Let me tell you, I’m all about Envelopes – these smooth technical indicators plotted right on my price chart, giving me upper and lower boundaries to work with. Envelopes? They’re my go-to for showing prices, variations, and those crucial trading ranges. What’s at the heart of the Envelopes indicator? You guessed it, a moving average! A moving average is like my reliable sidekick, acting as a trend-confirming tool, a trend-following tool, and yes, a lagging indicator. All three of those roles come into play with Envelopes.

Now, I’ve seen traders use Envelopes in all kinds of ways, but most of us use them to understand those trading ranges. When the price shoots up and hits the upper boundary, it's game over, my friend! That market’s overbought, and I’m ready to sell. On the flip side, when the price drops down to that lower boundary, you can bet I'm buying because that market's oversold!

Envelopes work best when I team them up with other analysis methods. For example, I look for opportunities when the price breaks out of the envelope, then I check my chart patterns for the next big move. Moving average envelopes? That’s the classic type I prefer. Just apply a fixed percentage for a simple envelope.

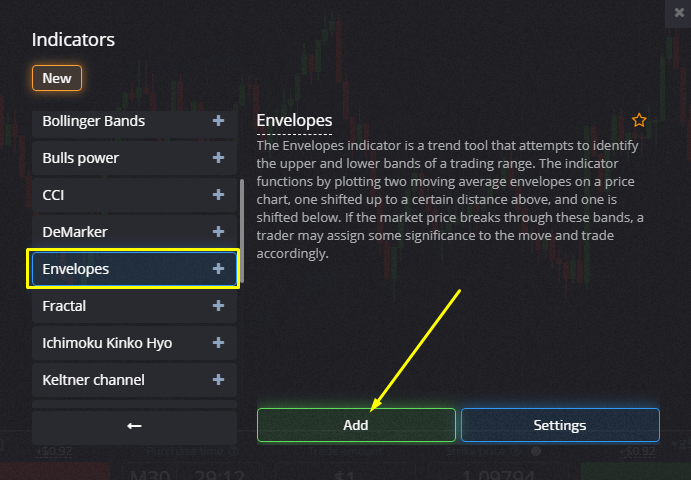

Pocket Option has Envelopes ready to go in their standard trading tools.

How to Activate the Envelopes Indicator

Alright, here’s the deal – in the world of technical analysis, we’re dealing with trend lines plotted above and below the current price. I use these to keep track of prices and figure out if the market's overbought or oversold.

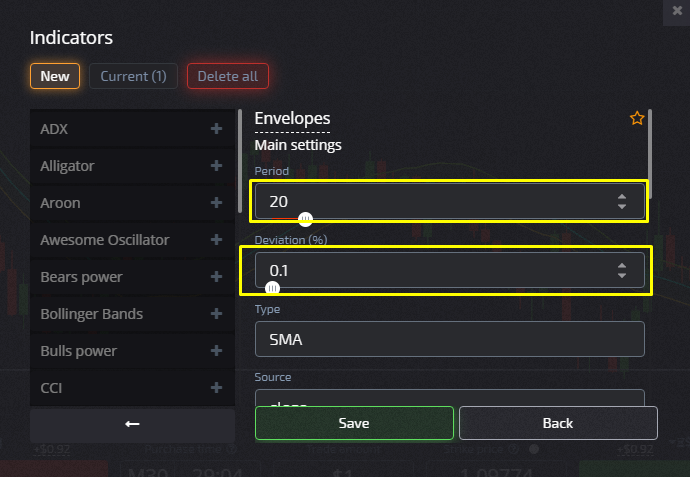

Ready to turn on the Envelopes indicator? All you need to do is hit the Settings, click on “Indicators” in the Pocket Option trading terminal for innovative strategies, and find the “Current” section. Look for the Envelopes Indicators and hit that pencil icon.

Pro tip: Make sure you set Period and Deviation (%). I usually start with 20 candles and adjust based on what the market's showing me.

In a volatile market? Increase the deviation. On a typical day, I suggest anywhere from 0.05 to 0.5, with the default set at 0.1. That deviation level is what widens or narrows my envelopes, and it’s all in percentage.

Timeframes? Go from H1 to D1, and make sure your expiration period doesn’t exceed the formation of two candles.

Trading with the Envelopes Indicator

This indicator really shines at showing the price range where things are gonna chill within the upper and lower limits during calm market times. When things get crazy, I bump up those percentages to cut through the market noise. If things are peaceful, I keep them lower for more trading signals.

If you're just starting out, here’s my starter pack of rules:

- Grab a sell signal when the price touches or crosses that upper band, and get ready to buy when it drops to or below the lower band. If that candlestick closes on a line, you can bet I’m jumping in.

- Keep an eye out for that sell signal at the upper band and buy signal at the lower. I usually get into contracts in the direction of the breakout. And if I see that breakout above the upper envelope? That’s my signal for a big price rise!

- And don’t forget, consider a buy when you see that line breaking the envelope and the candle closing outside. Just be prepared— that next candle might just jump back inside. Follow up your trade after that last candle.

Here are my golden rules for trading:

- Go long if the price closes below the lower envelope and the %R shows oversold vibes.

- Go short if the price closes above the upper envelope and %R is indicating overbought.

I might take a short position when that price breaks above the upper range and flip to long when it drops below the lower range. This method is great for snagging profits from the return to the average. Plus, I like to set my stop-loss just beyond the upper and lower limits, while my take-profit points sit near the midpoint line.