Let me explain the Alligator indicator for you, straight from my trading desk. This tool is all about giving me a heads-up on market trends and ranges.

Bill Williams created this indicator, which consists of three smooth moving averages that really make an impact.

The market has its own flow—trending and ranging—and those three lines function as the Alligator's jaws, teeth, and lips.

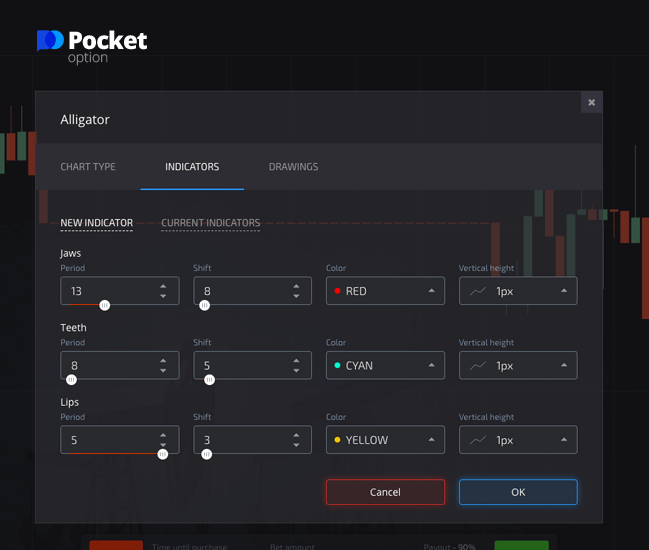

Here’s how I set up my Alligator indicator:

- Green moving average = Alligator's lips

- Blue moving average = the jaws of the Alligator

- Red moving average = Alligator's teeth

Now, here’s a pro tip: don’t try to use this Alligator on its own. It’s not the only thing out there, and it won't give clear signals for when to get into trades. I watch all those lines separately as potential support or resistance levels. Bill had a good sense of humor when he described this setup. The Alligator points me to three important stages of market behavior, and understanding these can really simplify my trading strategy:

- The Alligator is resting when the three lines are all tangled up – it’s a snooze-fest in the market. The longer it sleeps, the hungrier it gets. This fits perfectly with classic technical analysis. When the market is flat, it’s setting up for a more significant reaction once the price starts moving.

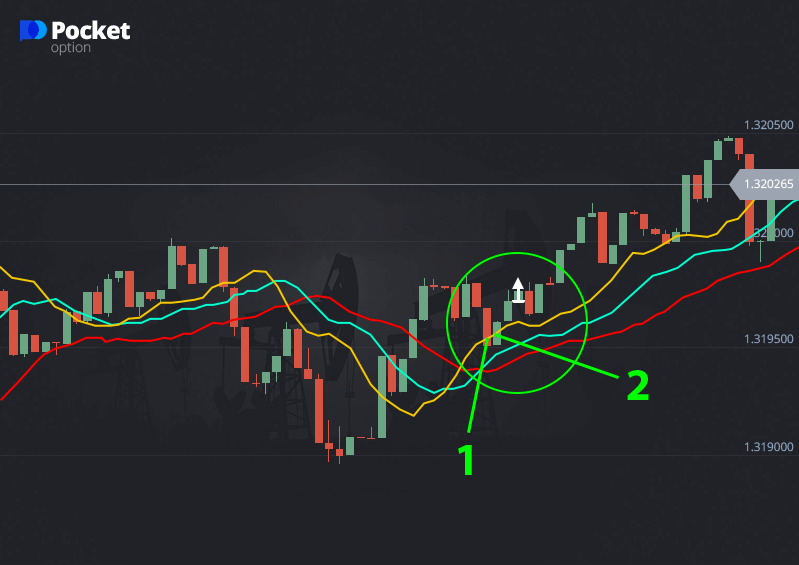

- When the Alligator begins to stir, I see the green line (the lips) crossing over the red and blue lines – that’s my signal that a trend might be starting. It’s as if he’s getting ready to hunt for price. The lines spread apart, almost like the Alligator’s mouth is opening wide. Where’s he opening it? That’s the key!

- The Alligator is feeding when I notice a candle closing above or below all three lines – that’s my signal to enter the market. He’s about to rest again and “digest” that price action. When those jaws snap shut, it signals the end of the trend. Time for me to exit and wait for the next move.

Bear Signal – Alligator Opens its Jaws

When I notice the Alligator’s jaws opening, it’s a clear signal to enter a trade. Soon enough, the Alligator will close its mouth – that’s when the slow and fast lines intersect (mouth and teeth).

Here’s the game plan:

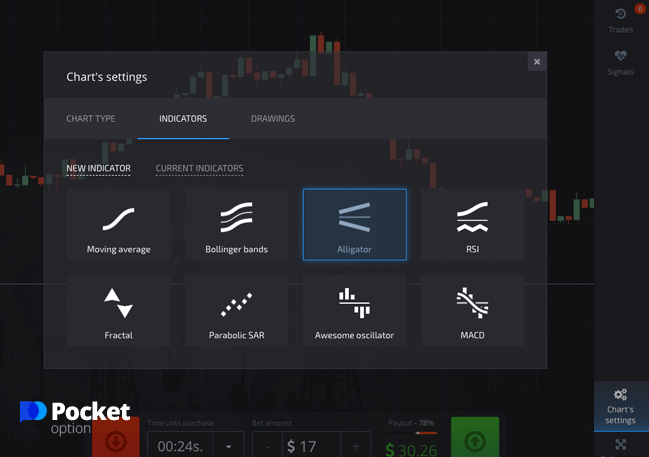

- First thing, I add the Alligator indicator to my price chart;

How to add Alligator Indicator to the chart

How to set Alligator’s parameters

- I wait for the price chart and the slowest line (the jaws, the red line) to cross;

- Once the lips and the jaws cross, it’s like the Alligator’s mouth closing. I go ahead and buy an option in line with the jaw’s direction.

The easiest way to work with the Alligator is to make a trade right after a candlestick closes on a line cross. My advice? Keep an eye on support and resistance to make sure I’m not jumping into a crowded trade area. For those interested in exploring comprehensive trading strategies with Pocket Option broker platform, understanding these concepts is crucial.

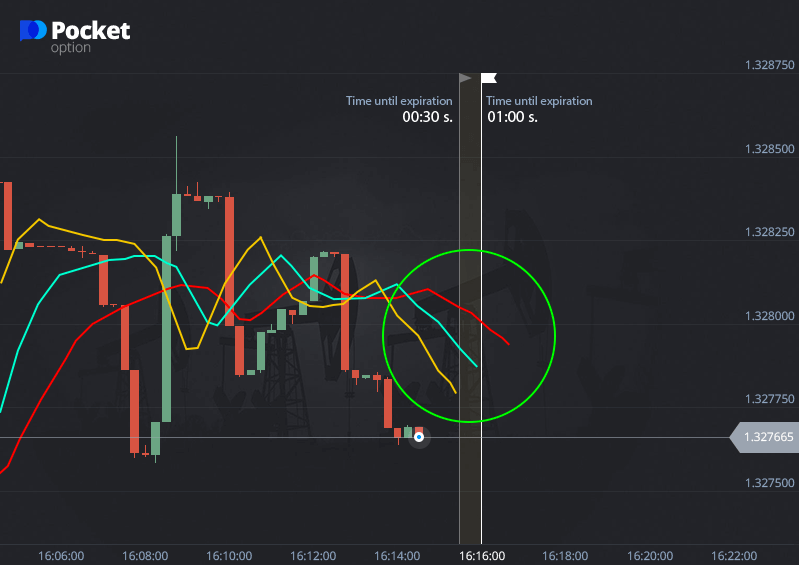

When the mouth closes, buy Put option

Advanced Moves with the Alligator Indicator

Remember, those Alligator lines can also act as support and resistance. When the price hits that eye-catching lip line (the purple one), it signals that a market bounce may be on the way. If the jaw line holds up well, it's telling me to stay alert.

Here’s the action plan when a signal appears:

- I keep my eyes on the closing of the current candle near the Alligator’s lip line or just after it. That could be a sign;

- A strong signal happens when a candle moves away from the Alligator lines. I look for that candle to close right above the lip line;

- To confirm, I wait for the next candle to follow the same movement. I buy an option along with the trend.

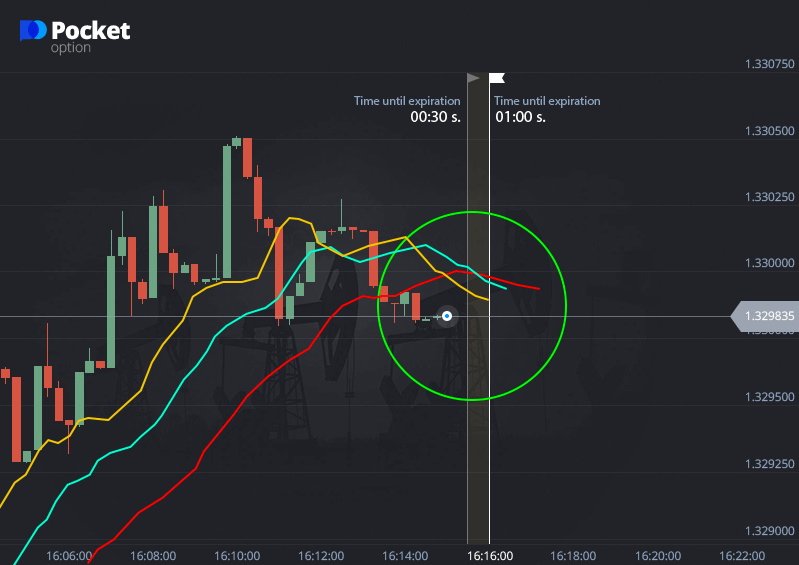

Buy a Call option

To sum it all up, the key part of the Alligator is when those three lines cross. It indicates that the Alligator is lazy, and I’m not getting any trading signals. When it starts to move, I keep an eye out for pullbacks against the main trend and take those opportunities with my pullback strategy.

As with any trading strategy, testing is essential. Good luck out there!