Hey there, traders! Let me tell you about the Pocket Option Trading Platform – it’s a standout in the busy world of binary options. With a sleek website and an impressive trading platform, it has a modern vibe. Plus, they offer a fantastic demo account for us beginners to test things out for free! The account features are solid, which explains why it’s gained a lot of respect across the CIS and in various countries in Europe, Asia, and South America. Experts were raving about it as one of the most innovative and fastest-growing trading platforms back in 2019, and they’re pushing even harder for 2020. What’s really awesome? Exploring trading strategies with Pocket Option broker platform is a breeze since that demo account lands in our inbox right after we sign up! You can try out your systems and strategies without risking any real money.

Now, let’s jump into one of the cool tools on the Pocket Option platform: the SMA. I’m ready to break it down for you.

SMA Description and Method

SMA, or Simple Moving Average, is one of the classic indicators and a favorite among traders. Usually, you’ll see SMA as a smooth line moving along the chart. It’s calculated by taking a bunch of recent closing prices, adding them up, and then dividing by the number of periods you're analyzing. I like to experiment with multiple SMAs, each with different time frames and expirations, for both my short-term and long-term trading needs.

This simple moving average is really customizable. You can set it up for different periods by averaging the security’s closing prices for those periods. It smooths out the fluctuations, helping you see the price trend more clearly. If my SMA is climbing, it’s a sign that the security’s price is going up. On the other hand, if it’s falling, the price is dropping. Keep in mind, the longer the time frame, the smoother the line; but a shorter-term SMA can be a bit rocky, sticking closer to the real-time data.

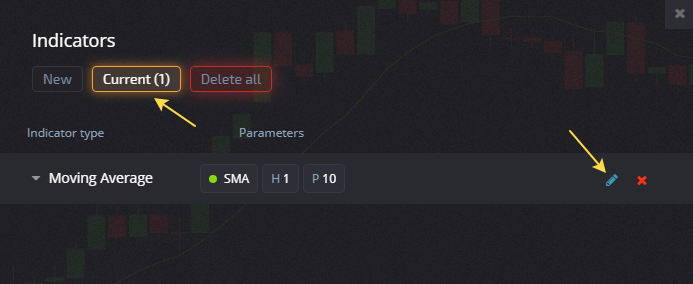

Want to adjust the moving average period in the Pocket Option terminal? Just find the indicator in the “Active” tab and click that pencil icon next to the SMA.

How to Trade Contracts Using SMA?

SMA is my go-to strategy for short-term trading. Grab any chart and set up 2 SMAs: one for 60 and another for 4. I’m all about using different colors to tell them apart. Set your timeframe to 15 seconds and stick with a 1-minute expiration.

Here’s how I manage short-term trading:

- When SMA (4) crosses above SMA (60), it’s time to look for a call.

- When SMA (4) drops below SMA (60), it’s time to consider a put.

SMA lets me stack different averages and see what’s trending. If my shorter SMA is above the longer one, I’m expecting an uptrend. If the longer one is on top, it’s signaling a downtrend. If you’re looking for some quick and exciting trades, you've gotta build and practice your strategy using that awesome Pocket Option demo account.