You know, I’ve been getting into trading and found this cool tool called the Alligator Indicator, created by the well-known trader Bill Williams. This nifty tool helps me see whether we’ve got a trend in action or if it’s just boring. Plus, it gives me a heads up on the direction of those trends.

Bill was an animal lover, which explains the fun Alligator name. It shows the market as an alligator waking up from a nap, shifting from flat to fierce. I mean, when that alligator finally goes out hunting, look out! The longer it sleeps, the hungrier it gets. And trust me, when those jaws start snapping, you better be prepared.

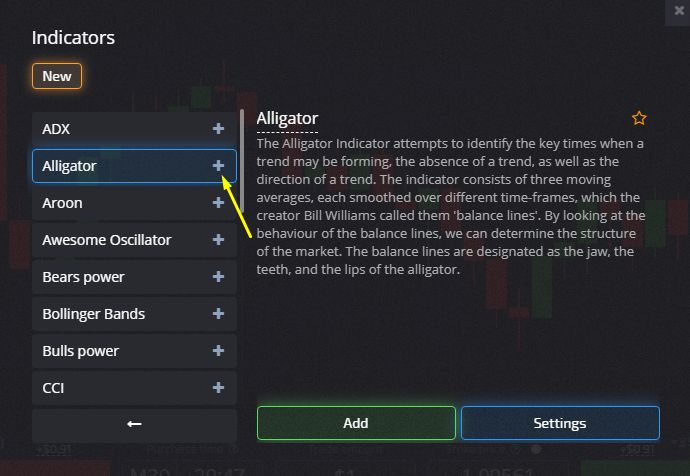

So, how do I determine the trend direction? How do I interpret these signals? It took me a little while to master using the Alligator in my trading, but it's totally worth it. Oh, and if you’re trading on the Pocket Option broker platform for enhanced trading experiences, they’ve got the Alligator conveniently included in their standard toolkit.

Setting Up the Alligator Indicator

So, the Alligator is this cool feature on my chart, consisting of three moving averages, all stylishly called the jaw, teeth, and lips:

- Jaw (the blue line) – a 13-period smoothed moving average, shifted to the right by 8 periods.

- Teeth (the red line) – an 8-period smoothed moving average, shifted to the right by 5 periods.

- Lips (the green line) – a 5-period smoothed moving average, shifted right by 3 periods.

If you’re just starting out like I was, stick to the standard settings. This setup helps predict price movements and cuts out all that market noise.

Here’s my cheat sheet for period and shift:

- Jaws: 13/8

- Teeth: 8/5

- Lips: 5/3

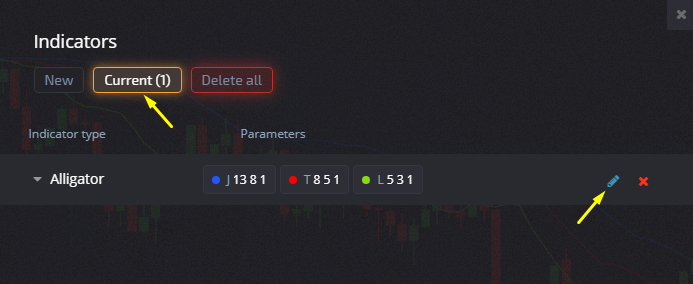

To spice up the Alligator settings in the Pocket Option terminal, I just click on “Indicators,” then “Active,” and hit the “pencil” next to Alligator to adjust. The terminal loves its color-coding with blue, red, and green for those moving averages, but hey, I can always change things up.

Alligator Indicator Signals

As I mentioned, the Alligator’s pretty good at hinting where prices are headed. It’s not just a trend-finder; it indicates when to enter a trade or when to hold back. By keeping an eye on those balance lines, I can see if we’re in a lull or gearing up for action. The Alligator goes through four phases:

- Alligator’s Sleeping. Markets are flat: this is NOT the time to trade.

- Alligator Awakens. Lines start showing some activity: time to get ready for trading.

- Alligator’s Hunting. The market moves: the ideal time for trading.

- Alligator Falls Asleep. Lines settle down: the market is easing off.

Interpreting the Alligator Indicator

When the Jaw, Teeth, and Lips are all twisted together, it’s like the Alligator’s taking a nap, with no upward or downward movement in sight. Bill suggests skipping trading during these sleepy times. But the longer the Alligator naps, the stronger the wake-up signal! When it finally wakes up, it opens up (those moving averages diverge), ready to take a big bite out of the market. Seize your chance! That Alligator’s about to yield some sweet rewards. Once it's finished, it settles back down (those averages start coming together), signaling a good time to take your profits.

- Call when the Alligator’s hunting and the lines are moving up.

- Put when the Alligator’s hunting and the lines are moving down.

Any timeframe works, but I set my expiration period for at least 4 candles.

- If the price is above the Alligator’s mouth, we’re in uptrend territory. The indicator lines align bullishly (green on top, then red, then blue).

- If the price is below the Alligator’s mouth, it’s a downtrend. The lines stack bearishly (blue on top, then red, then green).

Wrapping things up, there are a lot of combinations between the Alligator and other tools in my trading arsenal. The Alligator’s great as a standalone system, but I often pair it with other analytical tools for better precision. I like to check multiple timeframes to see which one gives my trades that additional edge. Happy trading with that fierce Alligator!

Very good? Thanks