So, here’s the deal—Williams %R is kind of like the Stochastic oscillator, playing in the same field. But here’s the catch—the Fast Stochastic Oscillator swings between 0 and 100, showing us where the market closes in relation to its lowest low. Williams %R changes things up by applying a -100 scale to it. Some of the experts in trading circles say these two indicators are nearly identical, just presented differently.

Created by the renowned Larry Williams, this tool compares closing prices to the high-low range over a certain time frame. We usually go with a 14-day period to spot trend reversals in the financial landscape. Even with all the advanced tools available, experienced traders still appreciate the classic %R oscillator. You’ll also find a bunch of indicators and oscillators—like Stochastic, RSI, and CCI—hanging out in the binary options trading world.

I’m pretty familiar with setting up and using the Williams %R oscillator on my trading platform at Pocket Option. It’s sharp and dependable, but let’s be honest—understanding its limitations is crucial. Sometimes it can be a bit too jumpy, giving off false signals like a poker game that’s gone sideways.

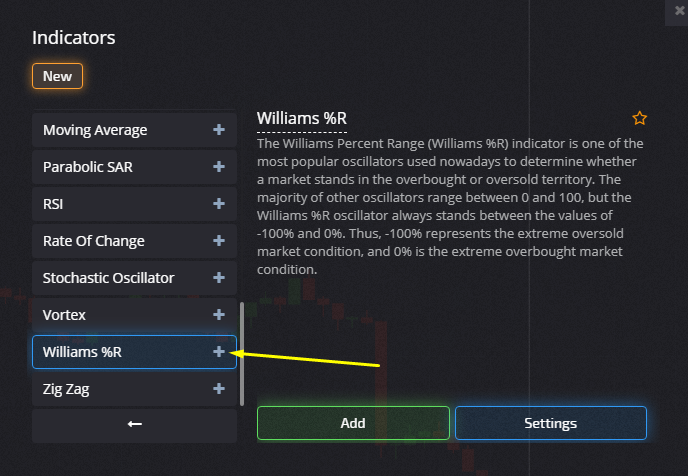

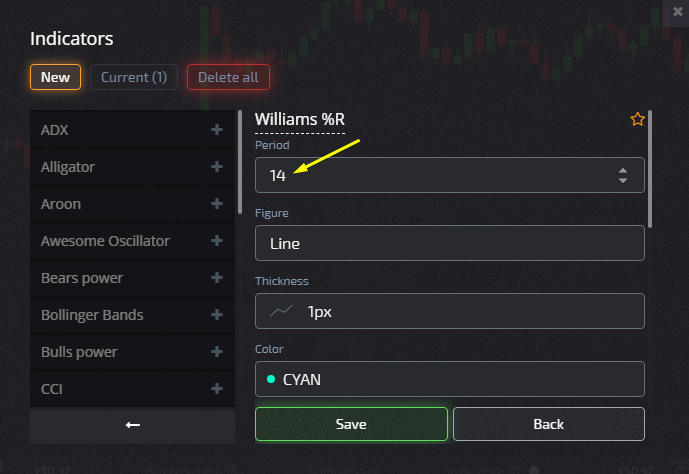

Let’s Dive into the %R Oscillator: Setting It Up and Using It

Back in '73, Larry Williams revealed the %R indicator in his book “How I Made One Million Dollars.” He’s been using this momentum indicator since '66 to trade stocks, futures, currencies, and commodities. The Williams Percent Range gained popularity almost overnight after Larry made an astonishing 11,000% return in the stock market—who wouldn’t want a slice of that cake? He originally created the oscillator for the securities market but quickly adjusted it for other assets to keep things interesting.

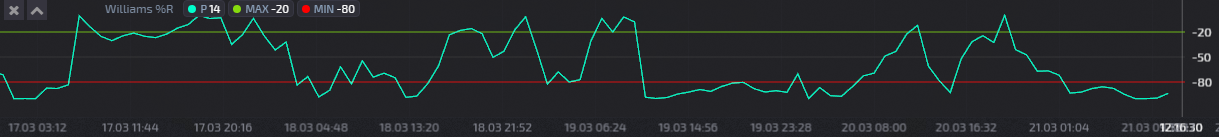

Typically, you’ll find the Williams %R below the price chart. Look for levels at 0, -20, -80, and -100, with a signal line moving up and down. If you're used to the Stochastic, just a heads-up—it might look a little backward at first. The Williams Percent Range offers us valuable insights into the strength or weakness of trends across stocks, commodities, currency pairs, cryptocurrencies, or pretty much any financial instrument with a price tag. To further enhance your understanding of such financial instruments, consider exploring the comprehensive trading insights offered by PocketOption broker platform.

Now, let’s discuss the zones:

- The oversold zone is between -80 and -100.

- For the overbought zone, it’s between 0 and -12.

- Stick with periods from M30 to H4 or use 14 candles.

Trading Options with Williams %R

This Williams percent range indicator is like my secret weapon for day trading in any market. It helps me pinpoint reversals, identify overbought or oversold conditions, assess trend strength, and gives me buy or sell signals.

The Williams Percent Range thrives on highly volatile assets like EUR/USD, GBP/USD, or the unpredictable world of cryptocurrencies.

Here’s the playbook:

- CALL contract when the signal line breaks out of the oversold zone or crosses above the -80 level from below;

- PUT contract when the signal line drops out of the overbought zone or crosses below the -20 level from above.

Make sure your expiration period is longer than the formation time of three candles.

Some traders also keep an eye out for divergence using the Williams Percent Range. To identify it, just look for when the peak prices on the chart differ from the oscillator. That’s when I jump in the direction of the trend.

The Pocket Option broker provides us with a wealth of tools. Momentum trading opens up fantastic opportunities, and using the Williams %R strategy can get you right into the action. It’s about not just waiting for the market turn; it’s about jumping into action during a rally or a sell-off. When the momentum shifts, that’s my signal to look for trading opportunities in the direction the oscillator crosses the -50 level. It’s all about making better, informed choices out there.