You know, before jumping into the trading world, I made sure to get the hang of the details in the financial markets. One of the major game-changers? Technical analysis. It's like having a sneak peek, watching all those past and present market actions to figure out where things are likely headed next. If you want to be a trader, you’ve got to explore the technical tools—trust me, it’ll boost your chances of landing a win in the online trading scene.

When I trade, I depend a lot on the technical analysis tools found on platforms like explore the diverse features of PocketOption's trading platform. Signing up is a total game-changer; you can assess the market situation with just one click. One of my favorite tools? The RSI oscillator. It’s a must-have for traders, no doubt!

What’s Up with the RSI?

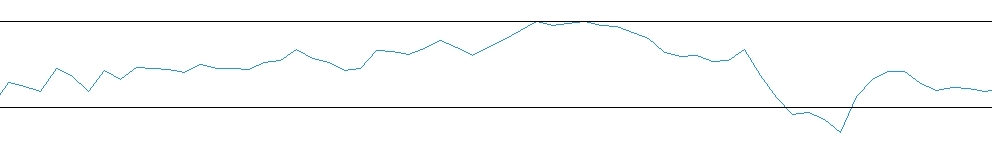

So, let’s break it down. The Relative Strength Index (RSI) is this handy scale with a signal line parked at the bottom of the chart.

This gem was created by the famous Wells Wilder, who introduced this indicator to the financial scene back in the 1950s. Fast forward over 70 years, and the RSI is still going strong, becoming a cornerstone for many trading strategies.

Now, let’s talk about how to calculate the RSI. It might seem a bit tricky at first, but it’s not that complicated.

RSI = 100 − [100/(1+ RS)], where RS = average gain / average loss.

So don’t be that person who rolls their eyes at the formula, thinking it’s only for the "math nerds." It’s super easy; on most broker platforms, they do all the hard work for you, and you get to see the results of the technical analysis pop right up on your screen.

Here’s the scoop: Wilder recommends using a 14-period RSI. And the key levels to watch? Set those at 30 and 70. They indicate oversold and overbought conditions—meaning when the RSI falls below 30, it signals that extreme selling is happening, and on the flip side, buying pressure picks up when it goes above 70.

Trading Tips with RSI?

The RSI is your friend for spotting reversal and correction signals. So, logically, if the chart is falling and drops out of that 0-30 zone, you can bet it might bounce back up. Conversely, if it dips below that 70-100 zone, it’s likely a sign that growth is going to slow down.

When the RSI line crosses level 30 from below, it’s all systems go for a CALL option.

For the PUT option? That’s when the RSI line falls below level 70 from the top.

Pro tip: Set the expiration to cover at least the formation of two candles.

It’s no wonder the RSI has such a dedicated following among traders. This tool not only lets me make quick moves but also offers a nice level of profitability.