Let’s break it down – Keltner Channels are cool volatility-based envelopes that sit above and below an exponential moving average. Think of them as relatives to Bollinger Bands, which use standard deviation to set their bands. Keltner Channels? They’re a trend-following indicator that helps spot reversals by monitoring channel breakouts and direction. Plus, they’re great for identifying overbought or oversold conditions when the market is flat.

You can easily find Keltner Channels in the comprehensive Pocket Option trading terminal for strategic enhancements, hanging out with the standard tools. Just drag it into your workspace, and you’re good to go with its signals.

History of the Keltner Channel Trend Indicator

Let’s take a trip back to 1960 when the Keltner Channel first appeared in Chester Keltner’s book, “How to Make Money in Commodity Markets.” Back then, it was called the “10-day moving average trading rule,” focusing on a ten-day simple moving average based on an average price. The channel was created using a ten-day range, capturing the highest and lowest price movements.

Fast forward to 1980, and the well-known trader Linda Raschke added her twist by combining the Keltner Channel with the Average True Range (ATR) indicator for width calculations. This blend gave rise to a modern version, merging traditional methods with ATR. Later, the smart trader Robert Colby replaced the simple moving average with an exponential one for enhanced precision.

Settings

When it comes to calculating Keltner Channels, it's a three-step process:

- First, choose a length for the exponential moving average.

- Next, select the time periods for the Average True Range (ATR).

- Finally, pick a multiplier for the ATR.

Remember – those candles should stay within the indicator. If they move outside the channel, it’s time to tweak those settings.

To adjust the right values for your asset and timeframe, just click the pencil next to the instrument's name. A settings window will pop up for you.

Set your EMA setting to the default – highly recommended!

Stick to a 20-candle period for the average market price. Trust me on that one!

Now, how the indicator reacts to price changes relies on the ATR period. The default is set to 10 bars. Increase it, and the indicator lags more (ideal for longer timeframes). Decrease it to speed things up (perfect for shorter timeframes).

The deviation can range from 1 to 3. Keep an eye on that volatility. The more volatile the asset, the larger the deviation should be.

How to trade with Keltner Channels?

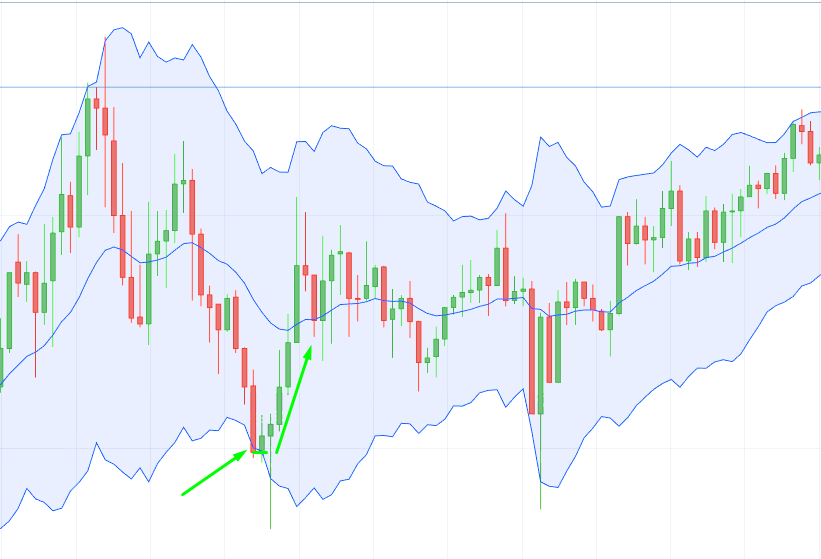

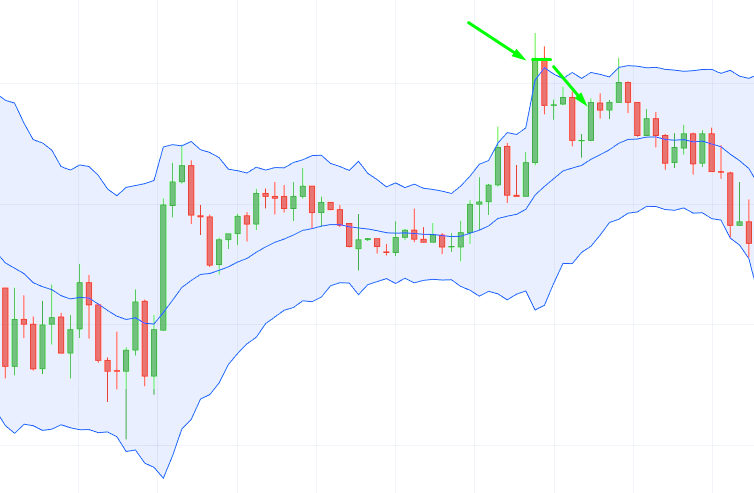

Stay alert for those trading signals from the Keltner Channel indicator. Jump into the trade when one of those extreme lines gets broken.

- CALL when the candlestick breaks through the lower channel.

- PUT when the candlestick breaks out of the upper channel.

Keep in mind, the expiration period should be at least as long as it takes to form three candles.

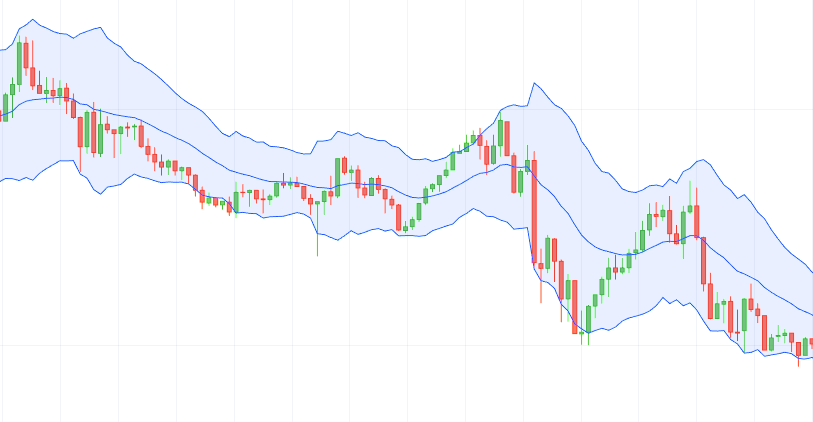

If the channel turns up and breaks above the upper trend line, that could be my signal for an uptrend. On the other hand, if the channel trends down and dips below the lower trend line, watch for a possible downtrend. Sometimes, though, a strong trend might not hold after breaking the channel, and the price can bounce between the channel lines. Those trading ranges get signaled by a steady, flat moving average, and I can use the channel edges to identify overbought and oversold levels for trading.