You know the routine, everyone—CCI is my favorite, the Commodity Channel Index. This tool is great for identifying trends and reversals. It has the flexibility and ease that every trader wants.

Here’s the scoop on how I work with CCI: I calculate it using this handy formula:

(Typical Price – Simple Moving Average) / (0.015 x Mean Deviation)

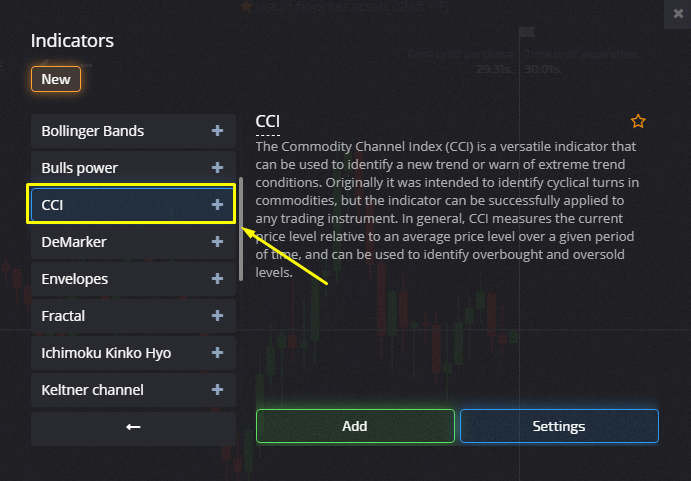

This helpful indicator shows me where the trend is going and warns me when it’s about to change direction. I often find the Commodity Channel Index hanging out among the standard tools on Pocket Option. If you're looking for a reliable broker PocketOption offers an intuitive platform that caters to both beginners and experienced traders.

Let’s Explore CCI and My Usage

This gem was created by Donald Lambert back in 1980. It was initially designed to identify long-term trend changes, but now it adapts to different markets and timeframes. I like using several timeframes because it provides more buy or sell signals for us active traders. I usually apply CCI on longer-term charts to identify the main trend, then switch to shorter-term charts to catch pullbacks and generate those trading signals.

The Commodity Channel Index operates on a scale of 5 levels: -200, -100, 0, 100, and 200, plus the signal line. You’ll see the indicator positioned below my price chart.

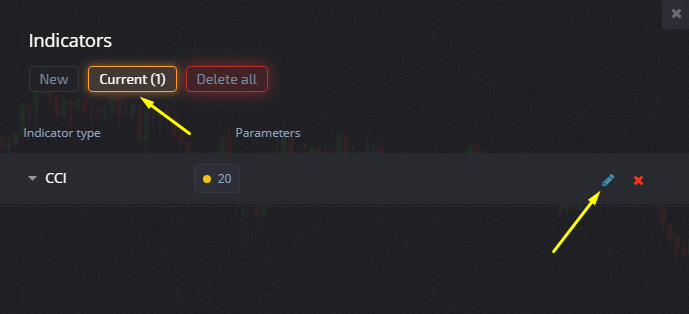

I need to set the period for CCI. The creator suggests keeping it at 20. If you go lower, those price swings turn into noise; if you go higher, the indicator becomes less effective. That’s why it’s great for long-term trading!

CCI compares current prices to average prices over a given period. It can float above or below zero, dipping into positive or negative zones. Most values—around 75%—stay between -100 and +100, while about 25% move outside that range, indicating strong price action.

When CCI is above +100, it shows that the price is significantly higher than the average according to this indicator. When it drops below -100, it indicates a price far below average.

Want to adjust the settings? Just hit the "Indicators" menu and find CCI there.

Let’s go over the basic rules for using the Commodity Channel Index:

- When the line’s rising between -100 and 100, that’s my uptrend signal;

- A downtrend happens when the line's going down;

- If the line is stuck between 100 and 200, it suggests we’re overbought, and a reversal may be coming;

- If the line lingers between -100 and -200, the market’s oversold, and a downtrend is likely on the way.

Using CCI Signals for Trading

CCI is excellent at finding optimal entry points:

- Buy a Call when the line crosses the -100 level from the bottom up.

- Buy a Put option when the line exits the oversold area and crosses level 100 from top to bottom.

As I mentioned before, this indicator really excels in medium-range trades (think 30 minutes to 4 hours). Make sure your expiration period aligns with covering at least 2 candle formations.

Remember, different strategies can utilize CCI in various ways, including using it across multiple timeframes to pinpoint dominant trends, pullbacks, or entry points. Some CCI-based strategies may generate a few false signals or losing trades, especially when the market gets choppy.