Alright, let’s break it down. I’m all about that Vortex oscillator vibe, known as the VI. This tool has two lines to keep an eye on: the uptrend line (VI+, green) and the downtrend line (VI-, red). I use this cool tool to spot trend reversals and support my current strategies. It’s a favorite among options traders because it reacts quickly to market changes, providing reliable signals.

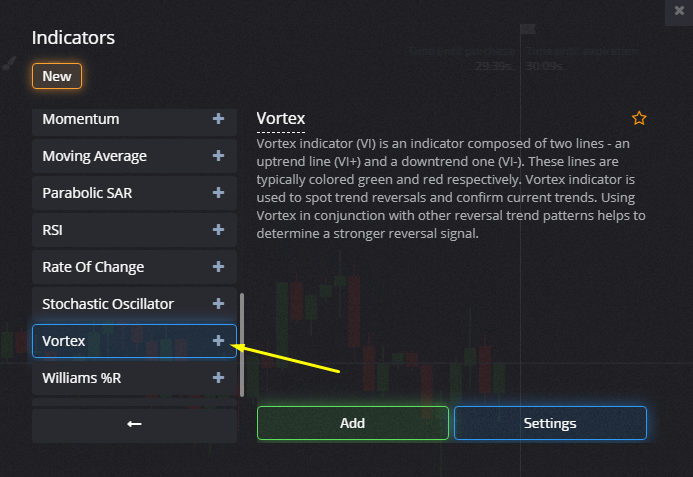

Now, the Vortex isn’t just any indicator. It was developed by Etienne Botes and Douglas Siepman back in 2010 and was featured in the “Technical Analysis of Stocks & Commodities.” Fortunately for me and my trading game, the comprehensive range of tools offered by PocketOption trading platform includes this indicator right off the shelf. Check out the screengrab to see how to launch the Vortex from the advisor list.

Originally, this Vortex indicator was focused on the forex scene but soon made its way into options trading, boosting my signal efficiency and reliability. Can’t beat that!

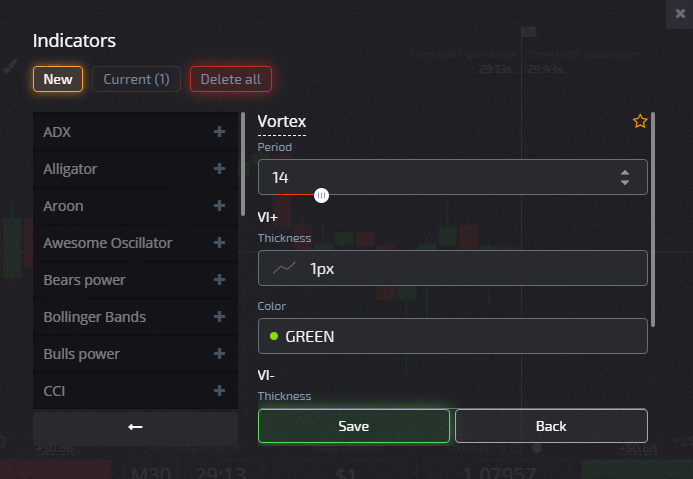

What’s Vortex Look Like and How Do I Set It Up?

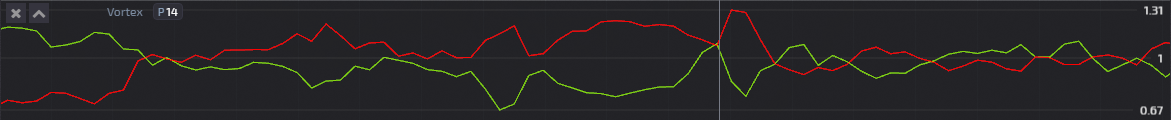

It’s a classic setup with two signal lines and key levels, giving it that familiar oscillator feel. I find the Vortex hanging out under the price chart in the Pocket Option terminal.

Line VI+ (that green line) is my uptrend, calculated by taking the current high minus the previous low.

Line VI- (the red line) represents my downtrend, calculated by taking the current low minus the previous high.

The magic of this indicator breaks down into four components: True Range (TR), the uptrend and downtrend moves, parameter lengths (14 or even 30 days), and those trusty trend lines VI+ and VI-.

Sure, it sounds a bit complex, but don’t worry! The software handles the tough part. Just install the indicator, tweak the settings, and you’re set.

No matter the timeframe, the creators of Vortex recommend using a 14-period setting. For those ready to get started in Pocket Option, go to “Indicators/Active” and click that pencil icon to check the settings.

Pro Tips for Trading Options with Vortex

Vortex is straightforward. A buy signal? Look for a line crossover.

I’m all in for a CALL option as soon as that green line crosses above the red from below. Smooth sailing!

And when the red line crosses over the green? I’m jumping on a PUT option right away.

Here are some general tips when trading with the Vortex Indicator:

- Stick to high volatility times;

- Consider currencies or cryptocurrencies as my trading assets;

- Ensure my expiration times exceed the formation of at least three candles;

- Avoid shorter timeframes (less than 5 minutes is a no-go).

Don’t forget, relying only on those VI- and VI+ crossovers can result in a lot of false signals during choppy markets. If things get tricky, increase the periods on the indicator—try 25 instead of 14.

The Vortex indicator works well with other trend reversal patterns, providing extra support for those reversal signals. You’ll find it integrated into most trading software, with VI+ and VI- displayed separately below a candlestick chart. It’s a good practice for most traders, especially when paired with other strategies, to enhance signal accuracy alongside additional tools.