Let’s dive into trading channels, which are essential for any smart trader like me who relies on technical analysis for long-term strategies. There are two main types of channels that everyone seems to dig: trend channels and envelope channels. They’re the foundation for chart lovers like us.

I often use Parallel Channels, which are great tools in our arsenal to assess market direction and momentum. You know how it goes—creating a price channel is crucial for making those trades stick.

The real magic happens when I spot price movement within that channel; that’s my sign to jump into the trade. If there’s a breakout from the channel, it could indicate that the trend might be changing. I test out a range of strategies with these parallel channels. With the comprehensive trading strategies available through the PocketOption broker platform, I can draw technical lines on my chart faster than you can say "bull market."

How Do I Build the Parallel Channels?

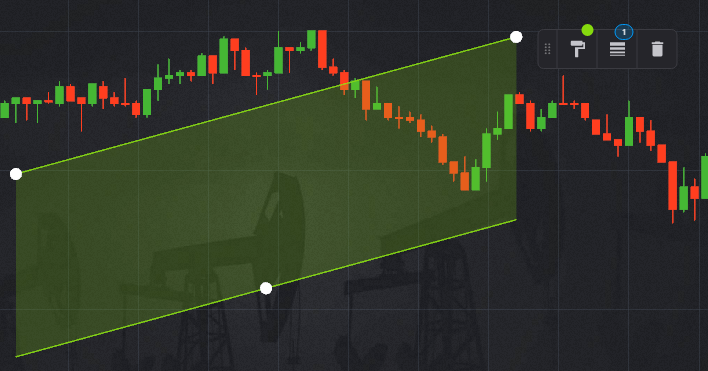

First step, I click “Build” in the Menu; just like that! Two parallel lines appear on my chart within that green channel.

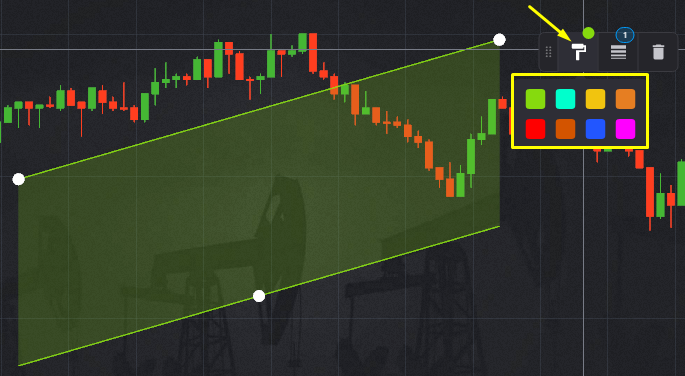

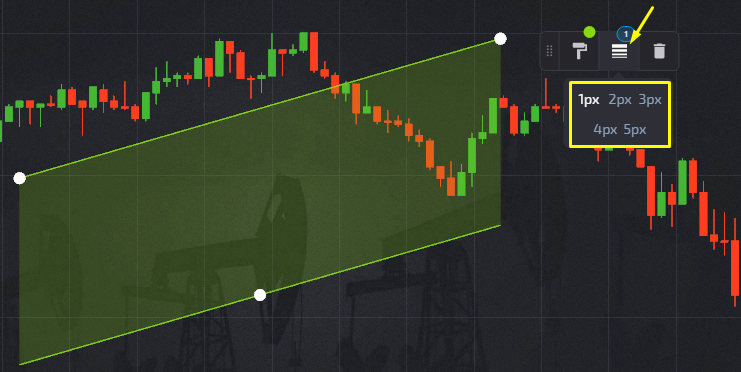

To get the parallel lines just right, I slide my cursor to the top line and drag that channel wherever I need it. Pro tip: the first button lets me adjust the color to my preference.

The second button? It adjusts the thickness of those channel lines. And if I want to start fresh, that third button clears the channels off the chart, just like that.

I usually keep the settings low for my parallel channels. As a trader, I like to set them to create a solid price corridor.

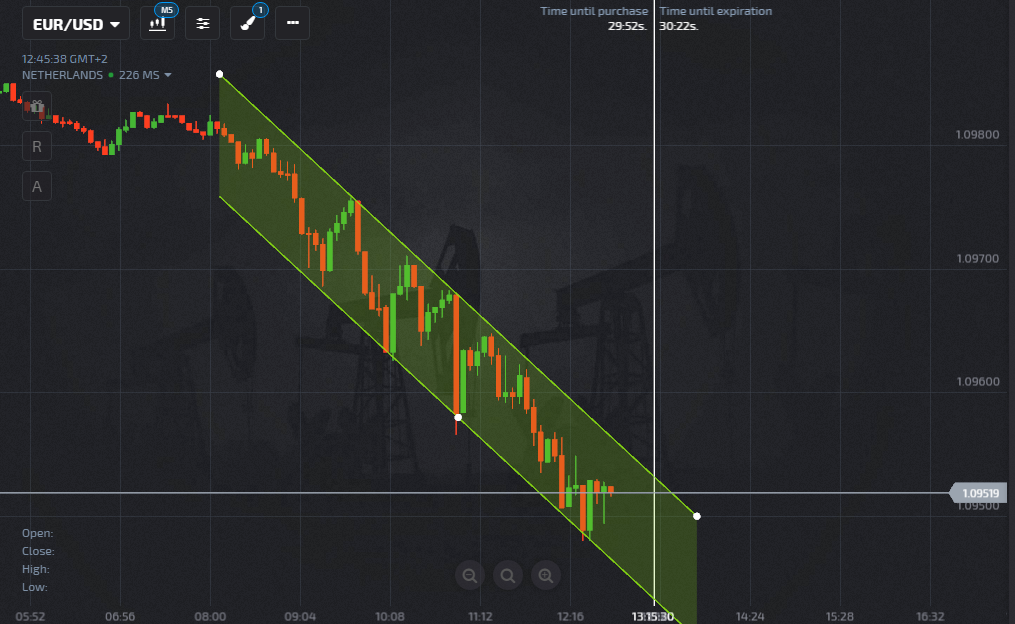

Using those white dots on the top line, I line it up to intersect with as many peaks in the current trend as I can. For the bottom line, I pull it tight to connect with the lowest points in the price movement. The goal is to create something that looks like this:

Done deal—my parallel channel is all set, and I’m ready to trade with confidence.

How Do I Trade Options using the Price Channel?

Working within a price range? It's not rocket science. The direction of those channel lines shows me the current trend. So, I’m looking to place trades on the bounce, right along with the trend.

- CALL when the price bounces off the support line during an uptrend.

- PUT when the price rebounds from the resistance line in a downtrend.

These parallel channels? They’re my go-to for spotting trend shifts. But once the price breaks out of that channel? That’s my signal to stop trading with the trend.

A trading channel consists of two parallel trend lines connecting support and resistance levels where a security's price is currently fluctuating.

To maximize those sweet profits during an uptrend, I focus on grabbing those buy positions at low levels. Once I identify a price channel, I can seize the opportunity when the price hits the channel's lower edge—easy buy at a discount. If the channel stays stable, I might hold my position at the upper bound, hoping for a breakout and a big price jump. However, if it seems like it’ll stay within the channel, I sell or take a short position at that upper edge to cash in my gains.

Now, a downward trending price channel can be just as rewarding. I’m looking to short at the upper limit and could even dive deeper into that short position once a breakout occurs. But hey, I can also play the other side, taking long positions from the lower edge, betting the price will stick to the channel boundaries and make its way back up.