Alright, let’s chat about the advantages of using a moving average (MA) in my trading strategy. MAs simplify things by calculating an average price based on reliable price data, constantly updating over a specific time frame. Whether I’m focusing on the short term or going for the longer haul, moving average strategies fit into any timeframe I'm working with.

When I look at the MA direction, I can quickly understand the market sentiment. If it's trending upwards, that's a sign that prices are increasing. If it’s heading down, well, the price is probably decreasing.

MAs can also act as support or resistance levels. When the market is in an uptrend, those 50-day, 100-day, or 200-day MAs often provide solid support. The market usually bounces off these averages. Conversely, in a downtrend, the MA might create a resistance level.

On my price chart, the moving average line gives me all sorts of signals, providing insights into potential changes, or where I might find support or resistance. If I want the best signals, I’ll focus on a moving average over a longer time frame. Just gotta keep in mind that different assets work better with specific timeframes; for example, I’ve seen the USD/CAD use a 30-period MA.

Here’s the scoop on my moving average strategy: If you're looking for a comprehensive platform to help refine your trading techniques, check out this PocketOption trading terminal for innovative strategies and insights. It offers excellent resources for enhancing your trading skills.

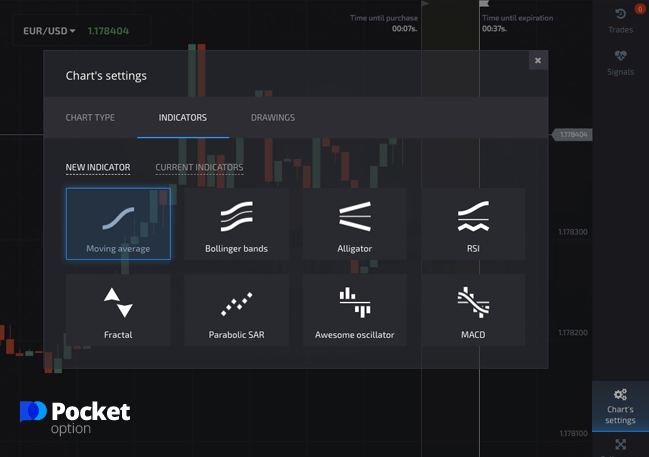

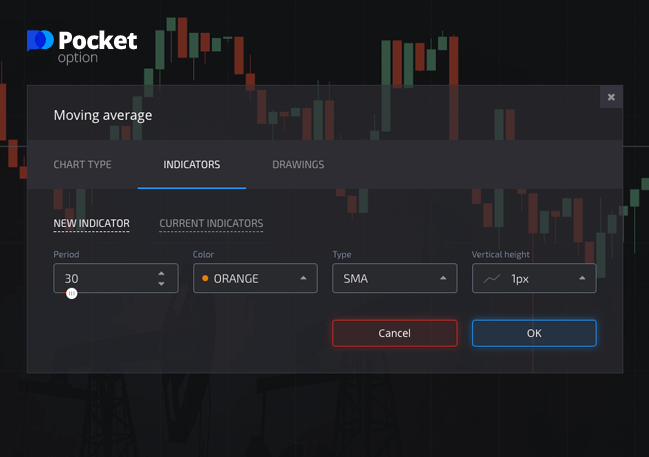

- First off, add that SMA tool to my chart and set it to a period of 30;

How to add SMA

How to set SMA

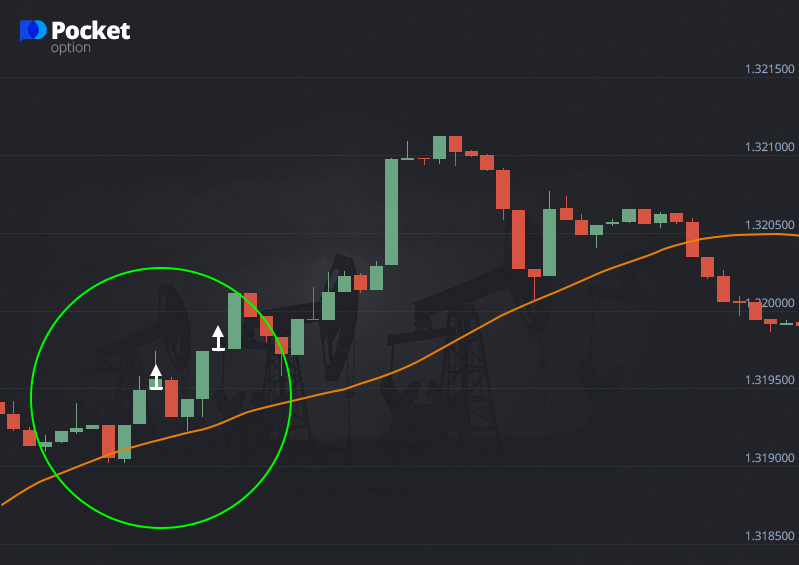

- Now, I just hang tight and wait for that signal. I’m looking for the price line to touch the SMA;

- Once it does, I’m ready to grab a call option after the second candle closes.

Buy a Call Option

Check this out – when the short-term MA crosses above the long-term MA, that's my signal to buy because the trend is shifting upwards! That's what I call a “golden cross.”

On the flip side, if the short-term crosses below the long-term MA, I’ve got a sell signal, indicating that the trend is going down – that’s called a “dead cross.”

Here’s the game plan for the moving average strategy:

- First things first, I add that SMA indicator to my chart again and keep it set to 30;

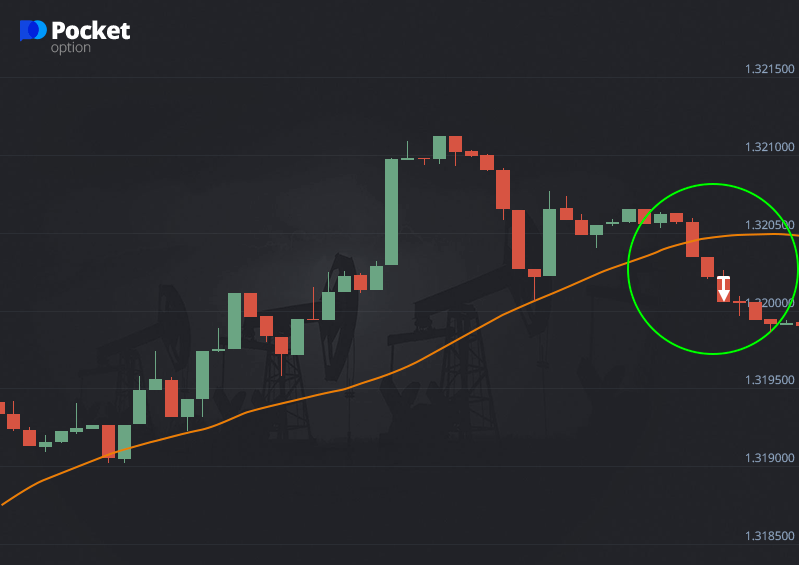

- I wait for the current candle to close under the SMA line;

- Then I jump in and buy a put option when the next candle opens and closes below that SMA.

Buy a Put Option when a Price and a Simple Moving Average Cross

Crossovers are essential for my moving average strategies. I keep an eye out for price crossovers whenever the price crosses the SMA line, signaling a possible trend reversal.

Overall, using SMA is pretty straightforward. My trading platforms handle the calculations, so I don’t have to stress over it. Just keep in mind that these moving averages are based on past data and don’t guarantee future outcomes. Sometimes the market respects the MAs, while other times, it just ignores them completely.