Hey there, I'm all about exploring the world of PocketOption broker trading online to keep my risks low and profit potential high. You've got to appreciate the Relative Strength Index (RSI) – it's a fantastic tool for making informed trading decisions. Trend trading is the way to go; it's all about grabbing profits by analyzing an asset's momentum in a specific direction.

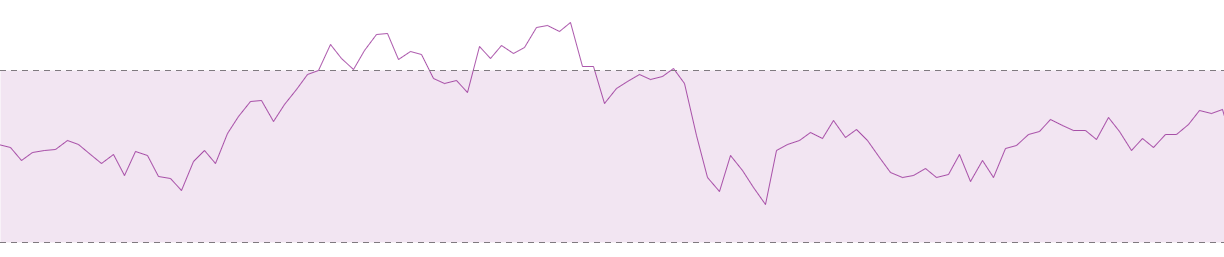

So, what's the deal with RSI? It's a momentum indicator that measures the strength of recent price changes to identify overbought or oversold conditions in stock prices. Catch my drift?

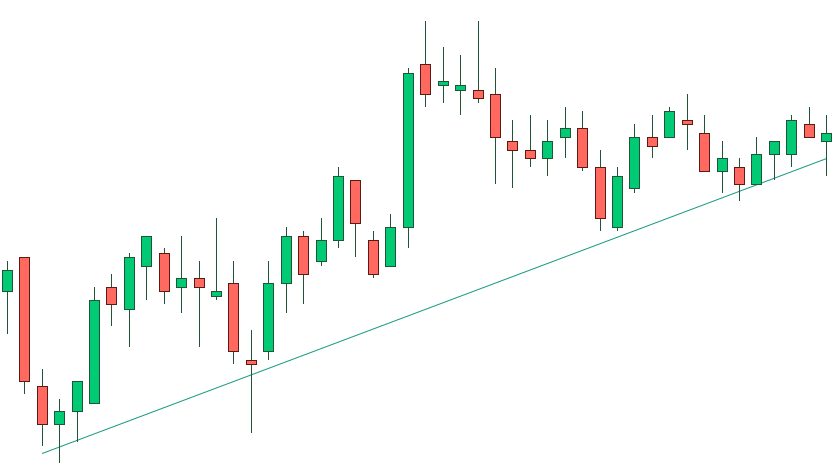

Now, moving averages – I've got some tricks up my sleeve. First off, look at the angle of that moving average line. If it's flat for a while, forget about trends; we're just ranging here. A trading range is when a security bounces between consistent highs and lows.

When that moving average line tilts up? Boom! We're in an uptrend. But, remember, moving averages don't predict the future; they just show what prices have been doing over time.

How do I set up the RSI?

Most traders use candlestick charts and currency pairs like EUR/USD, EUR/JPY, stocks, and cryptos. Get that RSI indicator rolling on your trading platform. I'm leaning towards 14 periods for timeframes of 15 minutes and above. If I'm diving into turbo options, though, I crank it up to 24-26 to filter out that annoying market noise.

Just a heads-up: the RSI sits below the price chart and has levels plus a signal line. Typically, I check the signals when they cross certain zones, but let's keep it interesting.

Here's a nugget: keep an eye on the candlestick chart shape and the RSI signal line. They kind of reflect each other but don’t get it twisted; they're not the same. The RSI smooths out the noise, giving you a clearer look at the price trend. Let’s overlay some technical lines on that indicator!

Here are some golden rules every trader should keep in mind:

- First off, don't fall for those false signals.

- Second, let the RSI show you the trend more clearly.

- And lastly, RSI not only reveals trend strength and direction but helps pinpoint those rebounds and breakouts.

Trading options with the RSI

Like I said, the Relative Strength Index (RSI) is a key momentum indicator for identifying overbought or oversold conditions. Check this out: If a stock's long-term trend is up, I'm looking for a buy signal when the RSI dips below 50 and then goes back above it. This indicates a pullback, so I hit the buy button when that pullback looks like it’s done and the trend's back on.

For short trades, I flip the script; if the trend's down and the RSI climbs above 50 before dropping back below it, I'm ready to act.

It's all about building a trend line on that indicator and making moves when you get a solid signal. Here's what I watch for:

- Rebound from the trend line that aligns with the main trend;

- Breakout of a technical level followed by its reversal.

And remember, set the expiration time to cover at least the length of three bars forming.

Indicators genuinely simplify price data; they signal trends and warn about reversals. You can use them on any timeframe and adjust their settings to fit your trading style. Mix and match those indicator strategies, or come up with your custom rules so you've got clear entry and exit signals.

RSI-based strategies are timeless and have stood the test of time. They remain popular among trend traders who want to dive deep into specific market indicators.