As a trader, I’m always trying to figure out what’s causing the price shifts in the market. Some of us use a couple of indicators, while others might have five or more in their toolkit. But let me tell you, the Pocket Option broker platform for diverse trading strategies? They're super popular among experienced traders like us.

Here’s the scoop: they say to follow the price, and that’s solid advice. Prices tend to move in waves: up, down, or sideways. Just take a look at the chart, and you can spot those movements easily.

But knowing the direction isn't the whole story. To make those sweet, profitable trades, you’ve gotta have a sense of the market's potential.

There are plenty of ways to assess the market trend strength, but here’s my go-to: I really lean on Bulls Power and Bears Power.

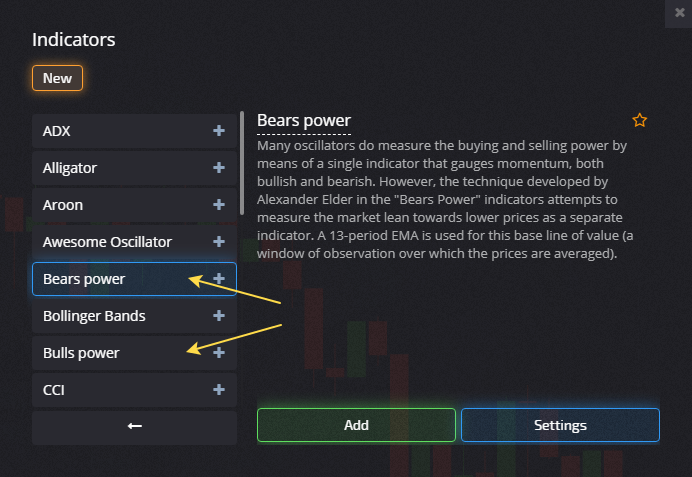

What I love about these indicators? They're straightforward and user-friendly. I just check the terminal of the Pocket Option broker, and voilà! Both indicators are right there in the standard tools list for technical analysis.

How does it look and how do I set it up?

These indicators are oscillators, so they show up below the price graph.

So, Alexander Elder is the genius behind the Bulls Power and Bears Power indicators. This guy knows his stuff - he’s a top trader and has written a bunch of great trading strategies and books. Bears Power? It measures the market’s appetite for lower prices. Bulls Power? That’s all about figuring out the market’s appetite for higher prices.

Calculating Bears and Bulls Power Indicators

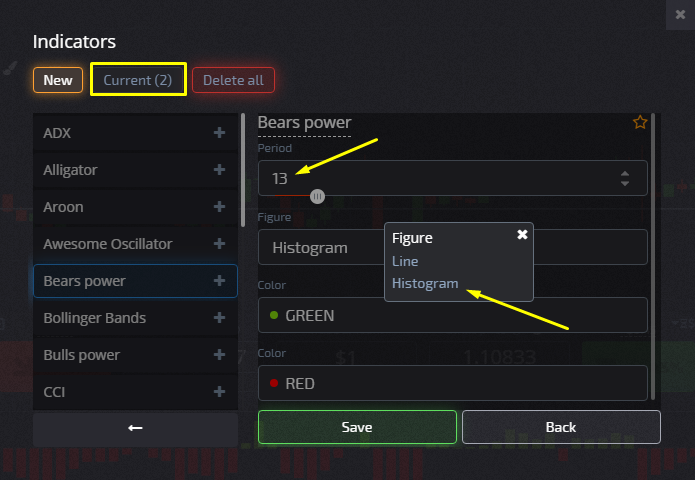

To work with these indicators, I start with the EMA of the price. Elder suggests using a 13-day EMA of closing prices. The high price? That's what I consider the upper limit of bullish strength.

- Bulls Power = High – EMA (13)

Now, the low price? That's to catch the lower limit of bearish strength, helping me assess the overall bearish sentiment in the market.

- Bears Power = Low – EMA (13)

Sometimes, I might extend the period beyond the 13-day EMA. When I do that, Bulls Power can go positive. But be careful; if the high for the period falls below the EMA, Bulls Power goes down.

And if I fall below the 13-day EMA? Bear Power dives into the negatives. But there will be times when that low breaks above the 13-day EMA, and bam, Bear Power swings positive.

So, to set up these indicators, I hit the “Active” menu, click the pencil icon, set it to a period of 13, and display it as a “histogram.” And just like that, I'm good to go, as you can see in the screenshot:

The indicators pretty much tell you what’s up. The EMA slope shows me the trend direction—I always trade in that direction. Bulls Power and Bears Power help me nail those entry and exit points like a pro. Now, when I'm considering buying, here are my go-to rules:

- Buy when the market's in an uptrend

- Buy when Bears Power drops below zero but starts to rise

But I've gotta keep an eye out for a few conditions:

- The peak in Bulls Power must be higher than the last one

- I need to look for bullish divergence in Bears Power alongside the price

Spotting bullish divergence in Bears Power? That’s my golden ticket to getting in. This divergence happens when prices hit new lows but Bears Power doesn’t drop. Now, for exit signals, if prices hit a new high but Bulls Power can’t find new peaks, that’s my cue that the bulls are losing steam. When I’m thinking of going short, I follow similar rules:

- Open a short position when the EMA shows a downtrend

- Bulls Power needs to be positive but trending down

And let’s not overlook the extra conditions:

- The recent low in Bears Power must be lower than the last low

- Bulls Power is fading after a bearish divergence

I’m ready to buy that PUT option when the price dips down from the SMA, plus when Bears Power drags its line below zero.

To spot an uptrend? I rely on the Bulls Indicator:

Buy the CALL option when prices are climbing, and the bullish signal is clear, with that line above the zero mark.

While I enjoy mixing Bulls Power, Bears Power, and an EMA using the Elder-Ray method, I’ve found that adding a couple of extra indicators helps create a fuller picture of what’s going on in the market. I always pick indicators that give me the clearest read on the data.

And don’t forget, folks—check out multiple time frames. Start with one time frame higher to really feel the overall vibe. Like if I’m trading on an hourly chart, I’ll glance at the four-hour chart first to pinpoint the trend.

Trading gets better with practice. So before I risk my cash, I test my strategies in a demo account without the pressure.