So, here’s the deal: the digital contracts market is my way to quick cash flow in the financial markets. This handy tool lets me jump into a bunch of short-term trades with set payouts, meaning I can skip waiting for prices to hit those sweet spots for my profits.

But hold up! Binary options aren’t all easy street. Since the losses are just as fixed, a wrong analysis can wipe out my account in no time. That’s why I stick to a smart trading strategy that might not churn out tons of daily trades, but it keeps my risks low and my income steady.

And let me tell you, staying sharp and adjusting my game plan is essential. This market is always changing, and something as small as an economic blip can throw things off. I make it a point to keep my ear to the ground for the latest market news and tweak my tactics as needed. Pros like me combine thorough research with smart risk management to keep our investments on a profitable track. With a good mix of experience, brains, and flexibility, I can confidently navigate this financial landscape.

Wanna keep your edge? Check out The Fidelity Trading Strategy; it’s got an impressive 90% success rate on binary options. This strategy uses two popular indicators, Envelopes and SMA, which you can easily find in the pre-installed toolkit from Option Pocket platform.

How Do I Set Up a Trading Screen?

First off, let’s point out that those Envelopes can deliver super accurate signals for contract entries all on their own. Think of this price channel like a fancier version of the Bollinger Bands, but with way more sensitivity to price action—perfect for my quick trades.

Here’s the deal: moving averages are my backup, helping to confirm my trades and improve reliability.

The “Fidelity” system can be customized to trade just about anything—currency pairs, stocks, commodities, you name it—even cryptocurrencies. Both indicators shine in markets that fluctuate at different levels!

As for timing, I’m all about the 5-minute intervals. Why? Because those fast 60-second trades can get lost in market noise. Longer timeframes just don’t deliver often enough for this method.

This goes without saying, but Japanese candlesticks are my go-to for charting.

And I need to tweak those standard indicators a bit. When I'm setting them up in my workspace, I adjust the parameters to the ones that the strategy experts suggest.

For Envelopes, I use a period of 14 and a deviation of 0.05. These settings are spot on for the M5 timeframe. If I’m looking at longer intervals, the indicator values need a little adjustment.

How Do I Trade with the Fidelity Strategy?

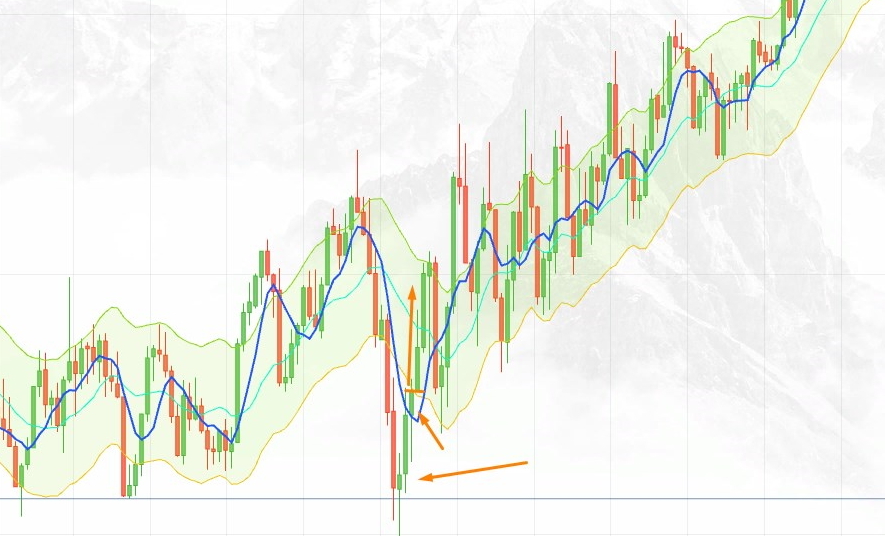

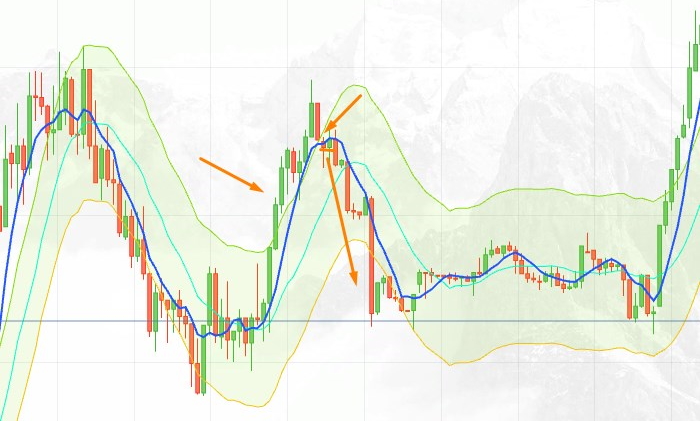

So, here’s the lowdown: the signal lights up when the price moves outside the Envelopes. Meanwhile, if the chart breaks through the moving average, that’s my green light to jump in.

This means I grab a CALL option when the candlesticks are hanging below the lower Envelopes and break up through the SMA as they slide back inside the channel.

Now, for a PUT option, I’m in the game when the candlesticks rise above the upper channel boundary and dip down past the SMA on their way back.

I stick to a fixed expiry time of 15 minutes.

By following the “Fidelity” strategy’s game plan, I can consistently earn from the digital contracts market. Many traders love this approach because it focuses on risk management and views binary options as a reliable income source.

To sum it up, the “Fidelity” strategy, with its straightforward rules and managed timeframes, is a smart move for anyone looking for a steady and reliable income in the electronic contracts space. It's a no-brainer choice for us risk-aware traders aiming to succeed in the binary options world.