So, let me break down the Average True Range (ATR), a handy tool in the Forex and broker options world. This gem was created by J. Welles Wilder back in '78, and he introduced it in his book, New Concepts in Technical Trading Systems. This versatile indicator also features the Parabolic SAR, RSI, and the Directional Movement Concept (ADX). Even though Wilder developed it before the age of advanced computers, his indicators are still performing well today.

ATR helps me assess market volatility like a pro. I often apply multiple ATRs to enhance my trading strategies. Originally designed for commodities and assets, ATR eventually carved out a niche in the broker options space. It was crafted to capture that tricky “missing” volatility. Just keep in mind: ATR doesn’t indicate where prices are headed; it simply reveals how much movement is happening. I use it to identify potential breakout signals or to set trailing stop-loss orders.

How to set up ATR in my Pocket Option trading account?

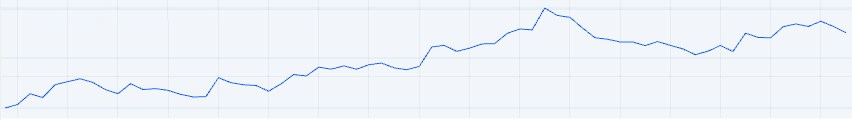

Getting ATR set up on my screen in the broker Pocket Option account is a piece of cake. I just open the “Indicators” menu and choose the ATR indicator. It appears as a single line beneath my chart, moving up and down. Understanding it isn't difficult: when ATR is high, volatility’s increasing; when it's low, things are quieter. Just remember, ATR isn’t about the trend direction—it focuses solely on volatility.

As a volatility indicator, ATR doesn’t concern itself with price direction. It focuses on how much the price of the underlying asset shifts within a specific timeframe and whether there are price gaps. If I’m using an hourly timeframe, I calculate the ATR value for each hour. On a daily timeframe, it’s calculated for each day, and so on.

Wilder’s formula for the ATR is based on determining the true ranges for a specified period using three simple methods:

- The difference between the current high and the previous close;

- The difference between the current low and the previous close;

- The difference between the current high and the current low.

To find the true range for the selected period, I take the highest value from those three methods. Since we're dealing with absolute values, the signs don’t matter. The average is calculated from the values over each period, with 14 periods being standard. Wilder also smoothed the resulting value for the 14-period ATR by incorporating the prior ATR value. For typical setups, the recommendation is 14 periods on timeframes up to H4. If I'm thinking long-term, I might reduce it to 7 periods.

How to trade Average True Range?

First off, I need to keep in mind that ATR doesn’t act as a buy or sell signal. It's all about highlighting whether market volatility is increasing or decreasing. Depending on my trading strategy, I can adjust the number of periods in the ATR calculation. Shorter timeframes give more signals, while longer timeframes are less frequent with alerts.

If the ATR line falls below the mid-level and trends downward, it indicates that market activity is slowing down, leading to lower volatility. On the other hand, when the line trends upward, it’s a signal that prices are gaining momentum.

Overall, Average True Range is a solid technical indicator, but it has its limitations. I need to use it alongside other tools if I want to make informed trading decisions.

Many of us experienced traders like to use the ATR together with other oscillators, such as the Parabolic SAR, which provides signals to enter a position (like during a candlestick breakout), while ATR supports the direction and volatility.

In summary, let's focus on three key points. First, ATR isn't a directional indicator like MACD or RSI; it's a unique gauge of volatility that reflects the level of market interest or lack thereof. Significant moves in either direction typically come with large ranges—those big True Ranges—especially at the beginning. Lackluster moves? They tend to have relatively tight ranges. Second, ATR can confirm the strength behind a move or breakout. A bullish reversal with a rising ATR signals strong buying pressure, reinforcing the reversal. Conversely, a bearish support break alongside an increase in ATR indicates solid selling pressure, solidifying the break. Finally, I can incorporate the Average True Range indicator into scans to identify assets with high volatility.