Hey there, fellow traders! Jumping into binary options trading is like hopping on the next rocket ship—exciting and packed with profit possibilities. Getting started is super simple. One key skill I’ve learned is recognizing those tricky patterns and developing solid strategies. If you put in the effort, you’ll start spotting recurring patterns. Let’s talk about the stair steps pattern—it’s a total game changer, especially for beginners.

This stair steps pattern appears during a trend. Picture this: when the market is declining, prices drop sharply (those are your long bearish candles) before bouncing back in predictable cycles. It looks just like a staircase! The areas where prices bounce back create new support and resistance levels—you’ll notice those breakouts from a distance.

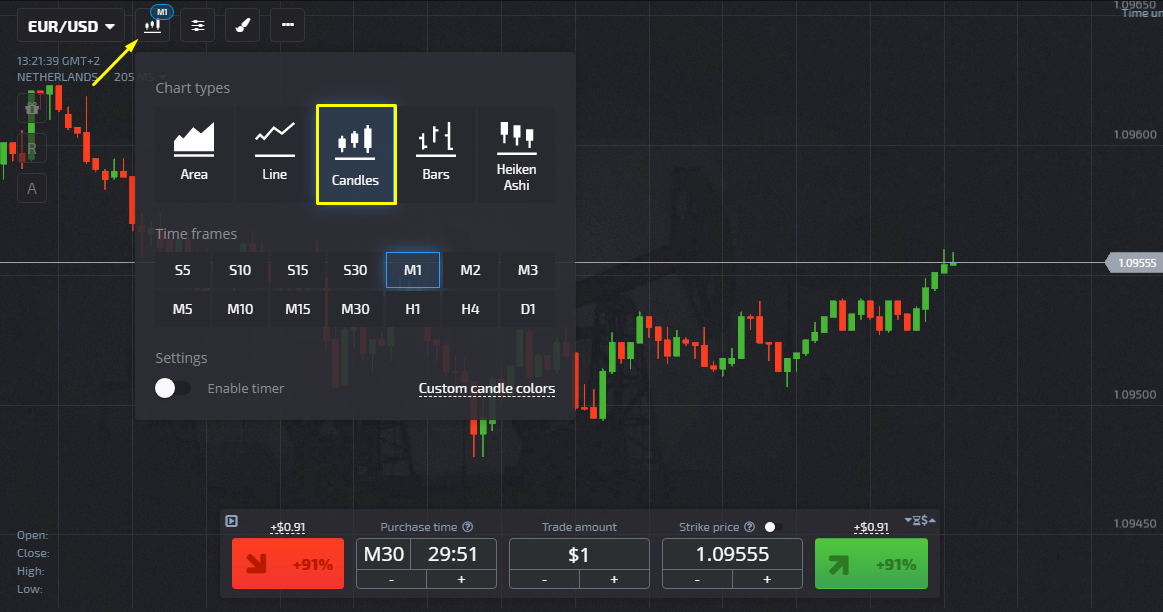

Alright, let’s go over a straightforward trading system based on these staircase patterns. It focuses on candlestick analysis, my friends. If you’re using Pocket Option, be sure to switch your chart to Japanese Candles. You’ll thank me later.

Candles, stairs, and breakouts

As I mentioned, the Staircase pattern strategy is like a walk in the park—no complicated indicators needed! You don’t have to be a genius to spot this Staircase formation. Even beginners can figure out how a candle shapes up.

Check out Pic.1. You’ll notice rectangles with bits sticking out on the top and bottom. Those rectangles? They’re called candles—they represent the open and closing price differences.

In Pocket Option broker platform insights for smart trading, red candles indicate a downtrend, while green candles signal an uptrend. So when you see red, the price closed lower than it opened. If it’s green, it’s rising and closing above the opening price.

The segments that stick out are “spikes” or “shadows”—they show the maximum and minimum price points while the candle forms (that’s your timeframe, buddy).

Speaking of timeframes, that tells you how long it takes to create the candle. You can set it or use the default options. If you pick H1, just remember that one hour is the candle’s duration.

Even if you’re new to the scene, you can definitely master the Staircase Pattern strategy.

Basic Tips for the Staircase Strategy

Here’s the scoop for those looking to explore the staircase strategy:

- Choose an asset with noticeable volatility. We’re talking about those price swings.

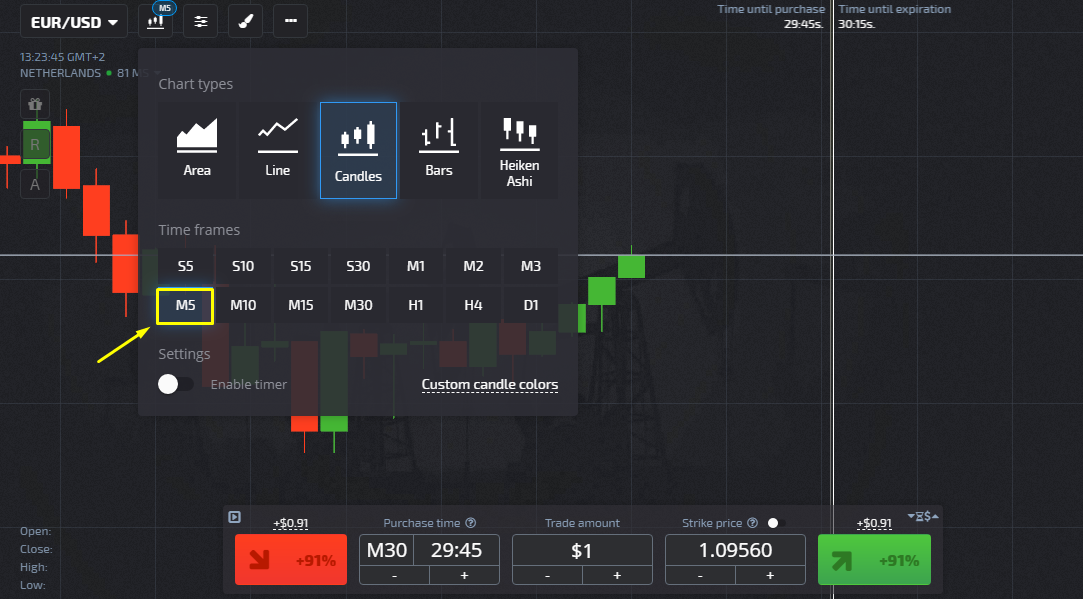

- Set the frame to M5. As for the expiration period? Keep it shorter than the time it takes to form a single candle.

- This strategy, like all good ones, relies heavily on market conditions. Avoid trading around holidays—volumes drop. And steer clear of significant news like FED announcements.

- Skip trading when important news drops.

- Trade the least amount possible. Don’t go too big just yet!

- Embrace the Martingale Principle. After a losing trade, raise the contract value.

Signals to Buy

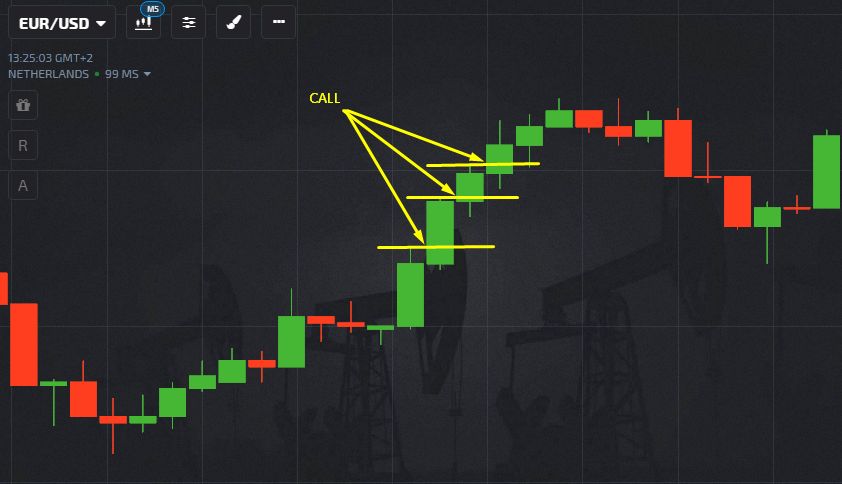

When it comes to the Stair Step pattern, here’s the deal: in an uptrend, the swing low should form at or above the previous swing high. What used to be resistance is now your support. The second rule? Price needs to pull back steadily, without any wild sell-offs.

Let’s cut to the chase—how do I spot signals to buy or sell? Once the price reaches my target level, I need some confirmation first. Check these tips:

- If the previous candle was green, and the next candle opens in the same direction, it’s time for an Option Call. Buy when the price is at least one point above the maximum (upper) of the last candle.

If luck isn’t your thing and you’re looking for more than random signals, you better have a trade trigger before you make your move. That’s where the staircase pattern fits nicely into any trading strategy.

Just a heads up—markets can stay in the overbought or oversold zones longer than you can stay in the game. To keep it simple: go long when you spot a Stair Step pattern with prices pulling back smoothly, forming a higher swing low above the last swing high.