contract? That’s when both lines have crossed the MA 15 from above.

Now, about expiration? That’ll depend on the timeframe I choose. Just remember, it needs to be at least as long as it took to create those three bars.

Despite its simplicity, the Rainbow strategy can generate some solid, consistent profits on digital options. Just keep in mind, lower timeframes are more likely to give false signals.