Staying cautious while the markets go crazy can be a challenge, but you know what? It can really pay off. I'm talking about trading digital contracts. If I stick to a conservative plan and use reliable market analysis tools, it can lead to some serious gains. My favorite method? The Catch strategy, which mixes two heavy hitters: ADX (Average Directional Index) and Parabolic SAR (Stop and Reverse).

This dynamic duo helps me find the right moment to grab those contracts. If you're keen to give it a try, both indicators are included in the Option Pocket trading platform starter kit. After you check it out, you might just want to jump in!

Setting Up My Indicators

Before diving into the Catch strategy, I need to adjust my trading platform for effective decision-making analysis. That means I focus on the assets I'm choosing, the timeframe I’m using, and the charts that align with the current market trends.

I always choose assets that are displaying strong trends. When trading currency pairs, I bring my A-game, especially with high-volatility ones like EUR/USD, GBP/USD, and USD/JPY. I can also ride the trend with shares of major companies or commodities like gold and oil. But let me tell you—low-volatility assets are out of the question. This strategy is all about capturing those strong movements!

As for timeframes? There aren’t strict rules here; the Catch system works well across different frames. That said, I've found it works best on the 5-minute to 1-hour charts. Using 5, 15, or 30-minute intervals helps me track trends while avoiding market “noise,” and it allows me to make several trades in a session.

For top-notch analysis, I stick with Japanese candlesticks. They give me a clear view of price action, showing both the beginning and end of each period, along with those high and low extremes.

Now it’s time to set up my tools to grab those perfect signals for trading the rise or fall of my chosen asset:

- First up, ADX helps me measure trend strength. It doesn’t indicate direction, but it tells me how strong that trend is. If the ADX is over 25, that’s a strong trend signal; anything below that is weak. I stick with the default settings.

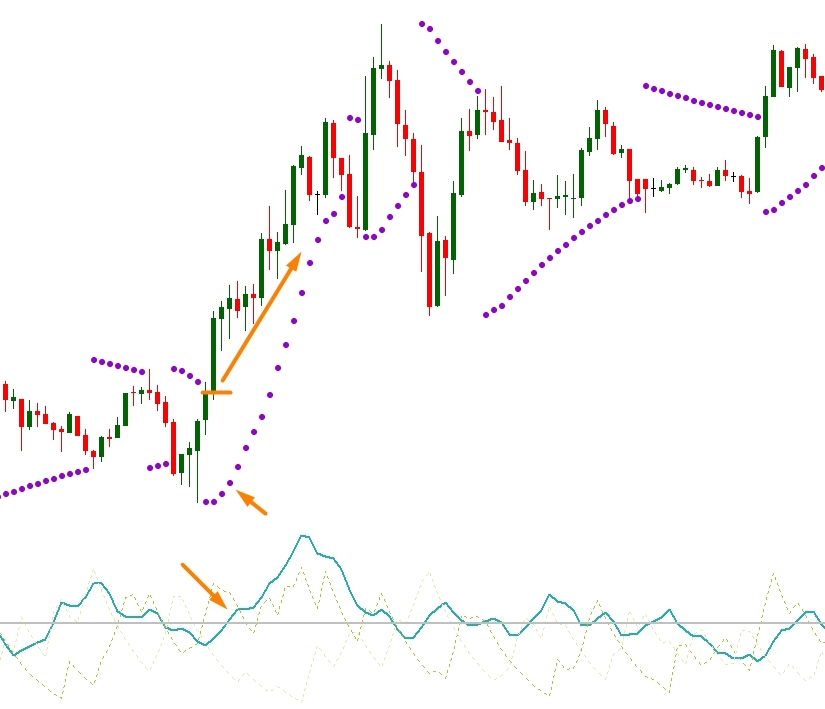

- Next, I use Parabolic SAR to identify trend reversals. This indicator shows up on the chart as dots tracking the price. Dots below the price? That’s a sign to buy. Dots above? Time to sell. Default settings for the win.

Trading with the Catch Strategy

The way this system works is by syncing the signals from ADX and Parabolic SAR. The core idea? I only open trades when the trend's strength is confirmed by the ADX and the trend direction is set by the Parabolic SAR.

If I'm going for a call option, here’s what I’m looking for:

- ADX needs to be above 25, signaling a solid trend.

- Parabolic SAR sits below the price, indicating an uptrend.

- And for that sweet confirmation: the price is rising, forming those upward candlesticks.

When it’s time for a put option, I follow these rules:

- ADX should be above 25, confirming that strong trend.

- Parabolic SAR is above the price, indicating a downtrend.

- And that crucial confirmation: the price is showing consecutive lows and highs that are lower than the previous ones.

Pro tip: Set the expiration time for options to fall within 3-5 candles of the timeframe you’re using. If I’m on a chart with 15-minute candles, I'm looking at an expiration time of around 45-75 minutes.

The Catch strategy supports me as a cautious trader, letting me leverage the ADX and Parabolic SAR combo to not just find the trend direction but also gauge its strength, seriously boosting my success chances. And hey, I can’t stress enough how important risk management and discipline are when trading options.