When I jump into binary options trading, the first thing that comes to mind is mastering price movement analysis. You've got to pick out the important points like a hawk to know when to grab a contract. And let me tell you, figuring out the real moves from the fakes is super important.

My favorite tool for sensing current trends and potential reversals is the Zig Zag indicator. It’s a lifesaver for keeping track of those significant historical price changes and does a great job filtering out all that annoying market “noise.”

In this article, I’ll explain how to use this indicator effectively. You’ll find Zig Zag chilling in the standard indicators section over at Pocket Option for innovative trading strategies and insights.

What’s up with Zig Zag and how to set it up?

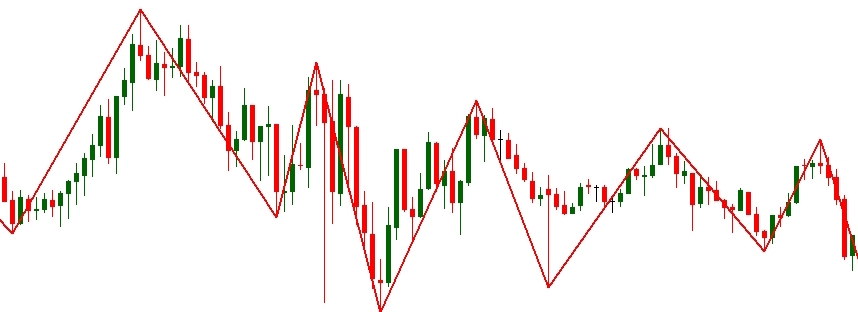

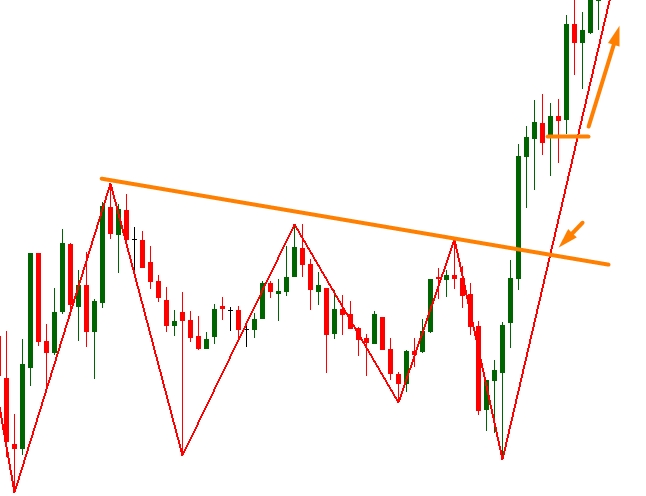

Zig Zag is a trend indicator that cuts through the clutter, highlighting the major trends and reversals while ignoring those minor price fluctuations. On my chart, it shows segments that connect those crucial highs and lows, giving me a clear view of the market's overall trend.

The main focus here is filtering out those little bumps and concentrating on the big moves. Because of this, I can spot long-term trends and technical levels with much more clarity.

To get the most out of my Zig Zag strategy, I set up these parameters:

- Depth: This is the minimum number of candles Zig Zag considers when identifying those extreme highs or lows. The larger the value, the less often Zig Zag changes its lines – bye-bye, small fluctuations.

- Backstep: This is the minimum number of candles between those extremes. It helps filter out any misleading quick shifts in direction from the Zig Zag line.

- Percentage Deviation: This is the key percentage change I consider significant for the indicator to take notice of. I usually set this between 5% and 10%, keeping an eye on market volatility and the asset structure.

Customizing these settings for my specific trading situations and assets is crucial. In super-volatile markets, I increase that percentage deviation to filter out those tiny price movements.

How do I trade with the Zig Zag Indicator?

This awesome tool is a game changer for binary options trading, making it easier for me to analyze trends and reversals. Here’s how I use it:

- It defines a trend

Zig Zag makes it a breeze to spot trends on my charts. If that Zig Zag line shows a series of higher peaks, it’s an uptrend. It’s time to consider those buyer options (CALL).

But if I see that Zig Zag line dipping with lower peaks, that’s my signal for a downtrend, indicating it's time to look at those seller options (PUT).

- It helps foresee reversals

Zig Zag is fantastic for spotting potential trend reversals. When it shifts direction, forming a new high or low, it’s my signal that a new move could be coming. If the Zig Zag changes after an uptrend to show lower peaks, I’m aware it might be the start of a downtrend, and vice versa.

Overall, the beauty of the Zig Zag setup is how it makes market data analysis a walk in the park. It filters out those minor price changes, focusing on what really counts. But just a heads up: Zig Zag doesn’t predict future movements; it’s all about analyzing the past. To hit peak efficiency, pairing it with other indicators is definitely the way to go.