So, I’ve been looking into this BBand strategy, right? It’s a great trading method that works well whether I’m an experienced trader or just starting out in the market. Let me break down how to pick up those awesome buy and sell signals with this simple strategy.

What’s nice is that most trading strategies can get pretty complicated with tricky technical analysis and heavy math. But the BBand Strategy is easy to grasp, even for beginners. We’re talking about an enhanced version of Bollinger Bands that helps identify trend changes and set important stop orders. Here’s what I can find with this BBand approach:

- Market consolidation phases

- Possible highs and lows

- Trends that continue or reverse

- Major volatility breakouts coming up

This strategy is especially effective for short-term options with expiration times under 5 minutes. If I stick to the plan and follow the rules, my chances of making successful trades really improve.

How do I set up the Pocket Option terminal for the BBand strategy?

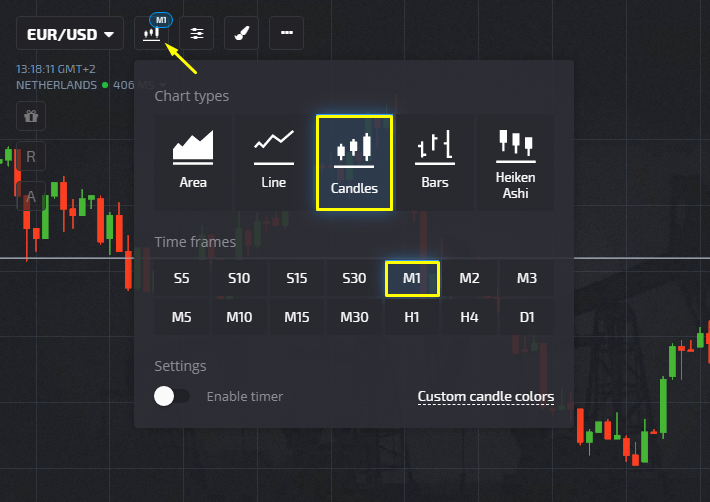

Alright, time to get going with the BBand Strategy and adjust my setup in the comprehensive PocketOption trading platform for diverse strategies. First, I go to the “Chart Type” menu and switch to “Candles,” setting my time frame to M1.

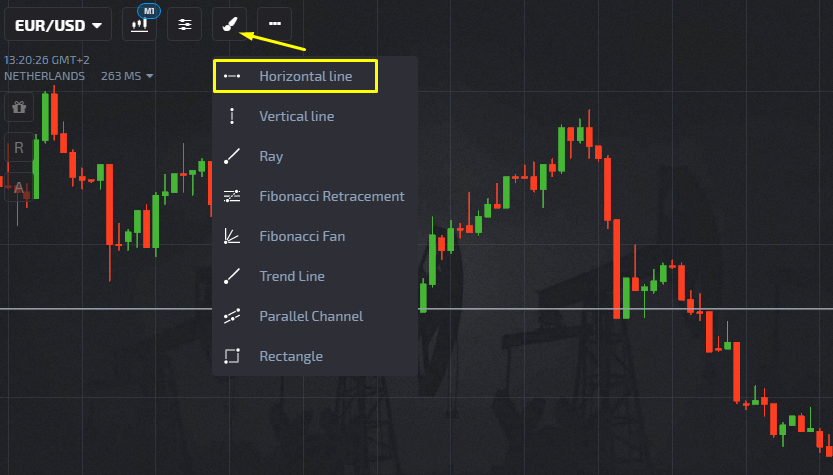

Next, I’m adding a technical line to my chart by clicking on that brush icon in the “Build” menu and choosing the horizontal line.

I can adjust the lines, moving them around by holding down the left mouse button.

Awesome! I’ve set up my terminal, and now I’m ready to go with the BBand strategy.

When’s the right time to grab a contract?

I’m feeling the five-minute period setup. For example, if I start trading at 11:23 PM, my next time frame runs from 11:25 to 11:30 PM.

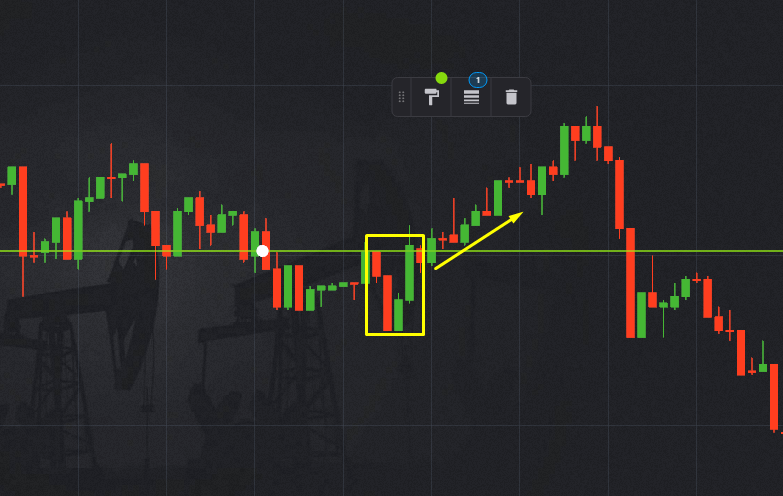

To make sure I don’t miss the start of price movement, I drag that horizontal line to the candle's opening at 11:25. Now, I wait for the “correction pool” to form – that’s when the price dips into that five-minute slot and bounces back out by about one point.

Most of the time, the market’s next move lines up with the direction of that correction.

So, here’s the deal: I’m buying a CALL contract if at the start of my five-minute period, the price dips but then rises back up to close near where it opened.

If I’m looking at a PUT option, it’s got to be the opposite situation. The correction pool should show a downward trend (a rise in price), and the price needs to close where it opened at the beginning of that five-minute period.

Remember, the expiration period needs to be exactly 5 minutes.

I’m definitely passing on buying a contract if the correction doesn’t reach the point where the next “five-minute” period starts. Signals can also be tricky if the pool is a lot larger than before. Honestly, this BBand strategy has what it takes to be a major boost for cashing in on profit with binary options.

I really hope these tips on the BBand strategy help anyone getting into it. If you’re eager to give it a shot, jump onto a demo account with Option Broker – it's loaded with extra indicators. Practicing risk-free is the best way to improve my trading skills. New traders should kick things off with a demo account to test out their strategies, keeping it real before diving into live markets.