Hey there, let’s simplify the binary options market for you. This space has evolved a lot since it first appeared, right? We're essentially talking about betting on a "yes or no" outcome—hence the name "binary." In the past, it was mostly a playground for big players and institutions. Then, in 2007, the SEC decided to let the everyday folks join in. And wow, we've seen a big increase in independent traders! These days, you can trade pretty much any financial instrument you can think of in this market.

Now, if you want to succeed in this game, you need to be quick with both technical and fundamental analysis. Sure, predicting price changes is important, but let's be honest—market surprises can catch you off guard. It's either win or lose.

If you're just getting started, pros recommend holding off on trades at the end of a trend until you gauge its strength. A lot of traders pay attention to indicators like the Relative Strength Index (RSI) for this purpose.

So, what’s this RSI? It's a momentum indicator used to assess whether an asset is overbought or oversold by looking at how much recent price changes have shifted.

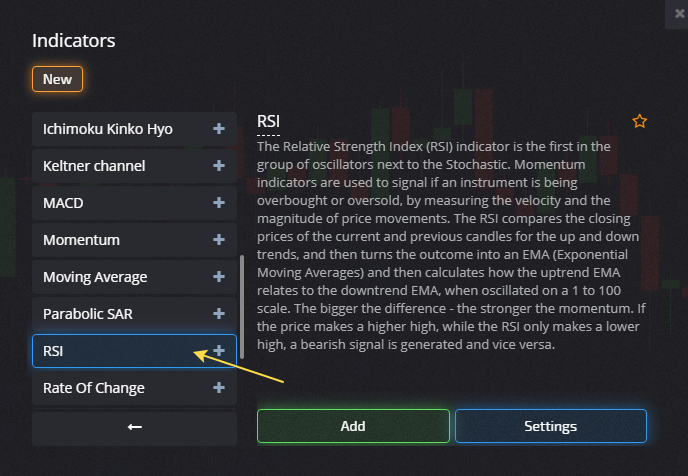

You can jump into the action at the comprehensive Pocket Option trading platform offering diverse strategies terminal, which has a variety of instruments and analysis tools, including the RSI.

Let’s Talk RSI

First off, the RSI is classified as an oscillator. You'll find it displayed below the price chart in its own section, looking like a scale with a signal line.

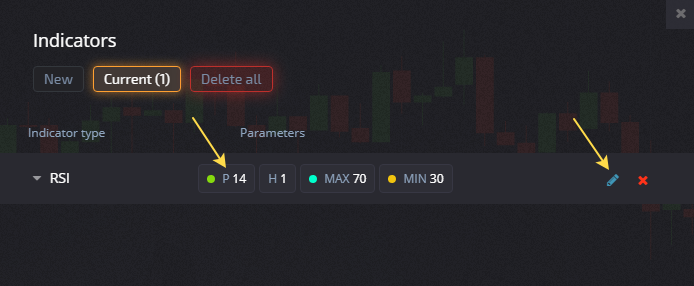

At Pocket Option, the lower level is at 30, highlighted in yellow. This area is called the oversold zone. When the signal line falls below 30, it indicates that supply is greater than demand—people are selling more than they're buying.

Then we've got the upper level at 70, marked in blue. This shows that an asset is overbought. So when the line crosses above that, demand outstrips supply—traders are buying more than selling, which means we're in an uptrend.

Fun fact: this indicator was created by J. Welles Wilder Jr. back in 1978 and outlined in his book “New Concepts in Technical Trading Systems.”

Crunching the RSI Numbers

Alright, how do we actually calculate the RSI? Here’s the interesting part: it's a bit of a complex formula:

RSI = 100 – 100/(1+ОC), where OC is ![]()

We use average gain or loss from a look-back period, calculating percentage rises and falls. We typically stick with a standard of 14 periods to find that initial RSI value. The timeframe? Doesn't really matter.

Once I have 14 periods of data, we can tackle the second part of the RSI calculation. After that, we get our results.

Here’s the lowdown—when the RSI is above 70%, it’s considered overbought, while below 30% it’s seen as oversold. The RSI compares bullish versus bearish momentum against an asset’s price movement.

The RSI goes up as more positive closes come in, but it dips as losses pile up. The second phase of the calculation checks the results, so in a strong trend, the RSI can get close to 100 or stay near 0.

Trading Binary Options with RSI Signals

To read the RSI signals correctly, it's really important to keep an eye on the main trend of the stock or asset.

If we're in a downtrend, expect the RSI to peak around the 50% level instead of 70%; smart investors can use this to signal bearish setups better.

Here are some general tips:

- Go for a CALL option when the signal line crosses level 30 from below.

- Look for a PUT option when the signal line slips below 70 from above.

Make sure your expiration time goes beyond the formation time of at least 2 candles.

The contract is only executed when the line exits the overbought or oversold zones.

A solid tip for new traders using the RSI is to stick with signals that align with the trend—meaning, go with bullish signals during bullish trends and bearish signals when the market's bearish. This will help you avoid those annoying false signals that can pop up with the RSI.