Alright, everyone, let’s jump into the world of trading strategies where folks are buzzing about those complicated systems and flashy indicators that can leave new traders baffled. Here’s the scoop: it doesn’t have to be complicated.

Before the Japanese candlestick chart took the spotlight, trading was a messy game. But these days, you can make some gains just by paying attention to the shapes and positions of the candles. This method has picked up a cool nickname among traders: "Candlestick Analysis" or, as the trendy ones call it, Price Action.

And believe me, this method works like a charm in the broker space with PocketOption—it’s like a cash-generating machine, letting me squeeze in multiple trades during a single session.

So, let’s zoom in on a wild setup that signals when the market’s about to turn around: the well-known Pinocchio pattern.

What are these Japanese candlesticks?

Imagine this: a candlestick formation looks like a tidy little rectangle, with the upper and lower spikes (or shadows, as we call them) perfectly aligned. The rectangle? That’s the candle’s body—and it’s created based on whatever timeframe I’m using. If I’m on an M1 chart, then each candle forms every minute.

The body shows the difference between the opening and closing price. Now, if the closing price falls below the opening price, we’ve got a downward candle; switch that, and we're seeing an upward candle. Usually, downward candles are red, while upward ones are dressed in green.

But hold up, there’s more! Picture the price opening, climbing up, then suddenly dropping below the opening price. In this case, a spike appears above the candle, giving me a clue about where the price was when the candle was formed.

Trading with the Pinocchio strategy—how do I roll?

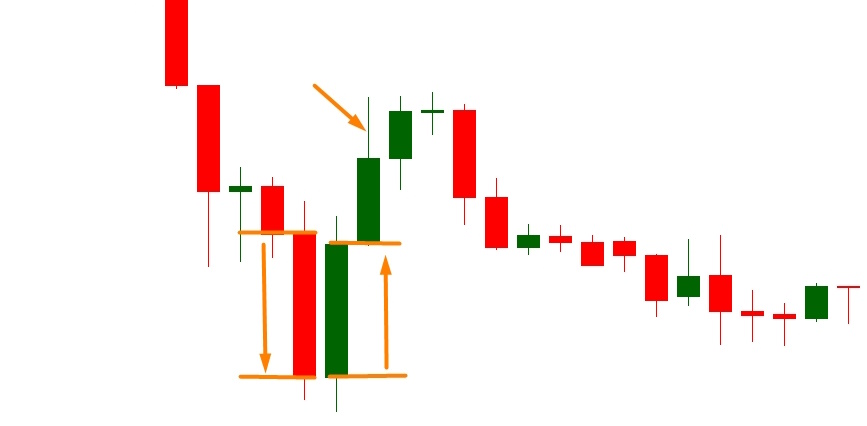

Now, let’s get to the point. Picture this: the chart’s heading upwards, everything’s looking bright, but after the last candle, bam—a huge spike shows up above it, stretching way beyond the candle’s body.

This signals that something’s off—like a significant trader wrapping things up or the market hitting a psychological barrier, or maybe it’s just the news shaking things up. Whatever the reason, it’s a clear sign that the market is preparing for a change.

CALL contract? That’s when I spot a red candle with a long spike below it during a downward move.

PUT contract? That's when I see a green candle with a long spike at the top during an upward move, just like I mentioned earlier.

Why's it called ‘Pinocchio,’ you ask? It’s all about those long shadows. Just like our favorite puppet whose nose grew when he fibbed, when the market tries to throw us off, the spike on the last candle stretches right along with it, aiming to leave traders in the lurch.

Just a heads up, though—trading based on price action is super popular but can be risky. So remember to stick to my money management guidelines.