Hey there, everyone! So, I have to share that trading contracts is really on the rise - and guess what? A lot of people are eager to learn about awesome trading strategies. No stress, because these strategies are completely based on indicators that don’t require you to be a math genius. They’re built right into the trading platform! Even if you’re just starting out, you'll pick it up quickly and start making smart trading decisions. Plus, that cool charting software does all the hard work for you.

One of my favorite strategies? It features the Parabolic SAR, and I usually combine it with the ADX for some major impact.

In the comprehensive trading experience available on the PocketOption platform, you can easily find both indicators in the standard indicators list. Dive deeper into the Parabolic trading system and give it a try on your demo or live account.

Let’s break down the Parabolic SAR indicators

So here’s the scoop: Welles Wilder created this innovative trading indicator, and Parabolic SAR stands for “stop and reverse.” When the market's moving up, you’ll spot dots below the price. But once the price hits a turning point, BAM! The dots shift above the price, signaling you to sell. This tool is integrated right into the price chart.

During a strong uptrend, those dots are hanging out below the chart, almost like they're cheering for the price. But when the candle breaks past the parabola? That’s your reversal signal, and the dots begin to appear above. Downtrends? Same concept, just switch it around.

Then there’s the ADX – this important indicator comes with three lines displayed in a separate window below the main chart.

The main line? That’s the ADX line – it shows how strong the current trend is. The higher the line, the stronger the trend! But to make the Parabolic Trading system really effective, we need signals from the +Di and -Di lines. It’s pretty simple: if the positive line crosses below the negative line, boom – we’re seeing some downward momentum. Flip it for the opposite result.

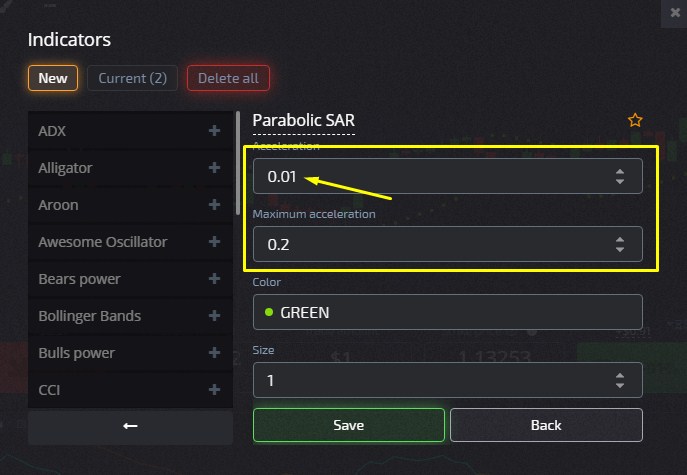

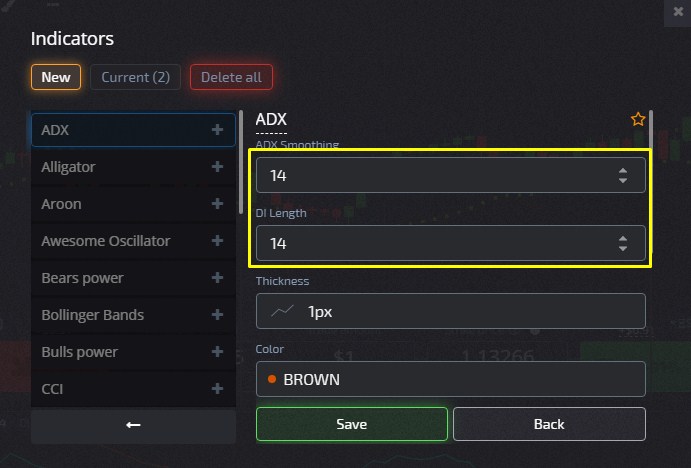

Here are my preferred settings for both indicators:

- Parabolic SAR: expiration acceleration at 0.01 (default’s 0.02), max acceleration at 0.2;

- ADX: both periods are set to 14, which is the default in the Pocket Option platform.

Time to trade with the parabolic strategy!

All right, now that we’ve covered the indicators and strategy, let’s get into trading. The Parabolic strategy works well with any trading style – whether you prefer quick trades or long-term holds. So, customize the timeframe that suits you best.

Choose assets that show good volatility. I’m talking about currency pairs like EUR/USD or GBP/USD — those are my favorites. You can even include some bouncy cryptocurrencies for added variety.

Parabolic SAR shines only when there's a strong trend happening.

Go for a CALL contract when the candle breaks the parabola from below, the dots are resting low, and +Di crosses -Di from bottom to top. Simple as that!

Now, for a PUT contract, wait for the candle to break the parabola from above. When the dots are floating above and +Di crosses -Di from top to bottom, it’s time to act!

Just a quick note: make sure your expiration time is equal to or greater than the formation of 2 or 3 candles to avoid that annoying market noise, especially on the shorter timeframes.

The big advantage of this indicator is that during a solid trend, it highlights the trend's strength and keeps you in the game. However, it’ll tell you to get out if there's a move against the trend, which could either be a wise exit or a total letdown.

But yeah, a downside is that it doesn't provide good insights or clear trade signals when the market’s stuck in a sideways position. Without a clear trend, it’ll keep flipping around the price like a game of hot potato.

That’s why it's a good idea to practice identifying trends—read that price action or use another indicator to avoid trades when there’s no trend and pounce when there is.