No doubt, my math skills help me succeed in trading, but hey, I don’t need a PhD in Applied Math to master a candlestick chart along with a solid strategy. I’m all about that Mathematician Strategy, which relies heavily on probability theory. Candlestick charts are my go-to for visualizing asset prices. Why? They're easy to read and show patterns that help in executing trades in the forex market. For those interested in exploring advanced trading techniques, consider the diverse trading strategies available with the PocketOption broker platform.

Mathematician Strategy Explained

In my view, trading based on probability theory is pretty simple: if I’m trading futures (or FX, stocks, cryptocurrencies) with a constant $1000 profit target and a fixed risk of $1000 (keeping an eye on the main trends), I should expect to profit in about half my trades.

Years of trading experience tell me that candles of the same color rarely go beyond eleven. Why's that? Because there are buyers and sellers in the market; any strong movement in one direction can be countered by the opposing forces.

Stats also indicate that after three candles of the same color, I have a 50% chance of a price reversal. If that increases to five candles, the odds rise to 75%. Sometimes, I see those amazing runs with eight, ten, or even twelve candles lined up.

How I Work with the “Mathematician” System

Using the Mathematician strategy is a breeze: I’m on the lookout for three candles of the same color before I go for a contract in the opposite direction. Here’s my game plan:

- CALL after three red (bearish) candles in a row.

- PUT after three green (bullish) candles back-to-back.

The expiry time shouldn’t last longer than the formation time of one candle.

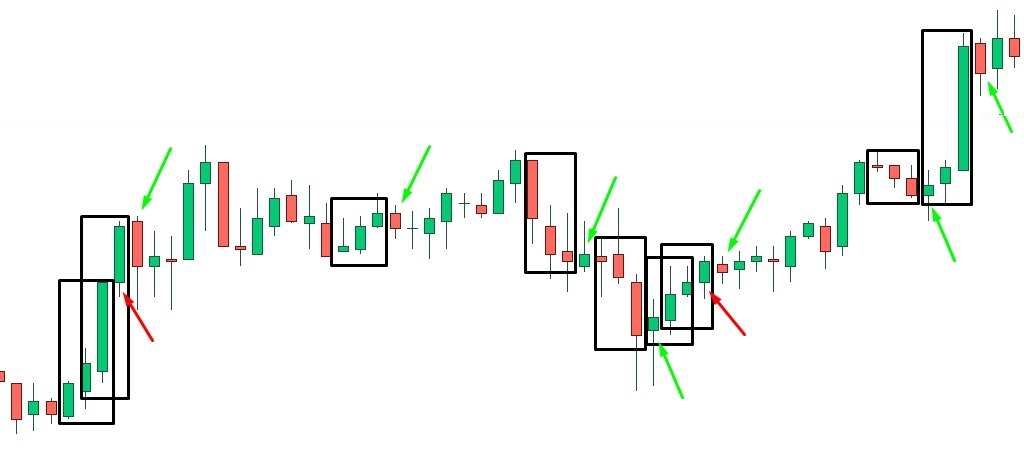

Check out the screenshot below where I’m showing this strategy in action:

Every trio of candles sharing the same color is marked with black rectangles on my hourly charts. Green arrows show when I bought the contract and made a profit. Red arrows indicate when I faced a loss.

Let’s be honest—seven out of the nine contracts I took ended up in the green.

Combining Martingale with the “Mathematician” Strategy

To keep things balanced, I often incorporate the Martingale principle. Think of it as a system where I keep increasing my investment size after losses or grow my position when my portfolio shrinks. Essentially, if I lose, I’m doubling down on my trade size. The idea here is that when I finally score a win, I recover all my losses. On the other hand, there’s the anti-Martingale approach, where I increase my stake after wins. However, there's always that risk limit I have to manage. The longer I stick with the Martingale strategy, the more likely I’ll hit an extended losing streak. Depending on my mental approach, this might be tough for me. Still, many people support the Martingale strategy. Now, let’s explore how I can incorporate its core principles into the Forex world.