Hey there, traders! Here’s the scoop on breakouts – those awesome moments when a stock price breaks through a clear support or resistance level, along with a bump in volume. You know how it goes; when a stock rises above resistance, that’s my signal to buy. On the flip side, if it drops below support, it’s time to sell. But check it out, I always play it smart by waiting for the next candle to form in the direction of the breakout before I jump in.

My Game Plan for Breakout Trading

- First, I wait for the price to get close to either support or resistance;

- Next, I keep an eye out for that unusual candle that breaks the usual flow;

- Now, I like to think strategically – wait for confirmation. If the next candle supports the breakout, I'm ready to act;

- Right after that confirming candle closes, I’m picking up an option in the direction of the breakout.

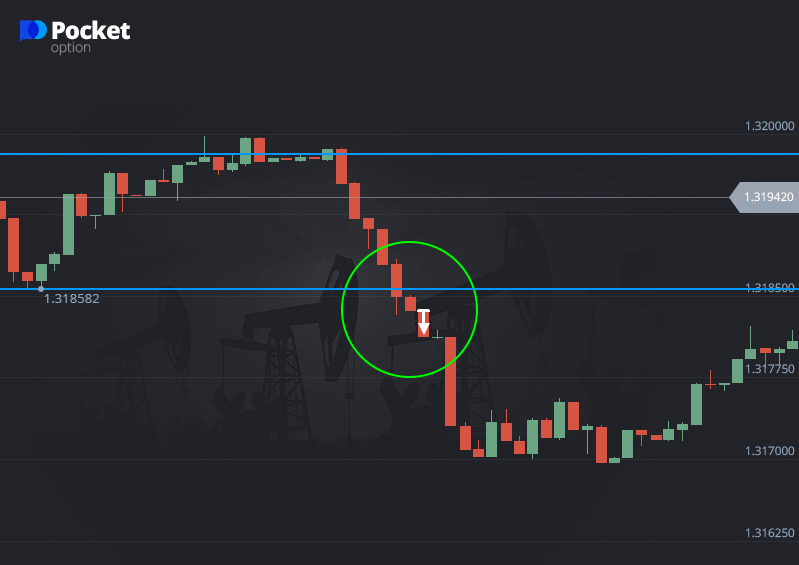

Snagging a Put option on a downturn can be an effective strategy when working with a broker like PocketOption for informed trading decisions, as it allows traders to profit from declining market trends.

Picking up a Put option when the trend's falling

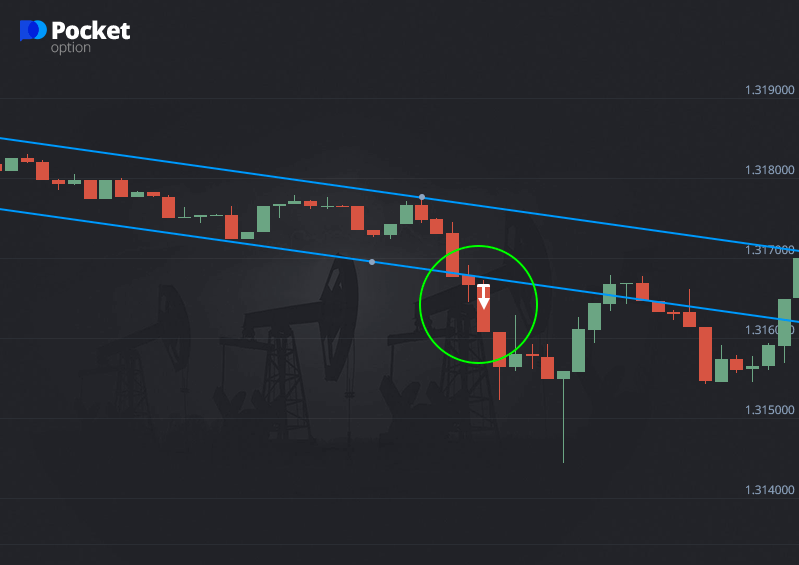

Locking in a Call option during a downturn breakout

Now, while I’m still building my skills, I like to approach breakouts with caution. Can’t stress this enough – waiting for that confirmation candle is crucial, as false breakouts happen. Just imagine this: a candle breaks the resistance level but then closes right back down. Then, the next candle bounces right back into the normal price range. Total trap!

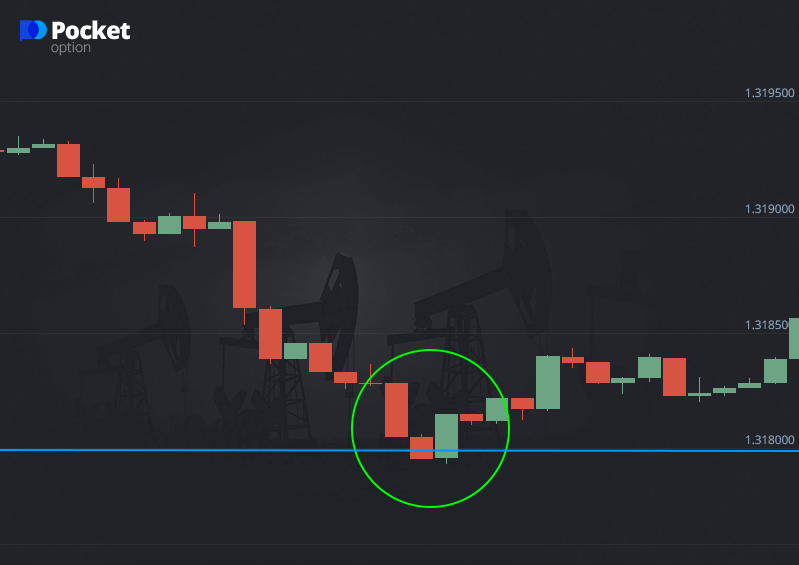

Red Flags of a False Breakout:

- It’s a false alarm when the candle just touches the range with its wick and then closes above the level;

- If a candle closes right on or just above/below the range but the next one reverses back into the price range, that’s another warning sign.

Identifying a false breakout

If after a breakout, a candle looks all off or just lingering, that's your sign – could be a fakeout, which is why I wait for confirmation from the next candle. Want to tell the difference between a real breakout and a fakeout? Just hold tight and look for confirmation. Fakeouts often see prices open outside support or resistance but then drift back within the original range by the end of the day. If you're jumping in too quickly without checking, you’re asking for trouble. I keep an eye out for higher-than-normal volume as a signal or wait until the trading day wraps up to see if those levels hold up.