So, here I am, diving into the world of binary options trading, right? It’s like a simple yes or no—super straightforward, and that’s what attracts a lot of traders, both seasoned pros and newbies. You either earn a fixed payout or get nothing. That’s why they’re called binary options—nothing more, nothing less. But hold on—before you jump in, it’s important to understand how these things work, which markets to focus on, and which time frames to consider. Don’t forget to weigh the pros and cons, too. I’ve been checking out Pocket Option, which offers a demo account and lots of educational resources for anyone looking to try their hand at trading. Plus, they've got all the technical tools to help experienced traders score wins.

Now, many of us are big fans of using Parabolic SAR in our trading strategies—it gives a real-time feel for market conditions and can signal when a trend might be about to switch.

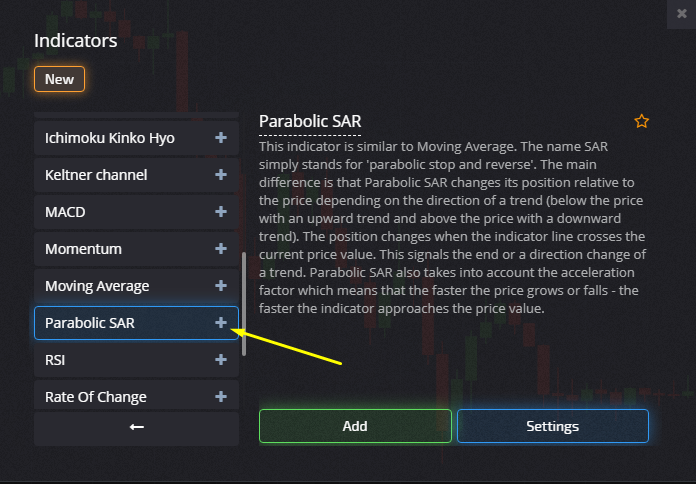

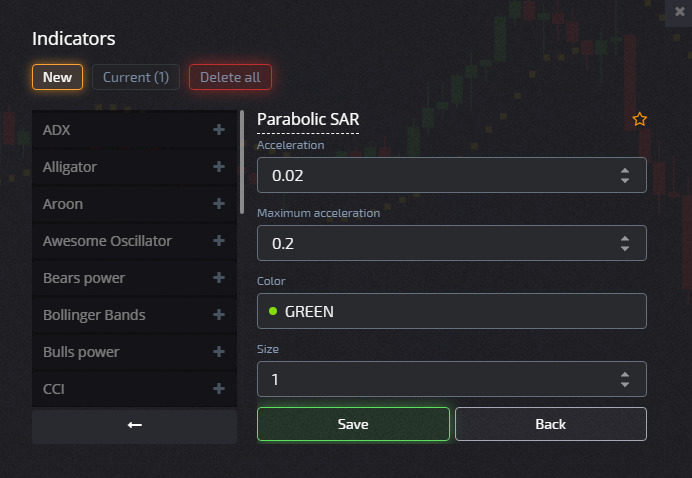

The Look, Settings, and Signals from Parabolic SAR

So, Parabolic SAR is like my radar for trading—it’s all about showing where an asset is heading and helping me plan my entries and exits. In this write-up, I'll break down the basics of this indicator and how to integrate it into my strategy. Of course, I'm also gonna share some insightful strategies offered by PocketOption trading platforms to keep an eye on.

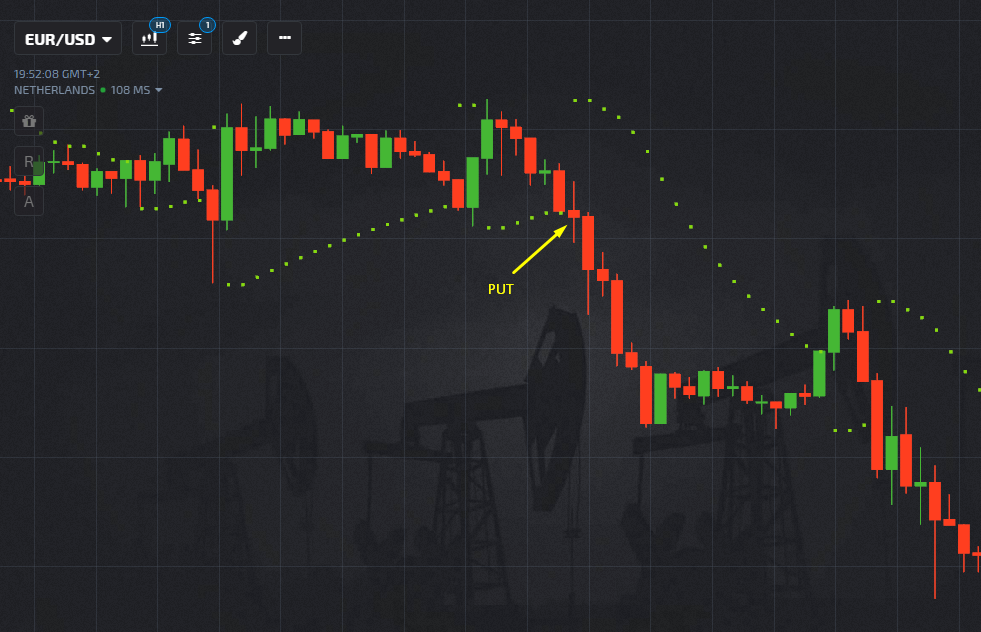

On a chart, it appears as dots either above or below the price bars. A dot below? That’s a green light—bullish vibes all around. If it’s above, well, the bears are in control, and it looks like the price might drop. When the dots switch positions, that’s my cue that a price change might be on the horizon. For example, if those dots are high above the price and suddenly drop below? I’m seeing a potential price surge.

The Parabolic SAR highlights acceleration and maximum acceleration—in other words, it’s all about speed. This gem was first introduced by J. Welles Wilder Jr., who also created the relative strength index (RSI), so you know it’s legit.

Wilder shared some solid setting tips like 0.02 and 0.2. He recommended using the Parabolic SAR on medium to long time frames because it helps eliminate market noise and false signals.

In technical analysis, the SAR points out these market conditions:

- Bullish Uptrend: dots sitting below the chart;

- Bearish Downtrend: dots hovering above the chart;

- Trend Strengthens: distance between those dots widens;

- Trend Reversal: when a candle breaks a segment with the next dot on the opposite side.

Trading with Parabolic SAR

When I adjust the indicator settings, the plan is to wait for that perfect signal to make my move. The sweet spot to grab a contract is right when a trend starts to form. My eyes are peeled for trend reversals or “breakdowns”:

- Grabbing a CALL contract? That’s when a bullish candle crosses the Parabolic line from below, and the next dot appears under the chart.

- Snagging a PUT contract happens when a bearish candle breaks the Parabolic line from above, and the next dot shows up above the chart.

Remember, the expiration time should be set for after two candles form. For instance, if I’m using the H1 timeframe, I want the expiration to be less than two hours.

The Parabolic SAR really works best in markets that are moving in a steady trend. However, in sideways markets, it tends to jump around, giving off false signals. It’s great for getting results when trends are clear but can get tricky with misleading signals when prices start to zigzag. To filter out some of the weaker signals, I only trade in the direction of the dominant trend. I find that combining this with other tools, like moving averages, helps keep me on the profitable path.