So, how can I ace trading options using just one index? This isn’t just some beginner's dream; even experienced traders are all in on it. Seriously, if I’m sticking with just one indicator, I can clear all that clutter off my screen and steer clear of random mistakes.

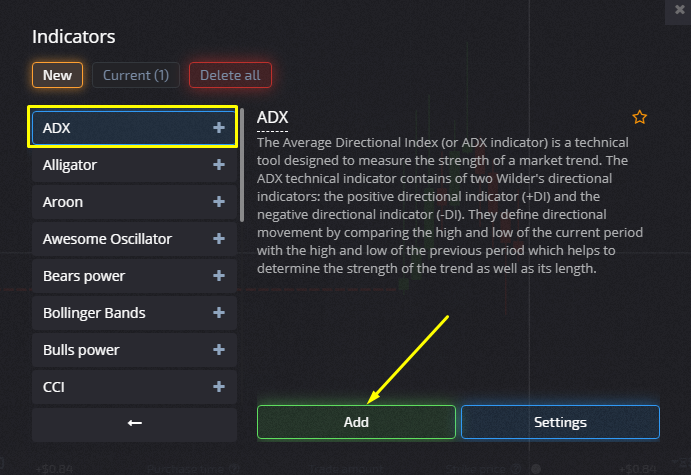

Some people will say it’s impossible to trade with only one index, but I’ve got a trick up my sleeve that reveals the strength and direction of a market trend. Plus, it provides clear signals when it’s time to leap into a trade. I’m talking about the Average Directional Index (ADX). This gem is ready to roll, right in the standard toolkit of PocketOption broker platform offering diverse trading insights and strategies.

Devised back in ’78, Wells Wilder created this indicator to show trend strength across price movements of a financial instrument.

You’ll find it hanging out under the chart, but let me clarify: ADX isn’t an oscillator. It started on the stock exchange and then made its way to other markets.

What ADX Looks Like, Its Settings, and Signals

As I mentioned, this tool resides in a separate window below my chart. It’s got that classic look like many oscillators (though it’s not one), featuring a scale with signal lines.

In my Pocket Option terminal, the ADX main line is red, blasting signals about the market’s upcoming moves. A bigger movement means a stronger trend is happening.

- -DI or Negative Directional Indicator (yellow) – this one shows the strength of sellers;

- +DI or Positive Directional Indicator (blue) – reflects the strength of buyers.

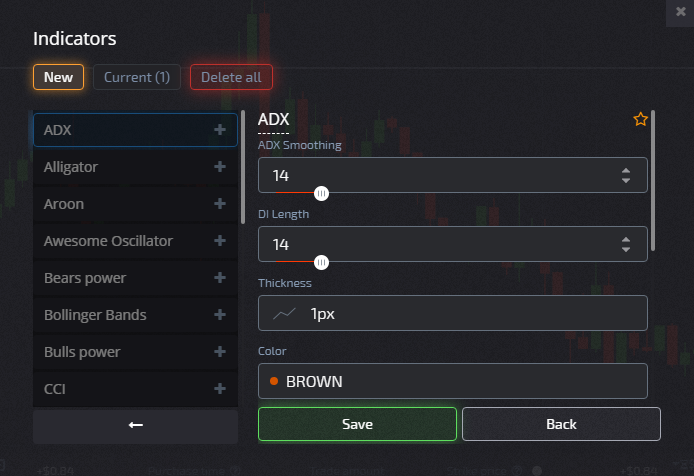

As for the settings, Wells suggests using a period of 14 for the main and signal lines. I stick with time frames from 30 minutes to 4 hours to filter out the false signals that pop up in messy markets.

Good news: Pocket Option terminal has all those recommended settings pre-loaded. I can always tweak the colors and thickness of the lines if I want to spice things up.

Wells Wilder is my go-to guy for signals on the Average Directional Index:

- Check how the signal lines are arranged: if +DI is on top, it’s buy time; if not, grab those sales.

- If the lines drift apart, that’s a green light for a steady trend, but if they’re bunched together or crossing a lot, we’re looking at a flat market.

- The main ADX line is my gauge for the trend’s strength. The higher, the better.

Trading Options with ADX

Here’s how I roll based on the rules above:

- Contracts catch my eye when signal lines cross.

- Grab a CALL when +DI crosses up over –DI from below;

- Time for a PUT when +DI crosses down through –DI.

Pro tip: Keep the ADX line above the crossover when making moves.

Always remember to look out for crossings that happen during a trend shift. If the lines move closer together and then cross while they were previously apart, that's your signal!

Expiration times should be at least double the time needed to form two candles.

To wrap this up, let’s be honest: the Average Directional Index isn't a magic solution. However, it can definitely help guide me towards making smarter choices in trading options. It’s easy to get the hang of it, whether I’m a rookie or a pro.