Hey there, fellow traders! Let me share a cool tool I've been using for my trading—it's called the stochastic oscillator. This tool really stands out when it comes to technical trading analysis. I’ve found it super helpful to combine two stochastic indicators. Using just one? Not enough to maximize gains, you know what I mean?

Here’s the deal: when you work with a dual stochastic trading system, the outcomes can be fantastic. I’m talking about a winning strategy that uses two stochastic indicators—one slow and one fast—to identify those profitable trading opportunities. For those interested in exploring such strategies further, the PocketOption trading platform for innovative growth and diverse trading insights is worth considering.

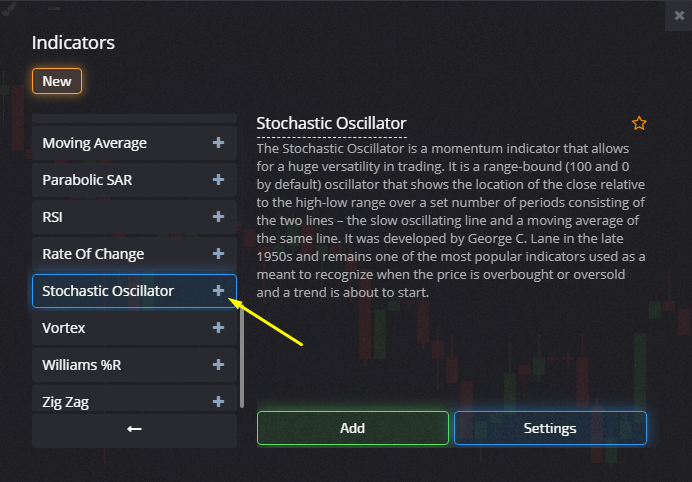

What is a stochastic oscillator?

So, what’s this stochastic oscillator all about? In plain terms, it compares an asset’s closing price to its high-low range over a certain timeframe. It’s a standard tool on most trading platforms, like Pocket Option.

You’ll typically find the stochastic below the price chart. It has horizontal levels and two signal lines moving within a range.

The fast line? It reacts quickly and shows the market trend, while the slow line provides confirmation.

We’re talking oversold zone with levels 0 and 20. When both lines are hanging out there, it indicates that sellers are in control.

On the other hand, levels 80 and 100 create the overbought zone. If both lines are up there, it means buyers are taking charge.

The standard settings are: period %K (slow) = 14; period %D (fast) = 3; slowing = 3. But feel free to adjust these settings to fit your trading approach!

The Trading Signals

The stochastic oscillator helps produce clear signals that don’t require a PhD in market mechanics to understand.

Here are the main signals I keep an eye on:

- Lines in the “over” zones. If those lines are in the oversold zone (0 to 20) and the fast line crosses level 20 going up? It’s time for a Call option after the current candle closes. Conversely, if they’re in the overbought zone and the fast line crosses level 80 down, that’s your signal for a Put option.

- The intersection of the lines. I watch for intersections when the fast line crosses the slow line. If it’s moving from bottom to top? Call option time! If it’s top to bottom? You guessed it—Put option!

- The direction of the lines. Some traders might pay attention to the direction, but I find that a bit unreliable.

Basic Tips for the Dual Stochastic Strategy

This strategy is popular for a reason. It’s straightforward and effective. Just set up two stochastic indicators—configure the fast one with (9; 3; 3) and the slow one with (21; 9; 9).

Break down your analysis on a 15-minute timeframe. This helps filter out the market noise. For expiration, I usually choose 45 minutes to 1 hour.

When I’m about to buy a contract, here’s what I look for:

- Buy Call when both stochastic indicators are in the oversold zone and the line’s moving up.

- Buy Put when both stochastic lines are in the overbought zone and the fast line crosses the slow one down.

So, there you have it—the Dual Stochastic Strategy is a solid plan for tracking trends. Keeping up with market trends is key if you want to see some serious profits. But remember, no indicator is perfect, and it’s smart to run some tests before jumping in.