So, here's the deal: I call this strategy a bit aggressive, but once you get the hang of it, you'll see the benefits! In simple terms, scalping is my favorite trading strategy for making profit from those small price moves, and I'm all about grabbing quick cash right after the trade starts making some gains. Trading requires discipline overall, but when you're executing lots of trades with tiny profits, sticking to my plan is crucial. You really don't want to suffer a bad loss that could wipe out a bunch of winning trades.

That's why turbo options are my main choice, especially those awesome 60-second expiration contracts. Compared to other trading methods, I'm all in on scalping. For turbo options, scalping is a no-brainer: it's easy, reliable, and can be super profitable quickly.

What Indicators Should I Use for Scalping?

Like I mentioned, scalping is a walk in the park. It relies on a few handy tools that help me figure out the trade direction and spot those great signals.

First, I've got to choose an asset to trade. My best pick? Volatile currency pairs. But let me tell you, I’d avoid crypto for this one.

Next, I set my chart to “Japanese Candles” and lock it in on a 10-second timeframe.

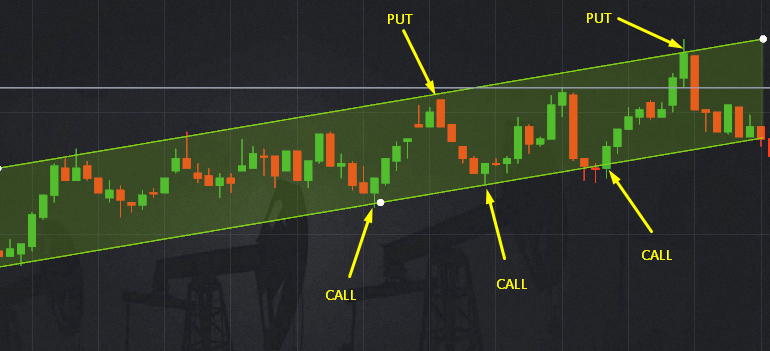

I trade on strong trends, so I outline my price corridor. “Parallel channels” is my tool of choice, straight from Pocket Option.

And here’s the kicker: I’m jumping in and out within 60 seconds. It’s super easy. Once I spot the trend and price range, I’m quickly buying options each time the price bounces off those channel edges.

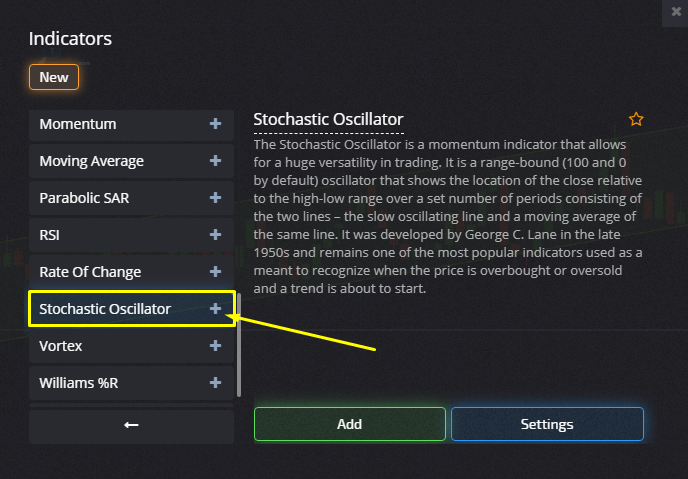

Scalpers like me love this method because it’s clear and straightforward. To eliminate those annoying false signals caused by market noise at lower timeframes, I've added another indicator. A classic choice? The Stochastic Oscillator.

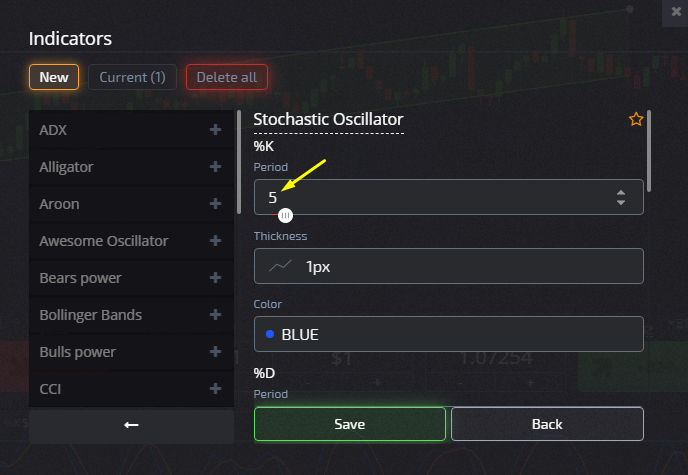

I set my Stochastic indicator for lower timeframes, adjusting the % K period from 14 to 5. I’m using the stochastic to take advantage of those nice price movements against its recent range. This tool helps me identify potential turning points.

With the oscillator in my toolkit, I’m ready to catch the waves in a trending market, whether it's going up or down consistently.

How Do I Trade With a Scalping Strategy?

Alright, you’ve set up the terminal and got your indicators working. Now it's time to execute. Signals come at me quickly, so I need to be on the ball and act without hesitation.

I grab a CALL contract when the price hits the lower boundary of my price channel, and the Stochastic moves out of the oversold area.

Then I hop on a PUT option when the price bounces off the upper boundary, and the Stochastic exits the overbought zone.

I make sure my expiration is under 60 seconds.

To sum it up, scalping requires strong discipline on my part, and it’s an all-in kind of deal too. Unlike longer-term trades where I can relax away from the platform while monitoring a few entries, scalping keeps me glued to my screen. Possible entry points flash in and out quickly, which means I’ve got to stay sharp and ready. If I’m trying to juggle a day job or other responsibilities, scalping might not be my best choice. Instead, I’d opt for those longer-term trades aiming for bigger profit targets.

Good luck with Pocket Option! Discover an innovative trading experience with OptionPocket for strategic growth and unlock new potential with insightful tools.