Hey there, fellow traders! I’ve always believed that “the trend is your friend,” but what about you? In this market, it’s super important to choose the right strategies and stick with the ones that really work. When I’m looking at breakout trading, I always focus on two main things. First, I need to identify a strong breakout level. The stronger the level I choose, the better my chances of riding a solid market wave. I make it a point to find those dependable support and resistance levels that have shown good results in the past.

For us binary options traders, using a breakout strategy with Pocket Option platform for enhanced trading involves first determining that breakout level, predicting the breakout itself, and then jumping into the market once I’ve confirmed the direction of the price movement.

I’ve got to learn to read the signals and take advantage of those breakout opportunities! However, I see many traders miss out because they can’t quite determine the reversal points. If I stick to the strategy I’m about to share, I’ll be able to identify trend changes like a pro.

How do I set up my trader’s terminal for the “breakout” strategy?

First things first, to kick off my “breakout” strategy, I need a candlestick chart and two handy indicators: the SMA and the RSI. I set these up in the Pocket Option terminal menu.

I switch my chart to a candlestick format and set the period to 15 minutes.

Here’s how I configure my indicators:

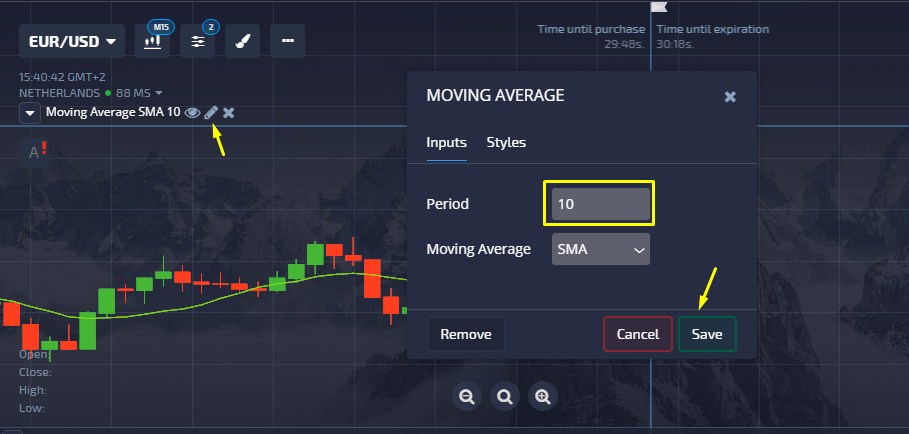

- I set the SMA period to 10;

- For the RSI, I set it to 14 periods, change level 70 to 50, and uncheck the box to remove that level.

With these settings in place, I use the moving average as my trend line, and the RSI gives me the confirmation I need.

I pay attention to market shifts when the main trend line breaks: it acts as resistance in downtrends and support in uptrends. But I have to stay alert because sometimes prices can bounce back. I need to filter out those false signals using the RSI.

How do I buy contracts with my breakout strategy?

Alright, I’m all set up and ready to hit the trading desk! This strategy works particularly well with European and American currency pairs.

If I see a break above a resistance level, it’s a green light for an uptrend, meaning prices are set to rise. During this uptrend, I trigger my Breakout Strategy for Binary Options and place CALL orders. From there, it’s all about riding the wave and cashing in.

On the flip side, a break below the support level means we’re looking at a downtrend or bearish territory. This signals the opportunity for PUT orders since I’m betting on instrument prices dropping.

Here’s my go-to approach:

- CALL option when an upward candle breaks the moving line from bottom to top (showing a shift in a downward trend) and the RSI line rises above 50.

- PUT option when a downward candle breaks the moving line from top to bottom (indicating a shift in an upward trend), with the RSI line dropping below 50.

But here’s the deal! I don’t jump into the contract right when the SMA breaks. I wait for the next candle to open after that break. I’m trading on a 15-minute timeframe, so I set the expiration period for 30 minutes, which lines up with the formation of two candles.

The Breakout Strategy may offer fewer trading opportunities, but it’s a fantastic complement to trend-following and support/resistance strategies. When you break down the strategy, it’s straightforward and effective. What I can’t stress enough is the importance of analyzing correctly and waiting for those breakout moments, all while avoiding the pitfalls of false breakouts. Trust me, those can really eat into your profits. And hey, keep an ear out for news that could change the game!