You know, searching for the best trading strategy is like every trader's ultimate goal. My trading strategy is that method I rely on when diving in and out of the market. It's all about those preset rules and criteria that help me make smooth trading decisions. Whether I stick with a simple approach or explore more complex ones depends on my style. You better believe I’m sifting through a bunch of strategies aiming for quick trades, while managing signals of different qualities and sometimes using a Martingale tactic when the timing feels right.

Now, let’s talk about the Keltner Channel breakout strategy. This one’s my way to catch those big moves that often slip past regular trend-pullback strategies. It's based on a couple of my favorite indicators, making it super easy to use. Perfect for lower time frames, it also helps me avoid unnecessary risks. For a comprehensive approach to trading, consider exploring the PocketOption trading platform for comprehensive learning experiences.

Setting Up Keltner Channels

So, if you’re working with the Pocket Option Broker, you’re set with a great platform that offers a variety of assets and tools. No need for any extra gadgets or third-party stuff.

To use the Keltner Channels strategy, I make sure I’ve got:

- Asset spot – EUR / USD;

- Chart style – Japanese candlesticks;

- Timeframe – M5;

- Indicators – Keltner Channels and ADX.

First off, I pull the Keltner Channels and ADX indicators from the list in my trading terminal. Setting up the Channels is usually straightforward.

Now, keeping it real, the trading market can be unpredictable. To filter out the noise and secure a position on a solid trend, I add an ADX indicator with a 14 parameter to my Keltner Channels strategy.

For the Keltner Channel, I adjust the parameters from 10, 10, 1 to 20, 20, 2. This adjustment reduces the indicator's sensitivity, which is crucial when I’m trading on those low time frames.

Trading with Keltner Channels

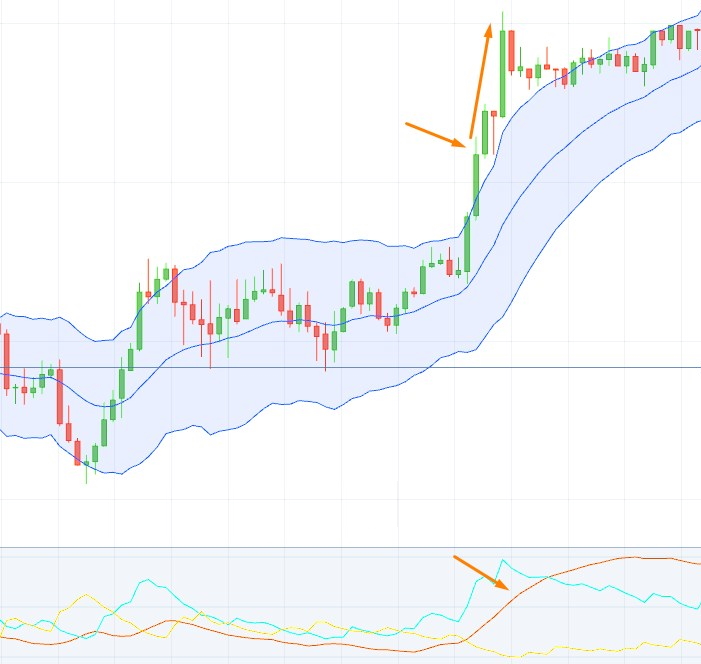

The Keltner Channel has a vibe similar to Bollinger Bands. I see an equidistant channel sliced down the middle with a moving average (MA). So yeah, the trading strategies are similar, but I think Keltner Channels give me a more accurate read than the Bollinger setup.

Key rule here? Always follow the trend. If the market's flat, I don’t even bother buying contracts. I usually jump in if the price breaks above the upper band or goes short if it drops below the lower band within the first 30 minutes after the market opens.

The middle band? That’s my go-to exit. There's no set profit target here; I exit whenever I touch that middle band, win or lose!

Since the market tends to be all over the place right after it opens, I might catch one signal that fails or just barely makes a gain, only to get hit with another signal right after. I play both, only taking two signals in those first 30 minutes. If I don't see any significant action after the initial two channel breakouts, I'm thinking it’s not happening.

Checking the trend with the Keltner Channel is easy: if those candles are staying snug inside the channel and tilting in a particular direction, I’m in good shape.

Let me share some pro tips:

- CALL option happens when the candlestick breaks the upper channel while moving up, and ADX is above the 25 mark, indicating that the movement’s strong.

- PUT option is an option if the candlestick breaks the lower channel in a downtrend, with ADX also above level 25.

The bottom line? When the channel breaks in the trend's direction, it tells me the trend’s gaining strength. Plus, that ADX line staying above the 25 level gives me a solid confirmation of the signal.

Expiration time? Set it for 10 minutes.

One thing's for sure—I'm not using the Keltner Channels strategy when big news is about to hit. Trying this tactic on assets that don’t show strong, volatile moves in the morning? Yeah, that usually leads to a lot of losses because after a breakout, I can bet the price probably won’t keep running and instead will flip back on me.