As a trader, I've seen it all—from flashy strategies aiming for quick paydays to the DIYers putting together their own methods from various bits and pieces. The broker options world is buzzing with strategies, but let's be honest: almost all of them are loaded with indicators for trade signals and confirmations. You know, the pros nail the technical aspects, but us newbies often find ourselves bewildered by the complex formulas and charts, missing out on great opportunities. That's where something simple, like the 4/1 trading strategy, comes in handy.

Why Choose a Simple Trading System?

If you're just getting started, you need to know that trading systems are like your playbook. They lay down the rules based on either technical indicators or fundamental analysis. These systems outline when and how to make your moves. Simple strategies are a lifesaver for beginner traders because they’re easy to understand—no special training required.

So, what's in it for you with the 4/1 strategy? Here's the lowdown:

- You won’t need any fancy tech skills or math genius.

- Most of the tools are right there on broker platforms, especially Pocket Option.

- We're talking a one-minute timeframe. Just double-check those settings.

- It's perfect for quick trades; you can rack up a bunch of trades. With the right moves, that can mean some real profits.

How to Set Up Your Trading Terminal?

Even if you’re new to the trading scene, starting your trading terminal is super easy. To kick off with the 4/1 strategy, you need three simple components:

- Japanese candlestick chart;

- timeframe set to M1;

- currency pair: EUR/USD.

Set those parameters, and you're good to go.

How to Trade Using the 4/1 Strategy?

Before diving in, let’s cover some tips for that extra edge. With this straightforward strategy, your best friend is the Japanese candlestick. Since we’re on a one-minute timeframe, a new candle appears every 60 seconds.

The one-minute timeframe is top-notch; it’s quick and lets even those of us with full-time jobs join in while snagging some nice profits.

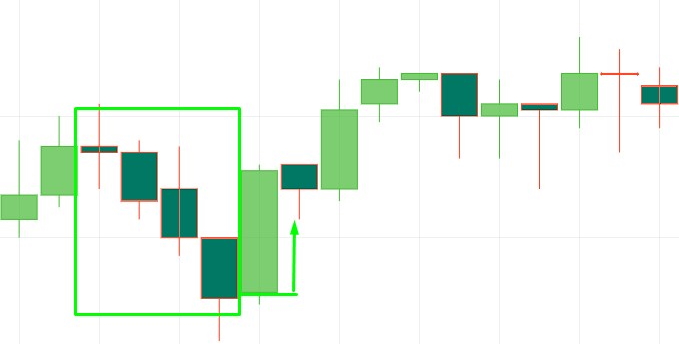

In the world of broker options, price fluctuates, and those downward candles follow the upward ones and vice versa. Stats show the chances of getting a reverse candle after four identical ones are about 70%. That’s the basis of our strategy.

- Grab a CALL option after spotting four downward candles;

- On the flip side, grab a PUT option after four upward candles.

Timeframe is 1 minute or the duration for one bar.

Heads up: avoid trading when major news breaks regarding the dollar or euro.

With the 4/1 strategy, you can hit a performance rate of 70%. And if you want to step up your game, consider adding the Martingale principle. Explore trading strategies with Pocket Option broker platform; minimum trade amounts start at just $1, allowing you to build a Martingale sequence up to 10 steps. There’s a mountain of success stories in trading, but let me tell you—it requires market know-how, a deep grasp, and solid trading psychology.