Let me break it down for you. I'm all about that MACD vibe—the moving average convergence/divergence indicator. Developed by the legend Gerald Appel back in the late '70s, this tool is my go-to for spotting changes in price trend strength, direction, and momentum. Since then, it’s become a must-have in my trading toolkit, just like for many smart traders out there.

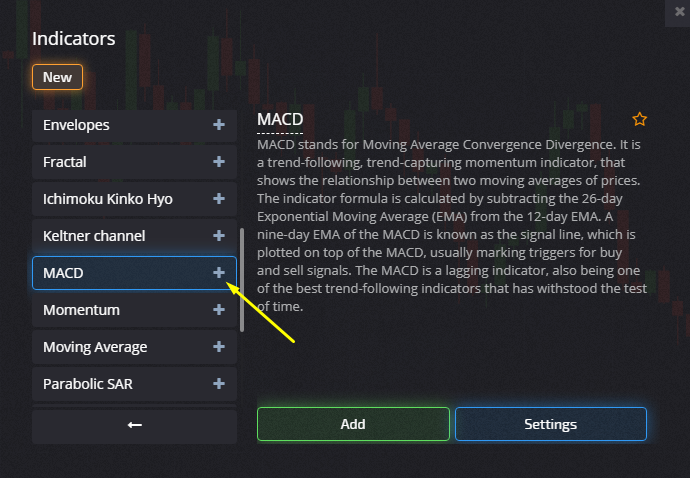

You know what? The Pocket Option platform has MACD as part of its features, and it’s just as slick as you’d expect.

Gerald Appel, the big name behind MACD, not only launched this gem in '79 but also wrote over fifteen books on investment strategies. Talk about credentials! This tool isn’t just for Forex enthusiasts; it’s a powerhouse in the binary options game too.

Honestly, you can’t underestimate the usefulness of this MA Convergence/Divergence tool. It’s key for identifying trend direction and predicting those sweet reversals.

Indicator Vibes

Like all indicators, MACD pops up in a separate window below the main chart. You’ll often see it displaying a histogram (check out my screenshot!) that shows the gap between MACD and its signal line. If the MACD's on top, the histogram's above the baseline, and when it's low, you’ll see a dip too. Every trader worth their salt uses that histogram to assess bullish or bearish momentum.

MACD Settings 101

When the MACD crosses above its signal line, it’s a buy signal. Cross below? Time to sell. The magic happens when you subtract the 26-period EMA from the 12-period EMA, and that cross indicates whether the market is overheated or undercooked.

I follow the pros’ recommended settings:

- Fast line: Period 12;

- Slow line: Period 26;

- Histogram: Period 9.

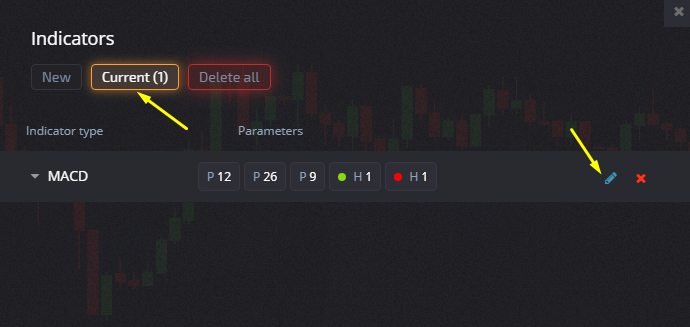

The default settings on the Pocket Option platform match these recommendations, but you can tweak them anytime by hitting “Indicators/Active” and clicking that pencil icon. You can also update the colors!

MACD Signals I'm Watching

When I’m using MACD, I focus on trend direction and possible reversals with these tips:

- Red histogram bars below zero? We're heading down;

- Green bars above zero? Let’s go up;

- Bars getting close to zero? Probably indicating a trend reversal.

MACD helps me track EMAs and signals for making trades:

- Fast MA crossing slow MA from the top? It’s going down;

- Slow MA creeping up from below? All systems go for an uptrend.

Options Trading with MACD

Feeling the market momentum with MACD? It’s a solid way to catch potential trend shifts through price divergence (like when price climbs but the indicator dips, for example). Here’s my winning strategy:

- Call option? That’s the play when the histogram’s nearing the zero mark and the fast line crosses the slow line from below.

- Put option? Look for a fall below zero in the histogram and a fast line diving below the slow line.

And you know what? MACD is great for spotting divergence—a situation where the market’s trend and the indicator don’t align. Flip a contract in the direction the histogram suggests.

MACD strategy is my go-to on any timeframe.

Expiration period? I aim for twice the duration of two candles.

But let’s keep it real. Divergence can give signs for reversals that don’t always happen—talk about false alarms! Some people wait for that confirmed cross above the signal line to avoid jumping the gun and getting caught too soon.

Diving into short-term trades offers that excitement while keeping an eye on profit and loss before you commit. With Pocket Option, it’s always lit—trading active markets 24/7. For those looking for a reliable broker for accessing diverse trading opportunities, check out PocketOption. Plus, I can rock a demo account for free to sharpen my strategies!