Let me share my favorite tool in the trading world—the DeMarker indicator. It's my secret weapon for timing market entries like a pro, helping me catch those sweet price trends before they really take off. Seriously, this tool is one of the most reliable indicators out there. I like to combine it with other signals to spot price exhaustion and identify those market peaks and valleys while keeping my risk in check. Although it was originally designed for daily time frames, I can use it on any chart time frame and still get great results.

What I appreciate about the DeMarker is that it delivers clear trading signals, regardless of the overall trend. If you're using the Pocket Option platform, you'll find the DeMarker included with the standard indicator set—no extra hassle.

This indicator focuses on the highs and lows of each trading period, filtering out the noise of closing levels. One of its biggest advantages? It’s as stable as they come, similar to the RSI, making it a staple in my toolbox.

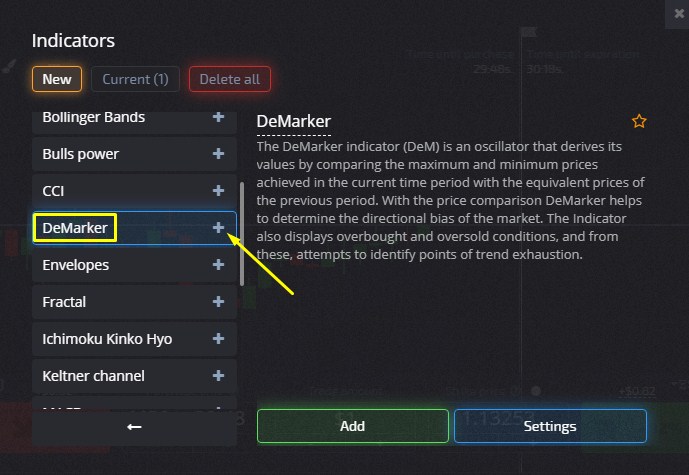

DeMarker Indicator Settings

Pretty cool, right? The DeMarker appears below my price chart, showing levels and a slick signal line.

My guy Thomas DeMark came up with the brilliant concept behind this indicator. It's all about comparing price highs and lows over a specific period.

Here's how I usually set it up:

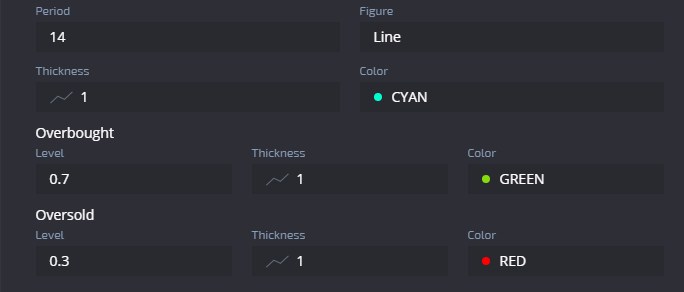

- Key Levels: 0.3 and 0.7;

- Moving Average Period: 14.

When I boot up PocketOption broker platform for advanced trading, the DeMarker oscillator is standard, ready to go.

The DeMarker indicator lays out two zones for me:

- Overbought zone: Above 0.7;

- Oversold zone: Below 0.3.

When values break these limits, I know it's time to be cautious—the stakes get higher and things can get tricky. If it's hanging below 0.3, I’m on high alert that tension's rising. Watch out for those critical shifts when the curve crosses those lines!

Trading with the DeMarker

When the market’s looking shaky or stalled, the DeMarker is my trusty companion.

For the oversold zone, here’s my game plan:

- If the signal line crosses above 0.3 and moves up, I'm jumping on that CALL option.

And for the overbought zone:

- If the signal line crosses below 0.7 and moves down, it’s time to grab that PUT option.

When divergence shows up, I'm placing my move based on the indicator's direction.

I’ve found that the expiration time should cover at least the formation of two candles, but the timeframe itself? Totally flexible.

As I explore this DeMarker indicator further, I realize it’s not just any momentum oscillator—it’s got more to offer. This gem helps me confirm whether I'm in a trending market or a stagnant one. If I’ve identified a trend, the DeMarker supports me with the overall bias. Plus, it breaks down buying and selling pressure like a pro. With these insights, it’s all about spotting those potential reversals in price trends before they happen.