So, here's the scoop on Rate of Change (ROC)—it’s really all about how one thing moves in relation to another. In our trading game, the ROC indicator is my top choice for tracking where the binary options market is heading. This tool helps me spot divergences, identify overbought and oversold conditions, and understand those centerline crossovers. If you're interested in exploring diverse trading strategies with Pocket Option broker platform, it might complement your use of the ROC indicator effectively.

I mean, let’s be real, every trader wants to figure out which way the market is going, right? That’s where indicators and oscillators come in as my reliable allies. Over at Pocket Option, I’ve got the ROC at my fingertips along with a whole bunch of features.

Settings Tips for the ROC Indicator

When I mention the Price Rate of Change (ROC), I'm diving into momentum territory—it’s a speed indicator measuring how strong that price movement really is.

First off, I get it rolling in my account by locating and clicking on the ROC in the menu.

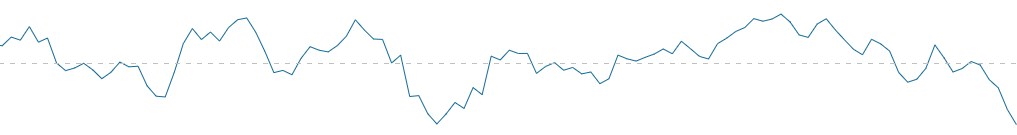

Just like most momentum oscillators, the ROC shows up in a separate window below the price chart. It runs above or below a nice zero line that indicates what's positive and negative. When it’s above, I’ve got buying momentum, and when it's below, it’s the opposite—selling pressure. If those values are rising in either direction, that’s my sign for more momentum, while a drop back toward zero suggests that momentum’s weakening.

The Formula for My Price Rate of Change Indicator Is:

RoC = (C / Cn) * 100

C stands for Closing Price of the Most Recent Period

Cn means Closing price n periods back from the most recent

And you know what? This value updates with every new bar that appears.

This means the ROC is right on the heels of price changes—no lagging behind here.

I usually set periods between 9 to 13 and prefer timeframes from 15 minutes up to 4 hours.

But hey, I wouldn't use the ROC for fast options—it's too erratic and produces a lot of false signals.

ROC Indicator Usage Advice

The Price Rate of Change (ROC) oscillator is what I call an unrestricted momentum player in technical analysis, staying close to a zero-level midpoint.

When ROC’s climbing above zero, that's a green light for an uptrend. If it’s dipping below zero, I’m looking at a downtrend.

Now, when the price is in a consolidation phase, ROC hangs out near zero. In this situation, I need to keep a close watch on the overall price action since ROC won’t offer much more than a thumbs up that consolidation’s happening.

I’ve got to buy contracts only when I’m on the right side of the trend.

Trading sideways? No thanks!

I only open positions when I feel that breakout vibe.

Trading Binary Options with ROC Effectively

Let’s break down how to use the ROC indicator for binary options trading—it’s a breeze once you get the hang of it.

I look for the signal to jump into a trade when that moving average crosses the zero line.

- Time to Buy a CALL contract on an uptrend when the line crosses from below upward.

- Time to put a PUT contract on a downtrend when that signal line crosses from above downwards.

My recommendation? Set that expiration for about 2-3 candles.

Wrapping Up

ROC is my go-to for spotting divergence, which can signal a trend change coming up. Divergence happens when the price of an asset is moving in one direction while ROC moves in the opposite direction. So, if a stock's price is rising but ROC’s trailing down, that’s bearish divergence signaling a potential downward shift. Flip the situation, and ROC is rising while the price drops? It may hint at an upward move. Just a heads up—divergence can be sneaky; it sticks around longer than expected and won’t always lead to a price reversal.

While I can rely on the ROC for divergence signals, they often appear way too early. When ROC starts to diverge, the price might still be trending in the current direction for a while. So, I don't make a move based on divergence alone—I combine it with other indicators and analysis to support my trades.