Let me break it down for you. The Aroon indicator? It's like my reliable buddy when I'm trying to catch the market's vibe. It shows me if a price is leaving the old range and moving into new, trendy territory. Big props to Tushar Chande for creating it – this guy also gave us the Stochastic and RSI. Basically, we work with two indicators here: Aroon Up and Aroon Down, which together make up the Aroon indicator. When the uptrends are heating up, I’m seeing new highs, and when the downtrends are cooling off, I’m spotting new lows. This tool signals all the action – or the lack of it.

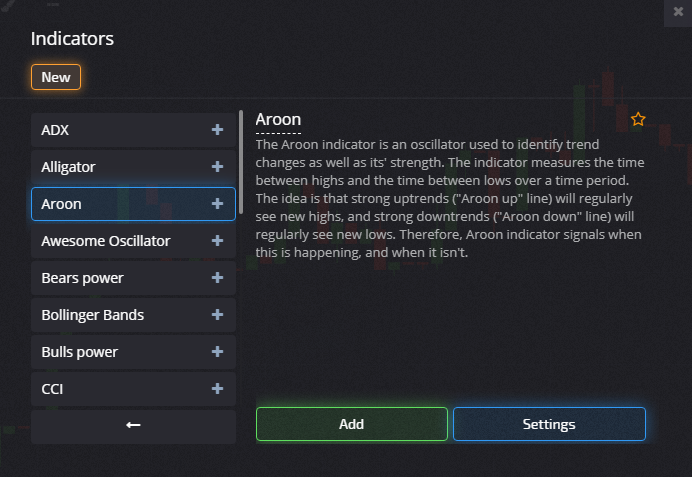

Now, if I’m navigating the Pocket Option terminal, I can grab that Aroon Indicator super easily – just hit the “+” icon, and I'm set!

Setting Up the Aroon Indicator in the Pocket Option Terminal

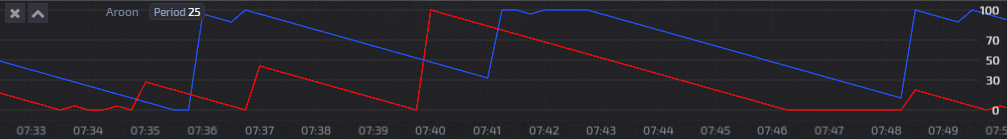

When I'm in the Pocket Option platform designed for innovative trading strategies, the Aroon shows up right below the price chart. It features a smooth scale with levels of 0, 30, 50, 70, and 100 alongside the two lines – Aroon Up (blue) and Aroon Down (red).

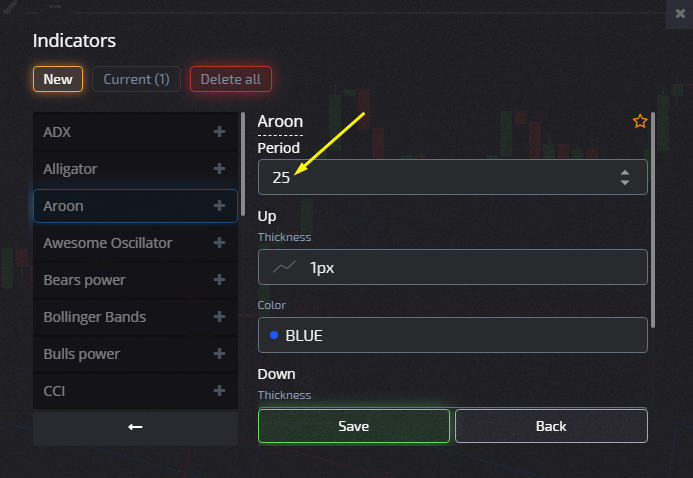

Next, I need to set the calculation period. If I'm aiming for short-term trades, I think 25; for a longer strategy, I go for 14.

To adjust the period, I just head to the Menu, select “Active,” and I can even change the color and thickness of those indicator lines to match my style.

Understanding the Signals Like a Pro

This indicator lays it all out for me. If Aroon Up crosses above Aroon Down, I know a new uptrend is just around the corner. On the flip side, if Aroon Down moves above Aroon Up, I better prepare for a new downtrend. And when Aroon Up hits the 100 mark, I can sense a fresh uptrend in the air. If those numbers hang out between 70 and 100 for Aroon Up, while Aroon Down is chilling between 0 and 30, then I’m all in on that uptrend.

So when I'm checking those lines against the scale, here's what they mean:

- 0 to 30 – not much happening;

- 30 to 50 – weak trend;

- 50 to 70 – feeling the momentum;

- 70 to 100 – a strong trend in play.

I keep my eyes open since Aroon Up tracks the uptrend and Aroon Down covers the downtrend. Downtrends are noted for lower peaks and troughs, showing shifts in trader sentiment. When the trends change, that's usually a supply and demand showdown, as investors change their outlook on the market. And don't forget, downtrends often come with big shifts in the scene, whether it's economic changes or news that’s shaking up a company.

Trading Smarter with Aroon

When Aroon Down spikes to 100, it signals that a new downtrend could be starting. If it stays between 70 and 100 with Aroon Up around 0 to 30, I know I’m looking at a fresh downtrend. When both Aroon lines move together, whether they’re flat or angled, the price is likely range trading.

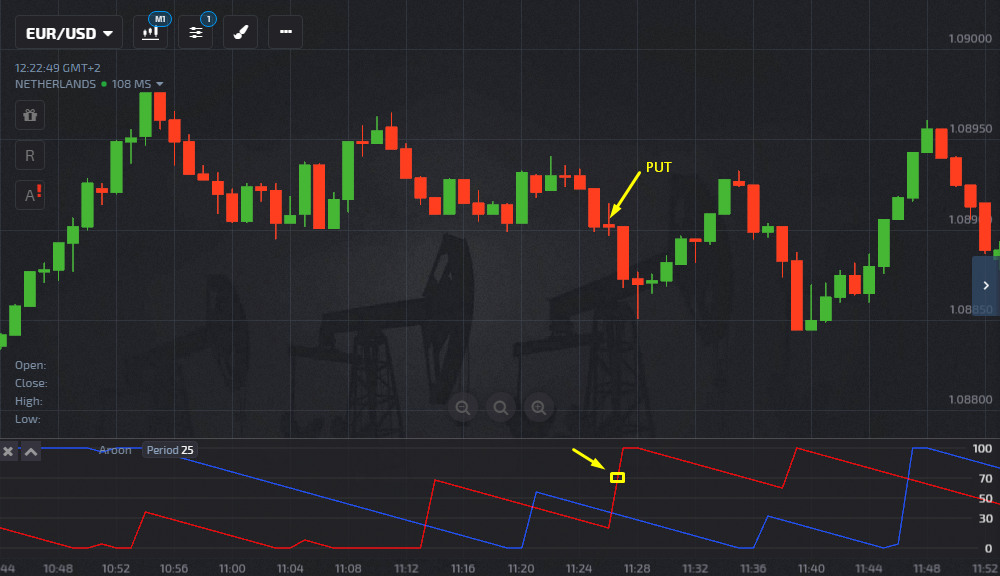

Most traders, myself included, prefer to ride the main trend, so here’s my go-to advice:

- Take a Call option when Aroon Up crosses above 70;

- Grab a Put option when Aroon Down crosses above 70;

When Aroon Down hits that 100 mark, it’s time to prepare for a new downtrend. If it stays between 70 and 100, with Aroon Up clinging to 0-30, I know a downtrend's in effect. If Aroon Up and Aroon Down are moving together? That’s range trading right there.

I know the excitement when those lines cross – if Aroon Up climbs over Aroon Down, it’s time for a Call! If it’s the other way around? You can bet I’m grabbing a Put.

I always make sure my expiration period is set for more than the formation of 3 candles.

In short, Aroon Up and Aroon Down are like best friends for traders, offering signals that help you make smart choices. With the Aroon indicator in your toolkit, you’ll quickly become a more skilled and experienced trader – especially when you practice your strategy with the demo account at Pocket Option.